FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Transcribed Image Text:2

kipped

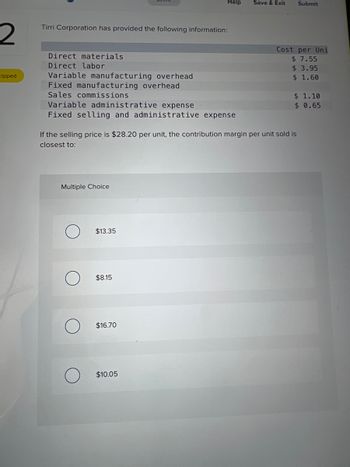

Tirri Corporation has provided the following information:

Direct materials.

Direct labor

Variable manufacturing overhead

Fixed manufacturing overhead

Sales commissions

Variable administrative expense

Fixed selling and administrative expense

Multiple Choice

O

$13.35

Help

If the selling price is $28.20 per unit, the contribution margin per unit sold is

closest to:

$8.15

$16.70

$10.05

Save & Exit

Submit

Cost per Uni

$ 7.55

$ 3.95

$ 1.60

$ 1.10

$ 0.65

Expert Solution

arrow_forward

Step 1

The variable cost per unit must be deducted from the selling price per unit so as to calculate the contribution margin per unit.

Variable cost are those cost which changes with the changing level of production / sales i.e. higher the production / sales more will be the variable cost and vice versa.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please do not give solution in image format thankuarrow_forwardBenoit Company produces three products-A, B, and C. Data concerning the three products follow (per unit): Product B $ 62.00 Selling price Variable expenses: Direct materials Other variable expenses Total variable expenses Contribution margin Contribution margin ratio A $ 80.00 24.00 24.00 48.00 $ 32.00 Required 1 Required 2 40% Required 3 18.00 25.40 43.40 $18.60 30% с $81.00 The company estimates that it can sell 800 units of each product per month. The same raw material is used in each product. The material costs $3 per pound with a maximum of 5,000 pounds available each month. 9.00 43.65 52.65 $28.35 Required: 1. Calculate the contribution margin per pound of the constraining resource for each product. 2. Which orders would you advise the company to accept first, those for A, B, or C? Which orders second? Third? 3. What is the maximum contribution margin that the company can earn per month if it makes optimal use of its 5,000 pounds of materials? 35% Complete this question by…arrow_forwardA tile manufacturer has supplied the following data: Boxes of tiles produced and sold Sales revenue Variable manufacturing expense Fixed manufacturing expense Variable selling and administrative expense Fixed selling and administrative expense Net operating income a. b. $ $ What is the company's unit contribution margin? $0.86 per unit $2.35 per unit $4.10 per unit $1.75 per unit C. d. 520,000 2,132,000 650,000 $ 464,000 $ 260,000 $ 312,000 $ 446,000arrow_forward

- am. 106.arrow_forwardA manufacturer reports the following. Compute contribution margin. Sales Variable cost of goods sold Fixed overhead Variable selling and administrative costs Fixed selling and administrative costs Multiple Choice $800,000 $642,000 $762,000 $524,000 $ 1,218,000 418,000 338,000 158,000 118,000arrow_forwardroduct Cost Method of Product Costing MyPhone, Inc., uses the product cost method of applying the cost-plus approach to product pricing. The costs of producing and selling 5,160 units of cell phones are as follows: Variable costs: Fixed costs: Direct materials $90 per unit Factory overhead $199,200 Direct labor 31 Selling and admin. exp. 70,300 Factory overhead 23 Selling and admin. exp. 22 Total variable cost per unit $166 per unit MyPhone desires a profit equal to a 13% rate of return on invested assets of $600,800. a. Determine the amount of desired profit from the production and sale of 5,160 units of cell phones.$fill in the blank 1 b. Determine the product cost per unit for the production of 5,160 of cell phones. If required, round your answer to nearest dollar.$fill in the blank 2 per unit c. Determine the product cost markup percentage (rounded to two decimal places) for cell phones.fill in the blank 3 % d.…arrow_forward

- What type of cost is this? Total Costs Units January $100,4881,057 February $100,488880 If it is a mixed cost, enter a 1 for your answer. If it is a variable cost, enter a 2 for your answer. If it is a fixed cost, enter a 3 for your answer.arrow_forwardAverage Cost per Unit Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Fixed selling expense Fixed administrative expense $6.55 $3.45 $1.45 $3.80 $1.40 $0.95 $1.35 $0.85 Sales commissions Variable administrative expense If 7,300 units are sold, the variable cost per unit sold is closest to:arrow_forwardRequired information [The following information applies to the questions displayed below.] Felix & Company reports the following information. Period Units Produced 0 1 2 9 10 408 800 1,200 1,600 2,000 2,400 2,800 3,200 3,600 Total Costs $ 2,545 Total cost at the high point Variable costs at the high point Volume at the high point Variable cost per unit Total variable costs at the high point Total fixed costs 3,265 3,985 4,705 5,425 6,145 6,865 7,585 (1) Use the high-low method to estimate the fixed and variable components of total costs. (2) Estimate total costs if 3,000 units are produced. High-Low method- Calculation of variable cost per unit 8,305 9,025 Total cost at the low point Variable costs at the low point Volume at the low point Variable cost per unit Total variable costs at the low point Total fixed costs (2) Estimated cost if 3,000 units are produced: Estimated total cost High-Low method-Calculation of fixed costs 0arrow_forward

- Godoarrow_forwardNonearrow_forwardBenoit Company produces three products-A, B, and C. Data concerning the three products follow (per unit): Product B $ 70.00 Selling price Variable expenses: Direct materials Other variable expenses Total variable expenses Contribution margin Contribution margin ratio A $ 84.00 25.20 25.20 50.40 $ 33.60 40% Required 1 Required 2 Required 3 21.00 31.50 52.50 $ 17.50 25% с $ 74.00 The company estimates that it can sell 750 units of each product per month. The same raw material is used in each product. The material costs $3 per pound with a maximum of 5,400 pounds available each month. Contribution margin per pound of the constraining resource Product Carrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education