FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

What is the total tax expense?

A. 300,000

B. 2,550,000

C. 600,000

D. 750,000

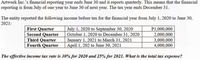

Transcribed Image Text:Artwork Inc.'s financial reporting year ends June 30 and it reports quarterly. This means that the financial

reporting is from July of one year to June 30 of next year. The tax year ends December 31.

The entity reported the following income before tax for the financial year from July 1, 2020 to June 30,

2021:

First Quarter

Second Quarter

Third Quarter

Fourth Quarter

July 1, 2020 to September 30, 2020

October 1, 2020 to December 31, 2020

January 1, 2021 to March 31, 2021

April 1, 202 to June 30, 2021

P1,000,000

2,000,000

3,000,000

4,000,000

The effective income tax rate is 30% for 2020 and 25% for 2021. What is the total tax expense?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- d cion The table given below shows the absolute tax amounts under five different tax policies for respective income levels. Table 19.2 Annual Pretax Income Tax Policy Alpha O Gamma. Alpha. SO $0 $0 $0 $0 $10,000 $1,000 $1,000 $1,000 $1,000 $1,000 $50,000 $5,000 $6,000 $4,000 $1,000 $900 $100,000 $10,000 $15,000 $6,000 $1,000 $800 Beta. O Eta. Refer to Table 19.2. The tax structure which leads to maximum income inequality is: Delta. Tax Policy Beta Question 18 Tax Policy Gamma 27 Tax Policy Delta Tax Policy Eta $0 tv 9 N 4.nts. Narrow_forwardQUESTION 8 Given the following information, calculate the total annual tax liability of the homeowner: market value of property: $350,000; assessed value of property: 40% of the market value; exemptions: $2,000; millage rate: 33.95 mills. O $11, 882.50 O $4,753.00 O $4,685.10 O $46,851.00arrow_forwardI need all solution....arrow_forward

- ements What is the total Wealth Accumulation of the following investment assuming the available after tax reinvestment rate is 5%? IRR 10.70% O $4,690,000 O $4,821,078 O $4,848,844 $4,905.989 n 0 $ 1 S 2 $ 3 $ AS 5 $ Investment $ (3,000,000) 240,000 250,000 260,000 266,000 3,674,000arrow_forward54. In relation to transaction #1, How much is the capital gains tax due, if any? A. PO C. P300,000 B. P360,000. D. P450,000arrow_forwardGIVEN: Тахрауer: Resident citizen IN (Phils) P550,000 100,000 Description OUT (Abroad) Business gross income Business expenses Compensation income Interest income from long term bank deposit Interest income from short term bank deposit Royalty income Dividend income P600,000 5,000 2,000 160,000 25,000 18.000 COMPUTE: Taxable income subject to REGULAR income tax. A. 450,000 B. 1,050,000 C. 1,210,000 O D. 1,235,000arrow_forward

- If net income before tax is 60000 OMR, tax is 2000 OMR, interest is 1500 OMR, depreciation is 1500 OMR and amortization is 1000 OMR, the EBITDA is: Select one: O a. 64000 OMR O b. Correct answer is not available O c. 62000 OMR O d. 66000 OMRarrow_forwardFor business deductions, which of the following is true (mark all that apply): A. An expense is not deductible under Federal law unless Congress creates a specific provision allowing it. B. None of these are true. OC. An expense has been held to be ordinary if it is normal, usual, or customary in the type of business conducted by the taxpayer, and an expense need not be recurring to be considered ordinary. D. An expense has been held to be necessary if a prudent businessperson would incur the same expense and the expense is expected to be appropriate and helpful in the taxpayer's business. OE. The courts have held that for any expense to be ordinary and necessary, it must also be reasonable in amount. If an expense is unreasonable, it is not deductible.arrow_forwardWhat would be the answer to problem (11) if a consolidated tax return were filed?a. –0–b. $300c. $1,500d. $7,500arrow_forward

- 16. What would income property be valued at if it had $50,000 annual gross income with 40% expense ratio and the agent uses 10% capitalization rate? A. $300,000 B. $200,000 C. $250,000 D. $500,000arrow_forward2023 TAXABLE INCOME FIRST $53,359 OVER $53,359 TO $106,717 OVER $106,717 TO $165,430 OVER $ $165,430 TO $237,675 OVER $235,675 ernment Budget Fiscal Policy FILL IN THE BLANK UNIT TAX RATE 15.00% 20.50% 26.00% 29.32% 33.00% D) The average tax rate for someone making $120,000. type your text here Based on the Canadian Federal Income Tax Brackets for 2023 shown above, calculate and input the numeric answers to the questions below. Round off your answers to the nearest dollar. Do not use $, decimals or comma. For example, instead of $23,486.52, write 23487. For answers requiring a tax rate, enter only the numeric value with two decimal places, with "%" symbol. For example, 20.50%).arrow_forwardHw.227.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education