FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:LEUIG CORP.

Horizontal Statements Model

Balance Sheet

Income Statement

Statement of Cash

Assets

Stockholders' Equity

Revenue

Expense

= Net Income

%3D

Flow

Event

Common

PIC in

Cash

Land

%3D

%3D

Stock

Excess

ommon stock

sue of additional shares

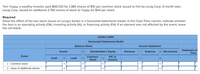

Transcribed Image Text:Tom Yuppy, a wealthy investor, paid $60,720 for 1,380 shares of $10 par common stock issued to him by Leuig Corp. A month later,

Leuig Corp. issued an additional 2,760 shares of stock to Yuppy for $44 per share.

Required

Show the effect of the two stock issues on Leuig's books in a horizontal statements model. In the Cash Flow column, indicate whether

the item is an operating activity (OA), investing activity (IA), or financing activity (FA). If an element was not affected by the event, leave

the cell blank.

LEUIG CORP.

Horizontal Statements Model

Balance Sheet

Income Statement

Statement of

Flow

Assets

Stockholders' Equity

Revenue

Expense

Net Income

Event

Common

PIC in

Cash

Land

Stock

Excess

1- Common stock

2 - Issue of additional shares

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Fragile Company used the direct method tom prepare the statement of cash flows. The entity had the following cash flows during the current year: Cash receipts from issuance of ordinary shares 4,000,000Cash receipts from customers 2,000,000Cash receipts from dividends 300,000Cash receipts from repayment of loan made to another entity 2,200,000Cash payments for wages and other operating expenses 1,200,000Cash payments for insurance 100,000Cash payments for dividends 200,000Cash payments for taxes 400,000Cash payment to purchase land…arrow_forwardThe income statement and additional data of Grand Corporation follow: (Click the icon to view the Income Statement.) (Click the icon to view the addit Prepare Grand Corporation's statement of cash flows for the year ended June 30, 2024. Use the direct in the statement leave the box empty; do not select a label or enter a zero.) Complete the statement one section at a time, beginning with the cash flows from operating activities. Grand Corporation Statement of Cash Flows Year Ended June 30, 2024 Cash Flows from Operating Activities: Receipts: Total Cash Receipts Payments: Total Cash Payments Net Cash Provided by (Used for) Operating Activities Data table Grand Corporation Income Statement Year Ended June 30, 2024 Net Sales Revenue Cost of Goods Sold Gross Profit Operating Expenses: Salaries Expense Depreciation Expense-Plant Assets Advertising Expense Total Operating Expenses Operating Income Other Income and (Expenses): Dividend Revenue Interest Expense Total Other Income and…arrow_forwardThe Stancil Corporation provided the following current information: Proceeds from long - term borrowing $ 13, 800 Proceeds from the sale of common stock 5, 000 Purchases of fixed assets 27,500 Purchases of inventories 2, 600 Payment of dividends 13, 800 Determine the total cash flows spent on fixed assets and NWC, and determine the cash flows to investors of the firm. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations.)arrow_forward

- Please give me answerarrow_forward2. The records of Alamo Corporation showed the following data: (see attached image for the given. Please answer it. Thank you so much!) Direction. From the following independent cases, journalize the dividend declaration and the dividend payment: a) The Board of Directors declared a 10% cash dividend.b) The Board of Directors declared a P5 cash dividend. c) The Board of Directors declared a merchandise dividend of P15 per share.d) The Board declared a property dividend of 2 SMB shares for one Alamo share. SMB shares are selling at P15 but were acquired by Alamo Corporation @ P10. Use PAS 39. SMC shares are considered available for sale securities. e) The Board declared a 22% stock dividend. Stocks are selling at P105 per share. f) The Board declared a 12% stock dividend. Market value of stock is P120.arrow_forwardUpon review of Take a Hike's Statement of Cash Flows, the following was noted: Cash Flows from Operating Activities ($4,000) Cash Flows from Investing Activities ($14,000) Cash Flows from Financing Activities $19,000 From this information, the most likely explanation is that Take a Hike is O A. using cash from operations to purchase long-term assets and pay dividends. B. using cash from operations and issuing common stock to purchase long-term assets. C. issuing stock to fund operations and purchase long-term assets. D. assuming long term-debt and selling long-term assets to fund operations. E. using cash from operations and selling long-term assets to pay back long-term debt.arrow_forward

- The following is the Comparative Balance Sheet of M/s Manish Ltd. Prepare a Funds Flow Statement and verify your answer. Liabilities Assets 31st Dec., 31st Dec., 31st Dec., 31st Dec., 2013 2014 2013 2014 Creditors 40,000 344,000 Cash 10,000 37,000 Loan 25,000 Debtor's 330,000 350,000 Loan from S.B.I 40,000 50,000 Stock 335,000 25,000 Capital 31,25,000 31,53,000 Machinery 380,000 355,000 2,30,000 32,47,000 Land 40,000 350,000 Building 35.000 360.000 2,30,000 32,47,000 During the year machine costing 10,000 (accumulated depreciation 3,000) was sold for 35,000. The provision for depreciation against machinery as on 31.12.13 was 25,000 and on 31.12.14 was 40,000. Net profit for the year amounted to 345,000. you are required to prepare Funds Flow statement.arrow_forwardOn May 1, Year 3, Love Corporation declared a $94,200 cash dividend to be paid on May 31 to shareholders of record on May 15. Required Record the events occurring on May 1 and May 31 in a horizontal statements model. In the Cash Flow column, indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA). If an element was not affected by the event, leave the cell blank. (Enter any decreases to account balances with a minus sign.) Date May 1 May 31 Balance Sheet Assets = Liabilities Common Stock LOVE CORPORATION Horizontal Statements Model Retained: Earnings Revenue: Income Statement Expense Net Income Statement of Cash Flowarrow_forwardThe following T-account is a summary of the Cash account of Coronado Company. Balance, Jan. 1 Receipts from customers Dividends on stock investments Proceeds from sale of equipment Proceeds from issuance of bonds payable Balance, Dec. 31 Cash (Summary Form) Net cash 7,000 365,700 Payments for goods 5,600 Payments for operating expenses 139,500 37,000 Interest paid 11,400 Taxes paid 500,000 Dividends paid 420,900 275,100 ✓by financing activities $ 8,300 What amount of net cash provided (used) by financing activities should be reported in the statement of cash f decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).) 60,100arrow_forward

- Waterway Mining Company declared, on April 20, a dividend of $426,000 payable on June 1. Of this amount, $119,000 is a return of capital.Prepare the April 20 and June 1 entries for Waterway. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)arrow_forwardFf.53.arrow_forwardOn May 1, Year 3, Love Corporation declared a $60,000 cash dividend to be paid on May 31 to shareholders of record on May 15. Required Record the events occurring on May 1 and May 31 in a horizontal statements model. In the Cash Flow column, indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA). If an element was not affected by the event, leave the cell blank. (Enter any decreases to account balances with a minus sign.) Date May 1 May 31 Assets Balance Sheet Liabilities + + + Common Stock LOVE CORPORATION Horizontal Statements Model + + Retained Earnings Revenue Income Statement Expense ||||| = Net Income Statement of Cash Flowarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education