FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

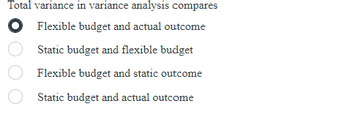

Transcribed Image Text:Total variance in variance analysis compares

● Flexible budget and actual outcome

Static budget and flexible budget

Flexible budget and static outcome

Static budget and actual outcome

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- When analyzing an organization's budget using 2-variance analysis, the 2 elements used are volume variance and: Select one: a. quantity variance b. price variance c. applied variance O d. budget variancearrow_forwardK Purchasing a greater quantity of raw materials than budgeted, but paying the Standard OA. Materials quantity variance B. Materials price variance C. Both of the variances may be affected D. Neither of the variances may be affectedarrow_forwardRevise the data in your worksheet to reflect the results for the subsequent period as shown below: A 1 Chapter 9: Applying Excel 2 3 4 Data Revenue 5 Cost of ingredients 6 Wages and salaries 7 Utilities 8 Rent 9 10 11 Actual results: 12 Revenue 13 Cost of ingredients 14 Wages and salaries 15 Utilities 16 Rent 17 18 19 20 Actual activity Miscellaneous Miscellaneous Planning budget activity $ $ $ $ $ GA $ $ GA B 10,400 800 2,200 600 30,295 11,110 10,310 1,210 2,200 2,060 C + + 1,700 meals served 1,800 meals served $ $ $ $ D 16.50 q 6.25 q 0.20 q 0.80 q Earrow_forward

- Subject:arrow_forwardParallel Enterprises has collected the following data on one of its products. During the period the company produced 25,000 units. The direct materials quantity variance is: Direct materials standard (7 Kilogram @ $2/Kilogram) Actual cost of materials purchased Actual direct materials purchased and used Multiple Choice $22.500 unfavorable $27.500 unfavorable $22,500 favorable $50,000 favorable $ 14 per finished unit $ 322,500 150,000 Kilogramarrow_forwardc. What is spending variance for wages and salaries? Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). The amount of the spending variance for wages and salaries d. What is spending variance for total expenses? Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). The amount of the spending variance for total expensesarrow_forward

- pls answer the questionsarrow_forwardiv) Labour rate variance v) Labour efficiency variance vi) Overhead variances (both) d.Comment on your calculations produced in c above.arrow_forwardWhich one of the following best describes the direct material price variance? O a. The difference between the standard quantity of material used at the standard cost per unit and the actual quantity of material used at the standard direct material cost per unit O b. The difference between the budgeted material cost and direct material cost according to the unflexed budget O c. The difference between the actual direct material cost and direct material cost according to the flexed budget O d. The difference between the actual cost of the material used and the actual quantity of material used at the standard direct material cost per unit O e. The difference between the actual cost of the material used and the standard quantity of material used at the actual direct material cost per unitarrow_forward

- Which of the following is a correct equation to calculate the fixed overhead production-volume variance? a. budgeted fixed overhead costs − fixed overhead costs allocated for actual output b. static budget amount − flexible budget amount c. actual costs incurred − fixed overhead costs allocated for actual output d. flexible budget amount − actual costs incurredarrow_forward1.What is the labor rate variance ( indicate the effect of each variance by selecting "f" for favorable, U for unfavorable, and None for no effect and round your final answer to the nearest whole number) 2. What is the variable overhead efficiency variance ? ( indicate the effect of each variance by selecting "f" for favorable, U for unfavorable, and None for no effect and round your final answer to the nearest whole number) 3. what is the variable overhead rate variance?arrow_forwardb. Calculate the profit variance c. Calculate the total revenue variance. d) Calculate the revenue volume variance. e) Calculate the revenue price variance. f) Calculate the total cost variance.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education