Concept explainers

QUESTION:

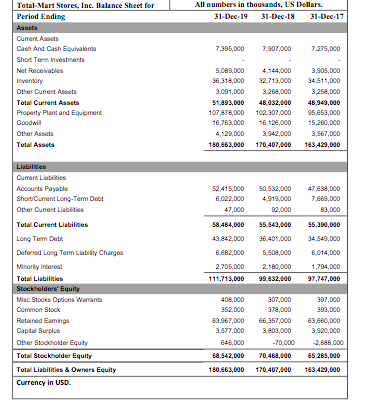

Find WACC (discount rate)

Additional Info:

Analysts expect the firm’s revenues, earnings, capital expenditures, and

The depreciation expense for 2019 is $5.182 billion.

Capital spending is expected to offset depreciation in the stable state period.

The yield on 30-year treasury bonds is 2% and the equity market risk premium is 6.2%.

The shares outstanding as of 12/31/2019 were 3,516,000,000 and the stock price was $60 per share.

The average price of the company’s long-term corporate Bonds was 123.95 with an average yield to maturity of 4.16%. The company’s long-term bonds have a bond rating of AA.

| Shares Outstanding | 3,516,000,000 |

| Stock Price | $60 |

| Yield (30Y Treasury) | 2% |

| Equity Market Risk Prem. | 6.2% |

| Avg. Price LT Corp. Bond | 123.95 |

| Avg. YTM | 4.16% |

| Depreciation Expense (2019) | 5,182,000,000 |

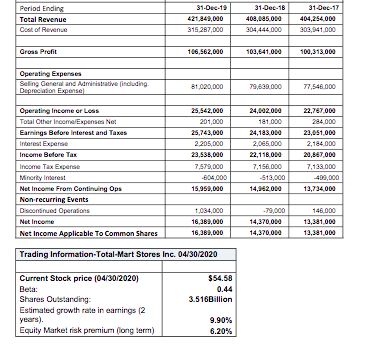

| Current Stock Price | 54.58 |

| Beta | 0.44 |

| Shares Outstanding | 3,516,000,000 |

| Estimated Growth Rate in Earnings (2Y) | 9.9 |

| Equity Market Risk Prem. | 6.2% |

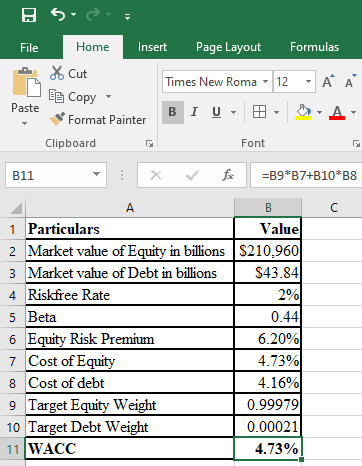

Calculation of WACC is shown below:

Hence, WACC is 4.73%

Step by stepSolved in 2 steps with 2 images

- The real risk-free rate of interest is 1.57% at the beginning of 2021. Inflation is expected to be 2% in 2021, jump to 4.00% in 2022, and run at 3% in 2023. A maturity risk premium is expected to be 0.37% per year to maturity. A liquidity premium on corporate bonds issued by small companies will continue to be 0.50%, regardless of their maturities. What should the interest rate on a 3-year Treasury security be at the beginning of 2021? Group of answer choices 5.85% 5.31% 5.54% 6.18% 5.68%arrow_forwardSuppose today that you have the following information: yield on 10-year TIPS: 3.5% yield on 10-year Treasury note: 3.0% What is the expected annual rate of inflation (approximate) over the next 10 years?arrow_forwardBased on economists' forecasts and analysis, 1-year Treasury bill rates and liquidity premiums for the next four years are expected to be as follows: R₁ = 0.55% R1 E(21) = 1.70% = 42 = 0.08% E(31) 1.80% 43 = L4= 0.12% 0.14% = E(41) 2.10% Using the liquidity premium theory, determine the current (long-term) rates. Note: Do not round intermediate calculations. Round your percentage answers to 2 decimal places (i.e., 0.1234 should be entered as 12.34). Current (Long-term) Rates Years 1 % 2 % 3 % 4 5 %arrow_forward

- Based on economists' forecasts and analysis, 1-year Treasury bill rates and liquidity premiums for the next four years are expected to be as follows: R1 = 0.80% = 1.95% E(201) E(3r1) E(41) = 2.05% = 2.35% Years 1 2 3 4 42= 0.07% 43= 0.11% L4= 0.13% Using the liquidity premium theory, determine the current (long-term) rates. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Current (Long-term) Rates % % % %arrow_forwardBased on economists' forecasts and analysis, 1-year Treasury bill rates and liquidity premiums for the next four years are expected to be as follows: 0.80% = 1.95% R1 E(201) E(371) = $2.05% E(471) 2.35% L2= 0.07% L3= 0.11% L4= 0.13% Using the liquidity premium theory, determine the current (long-term) rates. (Do not round intermediate calculations. Round your answers to 2 decimal places.) Years 1 2 3 4 Current (Long-term) Rates % % % %arrow_forwardNet Income for Company A is $200,000 in 2014, $300,000 in 2015, $400,000 in 2016, $500,000 in 2017, and $600,000 in 2018. The expected growth for all years after 2018 is 5%, the 90-Day T-Bill Rate is 20%, and the appropriate percentage above risk-free rate is 12%. Using this information, what is the appropriate discount rate? A. O.32 B. 0.02arrow_forward

- Bhupatbhaiarrow_forwardok Based on economists' forecasts and analysis, 1-year Treasury bill rates and liquidity premiums for the next four years are expected to be as follows: R1 = 1.00% = 2.15% 2.25% = 2.55% E(21) E(31) = E(471) 42 = L3 = L4 = Using the liquidity premium theory, determine the current (long-term) rates. 0.05% 0.10% 0.12% nel plecor (in 01234 should be enteredarrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education