ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

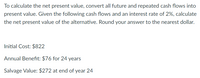

Transcribed Image Text:To calculate the net present value, convert all future and repeated cash flows into

present value. Given the following cash flows and an interest rate of 2%, calculate

the net present value of the alternative. Round your answer to the nearest dollar.

Initial Cost: $822

Annual Benefit: $76 for 24 years

Salvage Value: $272 at end of year 24

Expert Solution

arrow_forward

Step 1

In economics, present value refers to the current value of a future stream of cash flows. Net present value refers to the difference between the present value of cash inflow and the present value of cash outflow.

The net present value analysis is used to check the profitability of projects. The projects having a positive net present value are generally considered profitable.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Calculate the present worth of all costs for a newly acquired machine with an initial cost of $30,000, no trade-in value, a life of 12 years, and an annual operating cost of $16,000 for the first 5 years, increasing by 10% per year thereafter. Use an interest rate of 10% per year. The present worth of all costs for a newly acquired machine is determined to be $ __________ plz answer correct asap help Dont answer by pen pepararrow_forwardContributions of $800 at the beginning of every three months resulted in an RRSP worth $85.000 after 10 years. What effective rate of Interest did the RRSP earn Mample Choice 01:50:04 17.878% 18.3139 16.791% 17175% 1983%arrow_forwardYou have two machines under consideration for an improved automated wrapping process for Snickers Fun Size candy bars as detailed below. Compare them on the basis of annual worths at i= 14.00%. Machine First Cost Annual Cost per Year Salvage Value Life с $-30000 $-12000 $12000 D $-55000 $-17000 $18000 3 years 6 yearsarrow_forward

- Problem 3 Le The engineering department estimates that waste treatment costs will be $50,000 for the first year. Later the waste treatment cost will decline $4,000 each year. Use an 10% interest rate and annual cash flow analysis for 15 years to determine equivalent uniform annual cost.arrow_forwardComplete the following analysis of cost alternatives and select the preferred alternative. The study period is 10 years and the MARR = 10% per year. "Do Nothing" is not an option. A B $15,000 $16,100 240 290 1,000 1,250 -$41,731 - $45,131 Capital investment Annual costs Market value at EOY 10 FW (10%) Click the icon to view the interest and annuity table for discrete compounding when i = 10% per year. The FW of the alternative C is $. (Round to the nearest dollar.) Select the preferred alternative. Choose the correct answer below. OA. Alternative C OB. Alternative A OC. Alternative B O D. Alternative D D $17,900 110 1,950 ??? - $46,231 с $12,500 450 1,800arrow_forwardDon't use ai to answer I will report your answer. Solve it Asap with explanation and calculationarrow_forward

- Hinson’s Homegrown Farms needs a new irrigation system. System one will cost $145,000, have annual maintenance costs of $10,000, and need an overhaul at the end of year six costing $30,000. System two will have first-year maintenance costs of $5000 with increases of $500 each year thereafter. System two would not require an overhaul. Both systems will have no salvage value after 12 years. If Hinson’s cost of capital is 4%, using annual worth analysis determine the maximum Hinson’s should be willing to pay for system two.arrow_forwardAnnual thermal loss through the pipe lines of a factory is estimated to be $412 in terms of wasted energy. A new anti-heating technology can reduce the energy loss by 93% and costs for $1232. Although this new technology has no salvage value but it helps the factory to save much energy for upcoming 8 Years. Identify the present worth of the entire investment if the market rate is 10%.arrow_forwardRequired information Assume you started a sideline business in commercial photography last year using your then-owned equipment. Due to excellent success, you plan to purchase new equipment and upgrade your studio facility. First cost of equipment, $ -160,000 Annual expenses, $ per year -45,000 Annual revenue, $ per year 75,000 Determine the no-return payback period. The no-return payback period is years.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education