FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

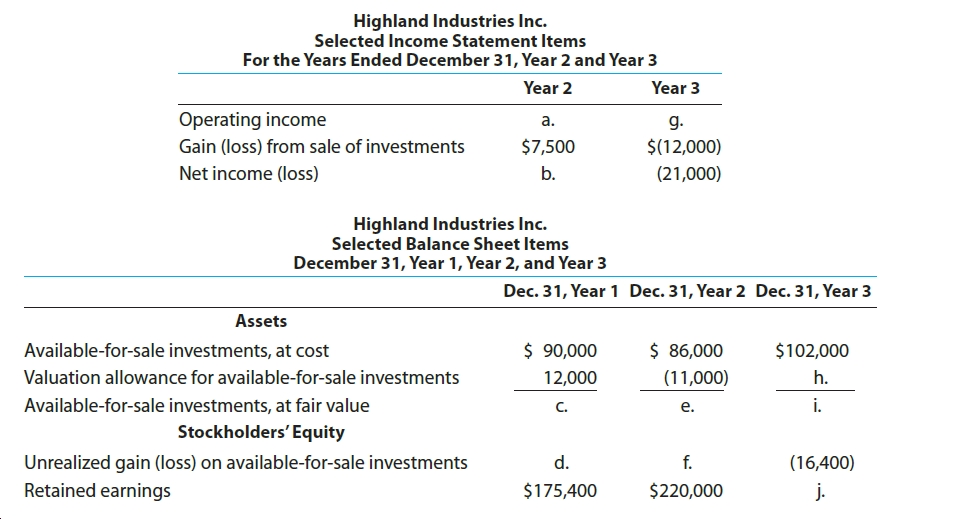

Highland Industries Inc. makes investments in available-for-sale securities. Selected income statement items for the years ended December 31, Year 2 and Year 3, plus selected items from comparative

Please see the attachment for details:

There were no dividends.

Determine the missing lettered items.

Transcribed Image Text:Highland Industries Inc.

Selected Income Statement Items

For the Years Ended December 31, Year 2 and Year 3

Year 2

Year 3

Operating income

a.

g.

Gain (loss) from sale of investments

$7,500

$(12,000)

Net income (loss)

b.

(21,000)

Highland Industries Inc.

Selected Balance Sheet Items

December 31, Year 1, Year 2, and Year 3

Dec. 31, Year 1 Dec. 31, Year 2 Dec. 31, Year 3

Assets

$ 90,000

$ 86,000

$102,000

Available-for-sale investments, at cost

Valuation allowance for available-for-sale investments

(11,000)

h.

12,000

Available-for-sale investments, at fair value

C.

i.

e.

Stockholders' Equity

Unrealized gain (loss) on available-for-sale investments

Retained earnings

d.

f.

(16,400)

$220,000

$175,400

j.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following information is available with regard to a stock item: Cost: $1,200 (of which $130 clearing charges) Selling price: $1,360 Market price: $1,090 At what amount should this inventory item be reflected in the statement of financial position (balance Sheet)?arrow_forwardCan you answer for the following: (d) Return on assets. (Assets on 12/31/20 were $2,800.) (e) Return on common stockholders’ equity. (Stockholders’ equity—common on 12/31/20 was $910.) (f) Debt to assets ratio. (g) Times interest earned.arrow_forwardRecord entries (if necessary) for the following transactions. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. June 30 Declared a $48,000 cash dividend payable to common stockholders. July 15 The date of record for the cash dividend declared is July 15. July 31 Paid the dividend declared on June 30. View transaction list 1 Declared a $48,000 cash dividend payable to common stockholders. 2 3 The date of record for the cash dividend declared is July 15. Paid the dividend declared on June 30. X Credit >arrow_forward

- Assume that Dennis Savard Inc. has the following accounts at the end of the current year. 1. Common Stock 2. Discount on Bonds Payable 3. Treasury Stock (at cost) 4. Notes Payable (short-term) 5. Raw Materials 6. Equity Investments (long-term) 7. Unearned Rent Revenue 8. Work in Progress 9. Copyrights 10. Buildings 11. Notes Receivable (short-term) 12. Cash 13. Salaries and Wages Payable 14. Accumulated Depreciation-Buildings 15. Restricted Cash for Plant Expansion 16. Land Held for Future Plant Site 17. Allowance for Doubtful Accounts 18. Retained Earnings 19. Paid-in Capital in Excess of Par-Common Stock 20. Unearned Subscriptions Revenue 21. Receivables-Officers (due in on year) 22. Inventory (finished goods) 23. Accounts Receivable 24. Bonds Payab;e (due in 4 years) Prepare a classified balance sheet in good form. (No monetary amounts are necessary). (For Land, Treasury Stock, Notes Payable, Preferred Stock Investments, Notes Receivable, Receivables-Officers, Inventory, Bonds…arrow_forwardStatement of financial position balances as at 31 December 20X8 and 20 x 9 are provided below for Laurel Inc. Laurel Inc. additional information: Net earnings for 20x9 were $714,000. Equipment with an original cost of $404,000 and a NBV of $ 152,000 was sold for $152,000 during the year. Long-term investments were sold for $137,000 during the year. Short-term investments acquired are treasury bills with an original term of three months. Required: Prepare an SCF for 20x 9 using the indirect method. Note any assumptions made during your SCF preparation. (Deductible amounts and Cash outflows should be indicated with minus sign.) Laurel Inc. Statement of Cash Flows For the year ended 31 December 20 X9 \table[[\table[[Operating activities:], [ Net earninas]]],[Net earnings, Øs, 714,000,], [Adjustments for non-cash items:...]. [Depreciation expense, 0 254,000,]. [Amortization of patent,var ? €, 17,000,], [Gain on sale of long-term investment,diamond,(35,000), ], [Change in cash,..].…arrow_forwardOn May 1, Year 3, Love Corporation declared a $94,200 cash dividend to be paid on May 31 to shareholders of record on May 15. Required Record the events occurring on May 1 and May 31 in a horizontal statements model. In the Cash Flow column, indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA). If an element was not affected by the event, leave the cell blank. (Enter any decreases to account balances with a minus sign.) Date May 1 May 31 Balance Sheet Assets = Liabilities Common Stock LOVE CORPORATION Horizontal Statements Model Retained: Earnings Revenue: Income Statement Expense Net Income Statement of Cash Flowarrow_forward

- Waterway Mining Company declared, on April 20, a dividend of $426,000 payable on June 1. Of this amount, $119,000 is a return of capital.Prepare the April 20 and June 1 entries for Waterway. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)arrow_forwardAt the beginning of its current fiscal year, Willie Corp's balance sheet showed assets of $14,600 and liabilities of $5,400. During the year, liabilities decreased by $1,000. Net income for the year was $3.100, and net assets at the end of the year were $9,900. There were no changes in paid-in capital during the year. Required: Calculate the dividends, if any, declared during the year. Indicate the financial statement effect. (Enter decreases with a minus sign to indicate a negative financial statement effect.) Stockholders' Equity Assets = Liabilities PIC RE Beginning: $ 14,600 $ 5,400 Changes: (1,000) + Ending:arrow_forwardPrepare journal entries to record the following transactions for Emerson Corporation. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) July 15 Declared a cash dividend payable to common stockholders of $165,000. August 15 Date of record is August 15 for the cash dividend declared on July 15. August 31 Paid the dividend declared on July 15. View transaction list Journal entry worksheetarrow_forward

- The current year financial statements for two competitors are presented below. Please analyze their financials. Note: if a ratio cannot be solved given the data provided, please leave it blank. There are a few ratios that cannot be solved given the information provided. Balance sheet: Cash Accounts receivable (net) Inventory Property & equipment (net) Other assets Total assets Current liabilities Long-term debt (interest rate: 15 %) Capital stock ($10 par value) Additional paid-in capital Retained earnings Total liabilities and stockholders' equity Income statement: Sales revenue (1/2 on credit) Cost of goods sold Operating expenses Net income Other data: Per share stock price at end of current year Average income tax rate Dividends declared and paid in current year Profitability ratios: 1. 2. 3. 4. 5. 6. Ratio 7. 8. 9. 10. Return on equity Return on assets Gross profit percentage Net profit margin Earnings per share Quality of income Asset turnover ratios: Total asset turnover Fixed…arrow_forwardShep Company's records show the following information for the current year. Beginning of year $ 50,800 $ 22,400 Total assets Total liabilities. End of year $ 81,000 $ 35,400 Determine net income (loss) for each of the following separate situations. Note: For all requirements, losses should be entered with a minus sign. a. Additional common stock of $3,400 was issued and dividends of $7,400 were paid during the current year. b. Additional common stock of $15,100 was issued and no dividends were paid during the current year. c. No additional common stock was issued and dividends of $12,400 were paid during the current year. a. Net income (loss) b. Net income (loss) c. Net income (loss)arrow_forwardOn May 1, Year 3, Love Corporation declared a $57,700 cash dividend to be paid on May 31 to shareholders of record on May 15. Required Record the events occurring on May 1 and May 31 in a horizontal statements model. In the Cash Flow column, indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA). If an element was not affected by the event, leave the cell blank. (Enter any decreases to account balances with a minus sign.) LOVE CORPORATION Horizontal Statements Model Balance Sheet Income Statement Statement of Cash Common Stock Retained Flow Date Assets Liabilities + Revenue Expense Net Income Earnings May 1 + May 31arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education