FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

To calculate diluted EPS, the accountant does all of the following except:

adds back to net income any compensation expense recognized on the employee stock

options

adds back any interest expense (net of taxes) on convertible bonds

adds back any dividends on convertible

net income to common shareholders.

enters only the net incremental shares issued (shares issued under options minus assumed

shares repurchased) in the computation of diluted EPS.

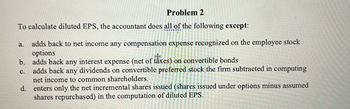

Transcribed Image Text:**Problem 2**

To calculate diluted EPS, the accountant does all of the following **except**:

a. adds back to net income any compensation expense recognized on the employee stock options

b. adds back any interest expense (net of taxes) on convertible bonds

c. adds back any dividends on convertible preferred stock the firm subtracted in computing net income to common shareholders.

d. enters only the net incremental shares issued (shares issued under options minus assumed shares repurchased) in the computation of diluted EPS.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- For this question, please refer to the Fact Pattern below (Same fact pattern as previous question). Given the set of transactions above, what was Adjusted EBITDA in 2021? O $1,107.2 O $1,082.2. O $1,068.2 $1,092.2 Activities during the year: Capital expenditures Cost of Goods Sold (excluding D&A) Dividend Payout Ratio (dividends/ net income to common shareholders) Income Tax Net Interest Expense Net Revenues Non-controlling Interest Expense (After-Tax) Litigation Expense Other Operating Expenses (excluding D&A) Purchases of intangible assets Preferred dividends Research And Development (excluding D&A) Proceeds from sale of land with book value of $15 Selling, General, & Administrative (excluding D&A) Write-down of PP&E 2021 580.0 3,256.0 40% 35% 45.6 5,800.0 25.0 97.0 16.5 45.0 5.0 56.3 20.0 1,488.0 7.0arrow_forwardThe dividend to general unsecured creditors is the dividend rate declared on common stock multiplied by the amount due to unsecured creditors. True of Falsearrow_forwardM Company prepares its financial statements using IFRS. M will record a deferred tax asset for stock options a. for the cumulative amount of the fair value of the options M has recorded for compensation expense. b. for the portion of the options’ intrinsic value earned to date times the tax rate. c. for the tax rate times the amount of compensation. d. unless the award is “in the money;” that is, it has intrinsic value.arrow_forward

- The following information is provided concerning the accounts of Jazzy Ltd .You are asked to identify how each of these items is shown in the financial statements. (a) gain on revaluation of available-for-sale investments (b) dividends paid during the year (c) revaluation gain on building (not reversing any previous revaluation) (d) transfer to dividend equalisation reserve (e) Unsecured notes issuedarrow_forwardWhich of the following statements is CORRECT? A. Net working capital is defined as current assets minus the difference between current liabilities and notes payable, and any increase in the current ratio automatically indicates that net working capital has increased B. If a company follows a policy of "matching maturities," this means that it matches its use of common stock with its use of long-term debt as opposed to short-term debt. C. Net working capital is defined as current assets minus the difference between current liabilities and notes payable, and any decrease in the current ratio automatically indicates that net working capital has decreased. D. Credit policy has an impact on working capital because it influences both sales and the time before receivables are collected.arrow_forwardCould the accountant be sure that all dividends due on the client's marketable securities have been received and recorded? Asaparrow_forward

- When the conversion of bonds payable to common stock is recorded under the market value method and the market value of the common stock exceeds the book value of the bonds at date of conversion, the difference is recorded as a debit to Loss on Conversion. debit to Additional Paid-in Capital−Common Stock. debit to Discount on Bonds Payable. debit to Retained Earnings.arrow_forwardIf stock is issued for an asset other than cash the asset should be recorded on the books of the corporation at the -book value of the asset -par value of the stock -current market value of the asset -fair market value of the stock minus the apt value of the stockarrow_forwardUnder IFRS, share dividends declared after the statement of financial position date but before the end of the subsequent events period are:(a) accounted for similar to errors as a prior period adjustment.(b) adjusted subsequent events, because they are paid from prior year earnings.(c) not adjusted in the current year’s financial statements.(d) recognized on a prospective basis from the date of declaration.arrow_forward

- Please provide answer in text (Without image)arrow_forwardWhich of the following items would not appear in the section of the statement of financial position (balance sheet) headed 'Capital and reserves'? a) Share premium b) Revaluation reserve c) Preference shares d) Debenturesarrow_forwardUnder the accumulated other comprehensive income in stockholders’ equity section of its December 31, year 2 balance sheet, what amount should Stone report? *arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education