Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

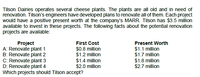

Transcribed Image Text:Tilson Dairies operates several cheese plants. The plants are all old and in need of

renovation. Tilson's engineers have developed plans to renovate all of them. Each project

would have a positive present worth at the company's MARR. Tilson has $3.5 million

available to invest in these projects. The following facts about the potential renovation

projects are available:

Project

A: Renovate plant 1

B: Renovate plant 2

C: Renovate plant 3

D: Renovate plant 4

Which projects should Tilson accept?

First Cost

Present Worth

$1.1 million

$1.7 million

$1.8 million

$2.7 million

$0.8 million

$1.2 million

$1.4 million

$2.0 million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Your company is developing a new textbook for FIN 301 and you paid your current FIN 301 instructor $700,000 for his input about the feasibility of such a product. The project would involve initial capital investment of $1,200,000 and installation costs related to the capital expenditures of $600,000. The project would also necessitate an increase in net working capital of $200,000 at the beginning of the project. You can straight line depreciate any depreciable expenses to zero over the three-year life of the project, and you don't expect the capital investment to be sold at the end of the project. Each year, you estimate you will receive $3,000,000 in sales revenue from your awesome textbook. Variable product and selling costs associated with these sales are expected to be 40% of revenue in each of those years. The fixed costs in each of the three years of the project will be $500,000. The corporate tax rate is 40%. Calculate the total year 0 cash flows associated with the project. $…arrow_forwardAssume that Walmart Inc. has decided to surface and maintain for 10 years a vacant lot next to one of its stores to serve as a parking lot for customers. Management is considering the following bids involving two different qualities of surfacing for a parking area of 11,300 square yards. Bid A: A surface that costs $5.25 per square yard to install. This surface will have to be replaced at the end of 5 years. The annual maintenance cost on this surface is estimated at 25 cents per square yard for each year except the last year of its service. The replacement surface will be similar to the initial surface. Bid B: A surface that costs $10.75 per square yard to install. This surface has a probable useful life of 10 years and will require annual maintenance in each year except the last year, at an estimated cost of 12 cents per square yard. Click here to view factor tables. Compute present value of the bids. You may assume that the cost of capital is 12%, that the annual maintenance…arrow_forwardThe investment committee of Granny’s Restaurants Inc. is evaluating two restaurant sites. The sites have different useful lives, but each requires an investment of $1,200,000. The estimated net cash flows from each site are as follows: Net Cash Flows Year Helena Butte 1 $375,000 $500,000 2 $375,000 $500,000 3 $375,000 $500,000 4 $375,000 $500,000 5 $375,000 6 $375,000 The committee has selected a rate of 20% for purposes of net present value analysis. It also estimates that the residual value at the end of each restaurant’s useful life is $0, but at the end of the fourth year, Helena’s residual value would be $500,000. Instructions: Using formulas/functions wherever available, complete the following on the Input tab… For each site, compute the net present value,…arrow_forward

- Vishunuarrow_forwardCitco Company is considering investing up to $512,000 in a sustainability-enhancing project. Its managers have narrowed their choices to three potential projects. • Project A would redesign the production process to recycle raw materials waste back into the production cycle, saving on direct materials costs and reducing the amount of waste sent to the landfill. Project B would remodel an office building, utilizing solar panels and natural materials to create a more energy-efficient and healthy work environment. Project C would build a new training facility in an underserved community, providing jobs and economic security for the local community. Required: 1. Assuming the cost of capital is 12%, complete the table below by computing the payback period, NPV, profitability index, and internal rate of return. (Future Value of $1, Present Value of $1, Future Value Annuity of $1, Present Value Annuity of $1.) 2. Based strictly on the economic analysis, in which project should they invest?…arrow_forwardWhat is the net present value of the investment in the car wash?arrow_forward

- At times firms will need to decide if they want to continue to use their current equipment or replace the equipment with newer equipment. The company will need to do replacement analysis to determine which option is the best financial decision for the company. Price Co. is considering replacing an existing piece of equipment. The project involves the following: • The new equipment will have a cost of $9,000,000, and it is eligible for 100% bonus depreciation so it will be fully depreciated at t = 0. • The old machine was purchased before the new tax law, so it is being depreciated on a straight-line basis. It has a book value of $200,000 (at year 0) and four more years of depreciation left ($50,000 per year). • The new equipment will have a salvage value of $0 at the end of the project's life (year 6). The old machine has a current salvage value (at year 0) of $300,000. • Replacing the old machine will require an investment in net operating working capital (NOWC) of…arrow_forwardCity of Oliver is considering automating a process in its accounting department that has been labor-intensive. The equipment currently used in the department can be sold. The new equipment will have a projected useful life of 10 years. The old equipment has a remaining useful life of 10 years. The following data are available to be used in making the decision. Should the city invest in the new equipment? Support your answer with appropriate calculations. Current equipment Current equipment book value $ 30,000 Annual depreciation charges 3,000 Current estimated disposal value 5,000 New equipment Cost $150,000 Annual depreciation charge 12,500 Expected disposal value 25,000 Labor savings each year $ 50,000 Present value factors @ 6% $1…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education