Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

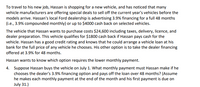

Transcribed Image Text:To travel to his new job, Hassan is shopping for a new vehicle, and has noticed that many

vehicle manufacturers are offering special deals to sell off the current year's vehicles before the

models arrive. Hassan's local Ford dealership is advertising 3.9% financing for a full 48 months

(i.e., 3.9% compounded monthly) or up to $4000 cash back on selected vehicles.

The vehicle that Hassan wants to purchase costs $24,600 including taxes, delivery, licence, and

dealer preparation. This vehicle qualifies for $1800 cash back if Hassan pays cash for the

vehicle. Hassan has a good credit rating and knows that he could arrange a vehicle loan at his

bank for the full price of any vehicle he chooses. His other option is to take the dealer financing

offered at 3.9% for 48 months.

Hassan wants to know which option requires the lower monthly payment.

4. Suppose Hassan buys the vehicle on July 1. What monthly payment must Hassan make if he

chooses the dealer's 3.9% financing option and pays off the loan over 48 months? (Assume

he makes each monthly payment at the end of the month and his first payment is due on

July 31.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Luke, Ashley, Casandra, Daisy, Rylie, Lucas and Ryan are helping their fellow classmate Jose search for a good deal regarding the purchase of a new Honda Accord automobile. After researching all the Honda dealers in this area, they have decided that they have found the best deal at Honda Cars of Rockwall, Texas. The following is their best deal and they want to know what the monthly payment will be. The new Honda Accord is $36,250 and that includes an extended warranty, tax, title and license...(TT&L). To help reduce the cost of this purchase he will receive two discounts; one the Honda "Purchase Incentive" $500 off discount and the second is the College Student discount of $400. Jose has elected to make monthly payments for four years. He has a trade-in vehicle that will decrease his purchase cost of the new vehicle by $17,600. The Honda interest rate program is the best that he can find which is 3.9%. All things considered Jose is still hesitant to make the purchase.…arrow_forwardAhmed is considering his plans for the coming weekend. He is currently working as a marketing specialist in a big advertising company. He normally spends the weekend with family but this weekend he is thinking of going on a camping trip that would cost him about $1,900. At the same time, his manager asked him whether he can help during the weekend and the company will be willing to pay him an overtime bonus of $1,000. If Ahmed goes on the camping trip, he can manage to provide a number of quick consultancy services that would earn him around $2,500. If Ahmed decided to go on the camping trip what would be the incremental income of that decision ($)? O a. 600 O b. 1,000 O c. 2,500 O d. None the given answers e. 1,900arrow_forwardJohn is considering purchasing a new car from Slimy's Sports Car Emporium. The car costs $25,000, and John has a down payment of $5,000. Slimy is offering John a 5-year loan with an interest rate of 5.5% / yr compounded monthly. To encourage John to make the purchase, Slimy offers to throw in free floor mats, a lifetime car wax, and "VIN number" (vehicle identification number) window etching. The monthly loan payment is $412.02. Based on the purchase price, down payment, and interest rate, what should the loan payment be?arrow_forward

- 1.Link wants to make $100,000 after tax on his new venture into selling pizza-on-a-stick, using a "push along" cart at the beach. For each pizza-on-a-stick, he incurs raw material costs of $5 and sells them for $10. He pays a salary to his friend Zelda, who operates the cart for $50,000. If he buys the cart himself, he will incur fixed expenses of $20,000. Or, he can rent the cart and pay $1 to the cart supplier each time he sells a pizza stick. What is his point of indifference? That is, at what volume of pizza sticks is he indifferent about renting or buying the cart? (Insert a number ONLY) 2. Like Link, Chrom sells pizza-on-a-stick at the beach. But Chrom also sells dogs-in-a-pocket, which are hot dogs you can carry with you that have enough preservatives to survive in your pocket for years. For each pizza-on-a-stick, Chrom incurs raw material costs of $5 and sells them for $10. He incurs material costs of $3 for the dogs and sells them for $5. He sells 3 times as many dogs as he…arrow_forwardSmith has arranged for a mortgage loan of $200,000. The annual rate on the loan is 12%. The bank requires Mr. Smith to make payments of $4,212.90 at the end of every month. How many payments will Mr. Smith have to make? You have decided to buy a car, the price of the car is $18,000. The car dealer presents you with two choices: Purchase the car for cash and receive $2000 instant cash rebate – your out of pocket expense is $16,000 today. Purchase the car for $18,000 with zero percent interest 36-month loan with monthly payments. The market interest rate is 4%. Which of the option above is cheaper? How much do you save?arrow_forwardJason owns a fish shop where he sells an exotic variety of tuna fish which he imports fromJapan. Jason refrigerates the fish in a cold storage facility near his shop that charges him avariable charge of $5 per day for each fish container that is stored. In addition the coldstorage charges a fixed annual fee of $1000. Every morning, Jason brings fish from the coldstorage to his shop for sale. Jason estimates that he incurs $10,000 electricity cost each yearon refrigerating the fish inside his own shop.Jason incurs the following ordering costs: Delivery Charges of $10,000 per delivery, andCustom Fees of $200 per order.Jason currently imports fish by placing one order of 20 cartons every month, which is themonthly demand of this tuna fish at his shop. Each carton costs $2,000.Jason is wondering if he can save inventory costs by adopting EOQ model.a)- Calculate the current annual total inventory holding cost and annual total ordering costb)- Calculate the economic order quantityc)-…arrow_forward

- Jim has an annual income of $300,000. Jim is looking to buy a house with monthly property taxes of $1200 and monthly homeowner's insurance of $300. Jim has $1,500 in monthly student loan payments and an average monthly credit card bill of $1,000. Apple bank has a maximum front end DTI limit of 28% and a maximum back end DTI limit of 36%. Considering both the front end DTI limit and the back end DTI limit, what is the most they will allow Jim to spend on a monthly mortgage payment? O A. $5,500.00 O B. $7,000.00 O C. $5,000.00 O D. $82,500.00arrow_forwardAntonio would like to replace his golf clubs with a custom-measured set. A local sporting goods megastore is advertising custom clubs for $890, including a new bag. In-store financing is available at 3.15 percent, or he can choose not to renew his $500 certificate of deposit (CD), which just matured. The advertised CD renewal rate is 3.33 percent. Antonio knows the in-store financing costs would not affect his taxes, but he knows he'll pay taxes (25 percent federal and 5.75 percent state) on the CD interest earnings. Should he cash the CD or use the in-store financing? Why? what is the after-tax CD earnings rate? Answer with a percent.arrow_forwardAldo Redondo drives his own car on company business. His employer reimburses him for such travel at the rate of 52 cents per mile. Aldo estimates that his fixed costs per year-such as taxes, insurance, and depreciation-are $2,400. The direct or variable costs such as gas, oil, and maintenance-average about 21.5 cents per mile. How many miles must he drive to break even? (Do not round intermediate calculations. Roundup your answer to the next whole number.) Break even point milesarrow_forward

- Ahmed is considering his plans for the coming weekend. He is currently working as a marketing specialist in a big advertising company. He normally spends the weekend with family but this weekend he is thinking of going on a camping trip that would cost him about $1,000. At the same time, his manager asked him whether he can help during the weekend and the company will be willing to pay him an overtime bonus of $2,500. If Ahmed goes on the camping trip, he can manage to provide a number of quick consultancy services that would earn him around $1,900. If Ahmed decided to go on the camping trip what would be the incremental cost of that ?($) decision 900 .a O 1,900 .b O 2,500 .CO None of the given answers 1,000 e Oarrow_forwardVashti has a suburban home within walking distance of the railroad. She commutes to work in the city at a cost of $366.50 a month. She also rents a car every weekend, which costs $450 a month including insurance and fuel. She is considering purchasing a new car for cash to replace commuting and rental costs. It would cost $22,000, get 31 miles per gallon, and have an estimated resale value of $8,000 after five years. After buying this car, Vashti would drive 20,000 miles per year and have maintenance and repairs of $1,400 per year, insurance of $1,500 per year, and fuel costs of $2.50 per gallon. Assume that all costs occur at the end of the year and that she sells the car at the end of the fifth year. If Vashti's discount rate is 7 percent after tax, should she purchase the car?arrow_forwardSteven wants to buy a new couch priced at $591 and agrees to pay for it over two years with a finance charge of 4.3% simple annual interest. How much will his monthly payment be? State your answer in terms of dollars rounded to the nearest cent (hundredth). Carl purchased a $385 car stereo at Worst Buy. He paid $25 at the time of purchase and agreed to pay the balance in 12 equal monthly payments. The finance charge was 14% simple annual interest. What was the amount of each payment? State your answer in terms of dollars rounded to the nearest cent (hundredth). Sammy wants to buy a new stereo priced at $449. He enters into an agreement to pay $21 a month for 24 months. How much will the finance charge be for this purchase?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education