FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

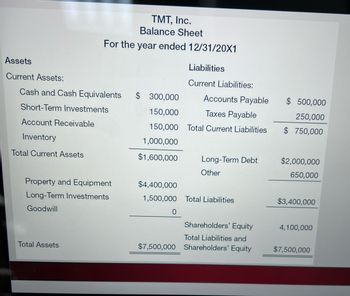

what is the debt to equity ratio rounded to 2 decimal places? i keep getting 0.83 but it’s not correct.

Transcribed Image Text:Assets

Current Assets:

TMT, Inc.

Balance Sheet

For the year ended 12/31/20X1

Cash and Cash Equivalents

Short-Term Investments

Account Receivable

Inventory

Total Current Assets

Property and Equipment

Long-Term Investments

Goodwill

Total Assets

$300,000

150,000

150,000

1,000,000

$1,600,000

Liabilities

Current Liabilities:

0

Accounts Payable

Taxes Payable

Total Current Liabilities

Long-Term Debt

Other

$4,400,000

1,500,000 Total Liabilities

Shareholders' Equity

Total Liabilities and

$7,500,000 Shareholders' Equity

$ 500,000

250,000

$750,000

$2,000,000

650,000

$3,400,000

4,100,000

$7,500,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is the formula for the dividens paid that results in the -787? I am struggling to find the correct numbers to usearrow_forward7- which of the statements given below is true? Please select one; a) every financial market allows loans to be made b) The New York Stock Exchange is an example of a primary market c) the capital market is a financial market in which only short term debt instruments (generally those with an original maturity of less than one year) are traded d) a pansion fund is not a contractual savings instution e) in the US financial intermediaries are restricted in what they are allowed to do and what assets m m they can holdarrow_forwardit say all answers above are incorrect, i need the yield on the debt percentage plz and thank uarrow_forward

- Which of the following statements is true?a. When the interest rate increases, the present value of asingle amount decreases.b. When the number of interest periods increases, thepresent value of a single amount increases.c. When the interest rate increases, the present value of anannuity increases.d. None of the above are true.arrow_forwardExplain FOUR (4) reasons that influence the changes which make debt security yields vary. Please giveexplanation in details with example.arrow_forwardnot use ai please don'tarrow_forward

- What determine the Structure of Interest Rates, and name the three primary shapes of the Structure of Interest Rates? (Only in 150 words)arrow_forwardRegarding the following statements about credit fixed income, identify who is correct (select all that apply): a. Meeyeon: "Credit spreads tighten when the economy is strong, and there is a continued positive outlook." b. Andrew: "Subordinated debentures are riskier for investors than senior debt." c. Greg: "The G-spread only measures the credit spread between a bond and a government curve over one point of time." d. Yuting: "Investment-grade credit never defaults." (only a and b is incorrect)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education