FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

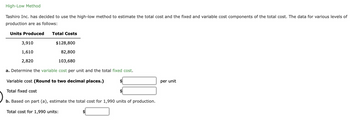

Transcribed Image Text:High-Low Method

Tashiro Inc. has decided to use the high-low method to estimate the total cost and the fixed and variable cost components of the total cost. The data for various levels of

production are as follows:

Units Produced Total Costs

3,910

71

1,610

2,820

a. Determine the variable cost per unit and the total fixed cost.

Variable cost (Round to two decimal places.)

Total fixed cost

b. Based on part (a), estimate the total cost for 1,990 units of production.

$128,800

82,800

103,680

Total cost for 1,990 units:

$

$

per unit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hi Tutor please provide Solutionsarrow_forwardPharoah Company has a unit selling price of $576, variable costs per unit of $324, and fixed costs of $183,456. Compute the break-even point in units using (a) the mathematical equation and (b) unit contribution margin. Break-even point (a) Mathematical Equation (b) Unit contribution margin units unitsarrow_forwardHigh-Low Method Ziegler Inc. has decided to use the high-low method to estimate the total cost and the fixed and variable cost components of the total cost. The data for various levels of production are as follows: Units Produced Total Costs 4,760 $305,760 1,960 196,560 3,290 236,090 a. Determine the variable cost per unit and the total fixed cost. Variable cost: (Round to the nearest dollar.) $fill in the blank Total fixed cost: $fill in the blank b. Based on part (a), estimate the total cost for 2,420 units of production. Total cost for 2,420 units: $fill in the blankarrow_forward

- Need ANSWER please provide Solutionsarrow_forward! Required information [The following information applies to the questions displayed below.] Felix & Company reports the following information. Period Units Produced 0 560 960 123456789 10 1,360 1,760 2,160 2,560 2,960 3,360 3,760 Total Costs $ 4,660 3,960 4,360 4,960 4,060 4,260 8,760 16,160 4,960 11,992 (1) Use the high-low method to estimate the fixed and variable components of total costs. (2) Estimate total costs if 2,440 units are produced.arrow_forwardIf variable manufacturing costs are $13 per unit and total fixed manufacturing costs are $198,900, what is the manufacturing cost per unit if: a. 3,900 units are manufactured and the company uses the variable costing concept?$fill in the blank 1 b. 5,100 units are manufactured and the company uses the variable costing concept?$fill in the blank 2 c. 3,900 units are manufactured and the company uses the absorption costing concept?$fill in the blank 3 d. 5,100 units are manufactured and the company uses the absorption costing concept?$fill in the blank 4arrow_forward

- need last three requirement , answer in text form please (without image)arrow_forwardHigh-Low Method Tashiro Inc. has decided to use the high-low method to estimate the total cost and the fixed and variable cost components of the total cost. The data for various levels of production are as follows: Units Produced Total Costs 6,300 $482,160 2,100 309,960 4,120 459,430 a. Determine the variable cost per unit and the total fixed cost. Variable cost (Round to two decimal places.) per unit Total fixed cost b. Based on part (a), estimate the total cost for 3,020 units of production. Total cost for 3,020 units:arrow_forwardHigh-low method Evander Inc. has decided to use the high-low method to estimate the total cost and the fixed and variable cost components of the total cost. The data for various levels of production are as follows: Units Produced 1,430 2,530 3,630 Total Costs $190,080 262,310 295,680 a. Determine the variable cost per unit and the total fixed cost. Variable cost $ Total fixed cost $ b. Based on part (a), estimate the total cost for 1,820 units of production. Total cost for 1,820 units $arrow_forward

- Required information [The following information applies to the questions displayed below.] Felix & Company reports the following information. Period Units Produced 0 1 2 9 10 408 800 1,200 1,600 2,000 2,400 2,800 3,200 3,600 Total Costs $ 2,545 Total cost at the high point Variable costs at the high point Volume at the high point Variable cost per unit Total variable costs at the high point Total fixed costs 3,265 3,985 4,705 5,425 6,145 6,865 7,585 (1) Use the high-low method to estimate the fixed and variable components of total costs. (2) Estimate total costs if 3,000 units are produced. High-Low method- Calculation of variable cost per unit 8,305 9,025 Total cost at the low point Variable costs at the low point Volume at the low point Variable cost per unit Total variable costs at the low point Total fixed costs (2) Estimated cost if 3,000 units are produced: Estimated total cost High-Low method-Calculation of fixed costs 0arrow_forwardHigh-low method Evander Inc. has decided to use the high-low method to estimate the total cost and the fixed and variable cost components of the total cost. T Units Produced Total Costs 1,350 2,570 4,350 $183,600 225,220 285,600 a. Determine the variable cost per unit and the total fixed cost. Variable cost $ Total fixed cost $ b. Based on part (a), estimate the total cost for 2,050 units of production. Total cost for 2,050 units $arrow_forwardPlease help me with show all Calculation thankuarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education