Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

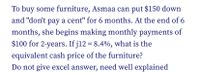

Transcribed Image Text:To buy some furniture, Asmaa can put $150 down

and "don't pay a cent" for 6 months. At the end of 6

months, she begins making monthly payments of

$100 for 2-years. If j12 = 8.4%, what is the

equivalent cash price of the furniture?

Do not give excel answer, need well explained

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 6. Homes-R-Us is offering free credit on a new $200,000 home. You pay $40,000 down and then $16,000 a year for the next 10 years. We-Build'em-Better does not offer free credit but will give you $40,000 off the list price. a. If the discount rate is 5% per year, which company is offering the better deal? b. If the discount rate is 8% per year, which company is offering the better deal? Compare your answers to (a) and (b). Why do you think you are getting those results? c.arrow_forwardDo not use excel to answer, i need good explanation. Gurleen buys a house and takes out a mortgage of $150,000 at j2 = 6%, to be repaid over 20 years with weekly payments of R. What is the value of R?arrow_forwardDo the task with the excel or manually if possible,thx If a family who owns a food stall is planning to buy a car in the next 3 years for $13920,89. The family is able to set aside 20% of their income from $1392,09/month by saving (1% bank interest/month). Is that money enough to buy a car? If not, how much should the family add?arrow_forward

- Kendra took out a loan for $750 et an 84% APR, compounded monthly, to buy a stereo. If she will make monthly payments of $46.50 to pay off the loan which of these groups of values plugged into the TVM Solver of a graphing calculetor could be used to calculute the number of payments she wil have to make? O A NIN -84, PV--750, PMT-46.5 FV-0, P/Y-1 C/Y-12 PMT END O B. NIN07, PV-750, PMT-46.5, FV-0, P/Y-12 C/Y-12 PMTEND O C. N-IN 8.4 PV-750, PMT-46.5 FV-0 P/Y-12 C/Y-12 PMT:END D. N-IN0.7: PV-750 PMT-46.5: FV-0; P/Y-1; C/Y-12 PMT:ENDarrow_forwardTrae needs to buy a car, but he doesn’t have any money for a down-payment and can only afford $190 per month for this car payment. If he can finance a car at 5.50% for 4 years, how much car can he afford? N= FV= I%= P/Y= PV= C/Y= PMT= End or Begin $170.00 $220.73 $11,555.84 $8,169.77arrow_forwardYou need to buy a new laundry center with a price of $ 22,000 because the one you had no longer works and has no repair, at the moment you do not have the cash available to buy it, so you went to a department store to buy it on credit, The store offers you to pay for the laundry center in 24 months with an annual rate of 17%. What is the amount you will have to pay monthly? Note: Step by step to get to the result, do not skip anything.Note2: If it can be done in excel it is betterarrow_forward

- on Sami buys a used truck for $1,500. After using it for 3 years, he expects to sell it for $800. If i = 7.5% per year, the future worth in dollars is: Select one: O O a. $1,500 – $700(P/F,7.5%,3) b. $ 700 + 10% of $700 c. $700 - $1,500 (F/P,7.5%,3) d. $1,500 (F/P,7.5%,3) - 800arrow_forwardYou are going back to school and anticipate you will need 25,000 a year for living expenses for 6 years. How much do you put away at 4%?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education