FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

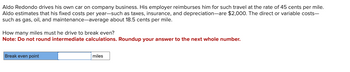

Transcribed Image Text:Aldo Redondo drives his own car on company business. His employer reimburses him for such travel at the rate of 45 cents per mile.

Aldo estimates that his fixed costs per year-such as taxes, insurance, and depreciation-are $2,000. The direct or variable costs-

such as gas, oil, and maintenance-average about 18.5 cents per mile.

How many miles must he drive to break even?

Note: Do not round intermediate calculations. Roundup your answer to the next whole number.

Break even point

miles

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Mr. Russ T. Steele sels his old vehicle for $5000 (you get more if you private sale!) and pays cash for a used (but newer vehicle) that costs $10.000. He also understands that he needs to allow for maintenance and operation costs of his vehicle. He estimates that these costs will be approximately $2000 a year and estimates that the costs will increase by $100 per year. He hopes to keep the vehicle for five years and then sell it for an estimated value of $2000. Mr. Steele has an MARR of 8%. The equivalent annual cost of the cash flow associated with his purchase is most nearly: $-1,850 $-3,100 $3,000 $3,800arrow_forward2. Jason Bradley decided to buy a home for $271,000. His bank requires a 25% down payment. His attorney, has notified Jason that besides the 25% down payment there will be the following additional costs: Recording of the deed $266.00 A credit and appraisal report 1521.00 Preparation of appropriate documents 444.00 In addition, there will be a transfer tax of 1.5% of the purchase price and a loan origination fee of 3% of the mortgage amount. Assume a 30-year mortgage at a rate of 9.5%. a. What is the initial amount of cash Jason will need? (Do not round intermediate calculations. Round your answer to the nearest cent.) b. What is his monthly payment? c. What is the total cost of interest over the life of the mortgage? (Use the amortization worksheet in the financial calculator.arrow_forwardVivian plans to replace all four air-conditioners in her home. The total cost is $70,000. The loan instalment plan offered by the shop requires her to pay $10,000 cash as down payment and borrow the remaining balance. The loan will be repaid in 2 years, at a monthly flat rate of 0.8%. Vivian is required to pay $250 as administration fee for loan application. The administration fee is paid at the time of application with no refund. a. Required: i. Calculate the total interest cost and fee on Vivian's instalment plan. ii. Calculate the monthly repayment amount of the instalment plan. iii. Calculate the approximate annual percentage rate (APR).arrow_forward

- John has just started a new engineering business, where he maintains lifts. He does not provide any materials, just his own labour. He could not afford to buy a van, so he rents one at a cost of £300 per week. Each time he does a repair call-out, he earns a standard fee of £140 and he estimates the average fuel cost of each repair at £19. Assuming no other costs, how much does John have to earn each week to break even?arrow_forward1.Link wants to make $100,000 after tax on his new venture into selling pizza-on-a-stick, using a "push along" cart at the beach. For each pizza-on-a-stick, he incurs raw material costs of $5 and sells them for $10. He pays a salary to his friend Zelda, who operates the cart for $50,000. If he buys the cart himself, he will incur fixed expenses of $20,000. Or, he can rent the cart and pay $1 to the cart supplier each time he sells a pizza stick. What is his point of indifference? That is, at what volume of pizza sticks is he indifferent about renting or buying the cart? (Insert a number ONLY) 2. Like Link, Chrom sells pizza-on-a-stick at the beach. But Chrom also sells dogs-in-a-pocket, which are hot dogs you can carry with you that have enough preservatives to survive in your pocket for years. For each pizza-on-a-stick, Chrom incurs raw material costs of $5 and sells them for $10. He incurs material costs of $3 for the dogs and sells them for $5. He sells 3 times as many dogs as he…arrow_forwardYou own a house that you rent for $1,400 per month. The maintenance expenses on the house average $260 per month. The house cost $231,000 when you purchased it 4 years ago. A recent appraisal on the house valued it at $253,000. If you sell the house you will incur $20,240 in real estate fees. The annual property taxes are $3,100. You are deciding whether to sell the house or convert it for your own use as a professional office. What value should you place on this house when analyzing the option of using it as a professional office? Multiple Choice $232,760 $231,000 $228,000 $253,000 $0arrow_forward

- John has just started a new engineering business, where he maintains lifts. He does not provide any materials, just his own labour. He could not afford to buy a van, so he rents one at a cost of £300 per week. Each time he does a repair call-out, he earns a standard fee of £140 and he estimates the average fuel cost of each repair at £19. Assuming no other costs, how much does John have to earn each week to break even? A) 140 B) 647 C) 347 D) 300arrow_forwardThe purchaser of a car paid $10,000 cash and agreed to pay $3000 at the end of 6 months for 10 years. He failed to make the first 5 payments of $3000 each. At the end of 3 years, he desires to pay the car by a single payment which will cancel both his accumulated liabilities and his future liabilities. What must he pay if money is worth 6% per annum compounded semi-annually?arrow_forwardPlease help answer all using typing as from one subpart.arrow_forward

- Ali is a student at the University. He recently purchased a car for OMRS, 000 to use it for going to the University. Ali also expects that other friends might ask for transportation from him. He expects a total monthly revenue of OMR70. He expects fuel cost to be OMR60 per month. One of Ali's friends is a taxi driver. He offered Ali to take him to University for a monthly fee of OMR10, Because he does not have to drive, Ali believes that he can perform online work that would earn him a monthly revenue of OMR30. What is the differential cost in this scenario? Select one: O a. OMR10 O b. OMR50 Oc. OMR30 Od. OMR40 O e. OMR20arrow_forwardJames has a yearly salary of $36,300 . His employer withholds $4382 in state and federal taxes and $3255 in FICA taxes throughout the year. He has the following monthly costs: transportation is $240 , cell phone bill is $50 , student loans require $230 in repayment, and rent is $675 . He is using the average monthly costs for each of the following in order to gain an idea of other monthly expenses: utilities are $120 , internet is $90 , health insurance is $363 , and groceries are $250 . How much money is left each month for discretionary spending after all necessities are accounted for? Round your answer to the nearest cent, if necessary.arrow_forwardAldo Redondo drives his own car on company business. His employer reimburses him for such travel at the rate of 52 cents per mile. Aldo estimates that his fixed costs per year-such as taxes, insurance, and depreciation-are $2,400. The direct or variable costs such as gas, oil, and maintenance-average about 21.5 cents per mile. How many miles must he drive to break even? (Do not round intermediate calculations. Roundup your answer to the next whole number.) Break even point milesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education