Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

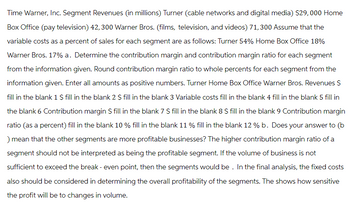

Transcribed Image Text:Time Warner, Inc. Segment Revenues (in millions) Turner (cable networks and digital media) $29,000 Home

Box Office (pay television) 42, 300 Warner Bros. (films, television, and videos) 71, 300 Assume that the

variable costs as a percent of sales for each segment are as follows: Turner 54% Home Box Office 18%

Warner Bros. 17% a. Determine the contribution margin and contribution margin ratio for each segment

from the information given. Round contribution margin ratio to whole percents for each segment from the

information given. Enter all amounts as positive numbers. Turner Home Box Office Warner Bros. Revenues $

fill in the blank 1 $ fill in the blank 2 $ fill in the blank 3 Variable costs fill in the blank 4 fill in the blank 5 fill in

the blank 6 Contribution margin $ fill in the blank 7 $ fill in the blank 8 $ fill in the blank 9 Contribution margin

ratio (as a percent) fill in the blank 10 % fill in the blank 11 % fill in the blank 12% b. Does your answer to (b

mean that the other segments are more profitable businesses? The higher contribution margin ratio of a

segment should not be interpreted as being the profitable segment. If the volume of business is not

sufficient to exceed the break-even point, then the segments would be. In the final analysis, the fixed costs

also should be considered in determining the overall profitability of the segments. The shows how sensitive

the profit will be to changes in volume.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Assume the following financial data pertains to a certain single-product lodging business:Room Sales - $400,000Total Variable - $260,000Costs Contribution Margin - $140,000Total Fixed Costs - $ 76,000IBIT - $ 64,000Based on the financial data provided, the contribution margin percentage is __________ percent.arrow_forwardRequired information [The following information applies to the questions displayed below.] Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales Variable expenses Contribution margin Fixed expenses Net operating income $ 40,000 26,000 14,000 8,680 $5,320 9. What is the break-even point in dollar sales? Break-even pointarrow_forwardBryce Co. sales are $848,000, variable costs are $466,300, and operating income is $229,000. What is the contribution margin ratio? Oa. 60.2% Оb. 55.0% Ос. 40.7% Od. 45.0%arrow_forward

- Lucido Products markets two computer games: Claimjumper and Makeover. A contribution format income statement for a recent month for the two games appears below: Sales Variable expenses Contribution margin Fixed expenses Net operating income Claimjumper $57,600 38,400 $ 19, 200 Required: 1. What is the overall contribution margin (CM) ratio for the company? 2. What is the company's overall break-even point in dollar sales? 3. Prepare a contribution format income statement at the company's break-even point that shows the appropriate levels of sales for the two products. Required 1 Required 2 Required 3 Complete this question by entering your answers in the tabs below. Sales Variable expenses Contribution margin Prepare a contribution format income statement at the company's break-even point that shows the appropriate levels of sales for the two products. (Do not round intermediate calculations. Round your answers to the nearest dollar amount.) Engberg Company Contribution Income…arrow_forwardContribution Margin Willie Company sells 39,000 units at $33 per unit. Variable costs are $22.11 per unit, and fixed costs are $191,100. Determine (a) the contribution margin ratio, (b) the unit contribution margin, and (c) operating income. a. Contribution margin ratio (Enter as a whole number.) fill in the blank ? %b. Unit contribution margin (Round to the nearest cent.) $ fill in the blank ? per unitc. Operating income $ fill in the blank ?arrow_forwardContribution Margin Ratio a. Young Company budgets sales of $112,900,000, fixed costs of $25,000,000, and variable costs of $66,611,000. What is the contribution margin ratio for Young Company?fill in the blank % b. If the contribution margin ratio for Martinez Company is 40%, sales were $34,800,000, and fixed costs were $1,500,000, what was the operating income?$fill in the blankarrow_forward

- Rings company has three product lines A, B and C. The following financial information is available:arrow_forwardSagararrow_forwardTime Warner, Inc. Segment Revenues (in millions) Turner (cable networks and digital media) Home Box Office (pay television) Warner Bros. (films, television, and videos) Assume that the variable costs as a percent of sales for each segment are as follows: Turner 34% Home Box Office 22% Warner Bros. 47% a. Determine the contribution margin and contribution margin ratio for each segment from the information given. When required, round to the nearest whole millionth (for example, round 5,688.7 to 5,689). Round contribution margin ratio to whole percents for each segment from the information given. Home Box Office Warner Bros. Revenues Variable costs $69,900 26,900 88,300 Contribution margin Contribution margin ratio (as a percent) Turner % b. Does your answer to (a) mean that the other segments are more profitable businesses? The higher contribution margin ratio of a segment should not be interpreted as being the sufficient to exceed the break-even point, then the segments would be…arrow_forward

- The following information is for Bullwinkle Industries Inc.: Line Item Description East West Sales volume (units): Product Alpha 45,000 38,000 Product Omega 60,000 50,000 Sales price: Product Alpha $500 $600 Product Omega $250 $225 Variable cost per unit: Product Alpha $275 $275 Product Omega $140 $140 a. Determine the contribution margin for the East Region and West Region.East Region: fill in the blank 1 of 2$West Region: fill in the blank 2 of 2$ b. Determine the contribution margin ratio for the East Region and West Region. Round the contribution margin ratio to one-tenth of a percent.East Region: fill in the blank 1 of 2%West Region: fill in the blank 2 of 2%arrow_forwardContribution Margin Ratio a. Young Company budgets sales of $1,050,000, fixed costs of $80,300, and variable costs of $357,000. What is the contribution margin ratio for Young Company? D% b. If the contribution margin ratio for Martinez Company is 39%, sales were $627,000, and fixed costs were $190,730, what was the operating income?arrow_forwardRam Company has three geographic segments: New York, New Jersey, and Connecticut. Its segmented income statement for last year is shown below: Company New York New Jersey Connecticut Sales 800,000 350,000 250,000 200,000 Variable costs 440,000 140,000 120,000 CM Traceable Fixed Costs 90,000 65,000 50,000 Segment margin Common Fixed Costs Net operating income 1. What was the amount of segment margin for New York? a)$60,000 b)$70,000 c)$80,000 d)$50,000 2. If Ram Company’s total fixed costs were $305,000, how much were the company’s common fixed costs? a)$110,000 b)$80,000 c)$100,000 d)$90,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education