ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

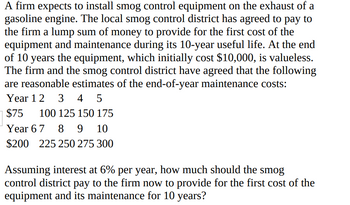

Transcribed Image Text:A firm expects to install smog control equipment on the exhaust of a

gasoline engine. The local smog control district has agreed to pay to

the firm a lump sum of money to provide for the first cost of the

equipment and maintenance during its 10-year useful life. At the end

of 10 years the equipment, which initially cost $10,000, is valueless.

The firm and the smog control district have agreed that the following

are reasonable estimates of the end-of-year maintenance costs:

Year 1 2 3 4 5

$75 100 125 150 175

Year 6 7 8 9 10

$200 225 250 275 300

Assuming interest at 6% per year, how much should the smog

control district pay to the firm now to provide for the first cost of the

equipment and its maintenance for 10 years?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Calculate the future worth (FW) at 10% of a project that will save $25K per year for 20 years. The first cost is $120K, and the salvage value is $20K. Compare this with the PW and the EAW. (Please show the process and solution ty.)arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardPlease fill out the spaces and answer the questions. Use table provided.arrow_forward

- Required information Assume you started a sideline business in commercial photography last year using your then-owned equipment. Due to excellent success, you plan to purchase new equipment and upgrade your studio facility. First cost of equipment, $ -160,000 Annual expenses, $ per year -45,000 Annual revenue, $ per year 75,000 Determine the no-return payback period. The no-return payback period is years.arrow_forwardPlease no written by hand and no imagearrow_forwardAssume that someone have to pay tuition for four years. Two years at RCC school and then two years at Northeastern University. Two years at RCC cost $25000 for Two years at Northeastern University $144000 That person then get a fulltime engineering job for $90000/yr. What is that person own simple payback period and his/her ROI for paying for school in order to get that Engineering job?arrow_forward

- Please answer question 5 with details on how to do it. Thank you.arrow_forwardPlease no written by hand and no emagearrow_forwardLittrell's Nursery needs a new irrigation system. System one will cost $145,000, have annual maintenance costs of $10,000, and need an overhaul at the end of year six costing $30,000. System two will have first year maintenance costs of $5,000 with increases of $500 each year thereafter. System two would not require an overhaul. Both systems will have no salvage value after 12 years. If Littrell's cost of capital is 4%, using annual worth analysis determine the maximum Littrell's should be willing to pay for system two.arrow_forward

- A transit system is considering buying 6 more buses to provide better service. It will cost $100,000 for buying a new bus and $15,000 per year for maintenance and operation for the following 8 years. If the city’s MARR is 8%, what is the equivalent uniform annual cost of this project? Assume the bus has no value at the end of 8 years.arrow_forwardPlease show the solution of finding the i*value which is 8.7%arrow_forwardthis are homework questions, pls explain the correct answer :arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education