FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

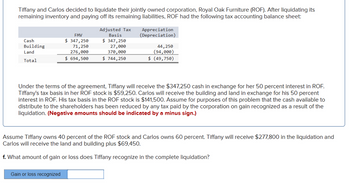

Transcribed Image Text:Tiffany and Carlos decided to liquidate their jointly owned corporation, Royal Oak Furniture (ROF). After liquidating its

remaining inventory and paying off its remaining liabilities, ROF had the following tax accounting balance sheet:

Cash

Building

Land

Total

FMV

$ 347,250

71,250

276,000

$ 694,500

Adjusted Tax

Basis

$ 347,250

27,000

370,000

$ 744,250

Gain or loss recognized

Appreciation

(Depreciation)

44,250

(94,000)

$ (49,750)

Under the terms of the agreement, Tiffany will receive the $347,250 cash in exchange for her 50 percent interest in ROF.

Tiffany's tax basis in her ROF stock is $59,250. Carlos will receive the building and land in exchange for his 50 percent

interest in ROF. His tax basis in the ROF stock is $141,500. Assume for purposes of this problem that the cash available to

distribute to the shareholders has been reduced by any tax paid by the corporation on gain recognized as a result of the

liquidation. (Negative amounts should be indicated by a minus sign.)

Assume Tiffany owns 40 percent of the ROF stock and Carlos owns 60 percent. Tiffany will receive $277,800 in the liquidation and

Carlos will receive the land and building plus $69,450.

f. What amount of gain or loss does Tiffany recognize in the complete liquidation?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Required information. Problem 19-63 (LO 19-5) (Algo) [The following information applies to the questions displayed below] Tiffany and Carlos decided to liquidate their jointly owned corporation, Royal Oak Furniture (ROF) After liquidating its remaining inventory and paying off its remaining liabilities, ROF had the following tax accounting balance sheet Adjusted Tax Basis $ 205,500 14,500 205,000 $425,000 Cash Building Land Total FMV $ 205,500 66,500 139,000 $ 411,000 Appreciation (Depreciation) Gain or loss recognized 52,000 (66,000) $ (14,000) Under the terms of the agreement, Tiffany will receive the $205,500 cash in exchange for her 50 percent interest in ROF Tiffany's tax basis in her ROF stock is $55,000. Carlos will receive the building and land in exchange for his 50 percent interest in ROF His tax basis in the ROF stock is $103,000 Assume for purposes of this problem that the cash available to distribute to the shareholders has been reduced by any tax paid by the corporation…arrow_forwardEleven years ago, Lynn, Incorporated purchased a warehouse for $315,000. This year,the corporation sold the warehouse to Firm D for $80,000 cash and D’s assumption ofa $225,000 mortgage. Through date of sale, Lynn deducted $92,300 straight-linedepreciation on the warehouse.Requiredc. How would your answers change if Lynn was a noncorporate business?arrow_forwardjagdisharrow_forward

- The Walston Company is to be liquidated. It has the following liabilities: Income taxes Notes payable (secured by land) Accounts payable Salaries payable (evenly divided between two employees) Bonds payable Administrative expenses for liquidation The company has the following assets: $ 7,600 136,000 93,000 14,000 78,000 28,000 Book Value Fair Value Current assets $ 88,000 Land 108,000 Buildings and equipment 108,000 $ 43,000 98,000 132,000 Required: How much money will the holders of the notes payable collect following liquidation? Total amount collectedarrow_forwardCayden Purchased the following for his rental real estate business: An apartment building; he paid $103,500 for the building ( not including the value of the land). Furniture for $8,649. Pickup truck for $27,500, used for 75% business. What is Cayden's total unadjusted basis immediately after acquisition (UBIA) of these assets? 1) $29,274 2) $112,149 3) $132,774 4) $139,649arrow_forwardrlock Tutor TutorMe) Ewing Corporation sold an office building that it used in its business for $879,381. Ewing bought the building ten years ago for $779,550 and has claimed $523,412 of depreciation expense. What is the amount of the $1231 capital gain for Ewing Corporation?arrow_forward

- Shauna and Danielle decided to liquidate their jointly owned corporation, Woodward Fashions Incorporated (WFI). After liquidating its remaining inventory and paying off its remaining liabilities, WFI had the following tax accounting balance sheet: Adjusted FMV Таx Basis Appreciation $ 165,000 33,000 $ 165,000 16,500 Cash Building 16,500 132,000 66,000 $ 247,500 Land 66,000 $ 330,000 $ 82,500 Total Under the terms of the agreement, Shauna will receive the $165,000 cash in exchange for her 50 percent interest in WFI. Shauna's tax basis in her WFI stock is $41,250. Danielle will receive the building and land in exchange for her 50 percent interest in WFI. Danielle's tax basis in her WFI stock is $82,500. Assume for purposes of this problem that the cash available to distribute to the shareholders has been reduced by any tax paid by the corporation on gain recognized as a result of the liquidation. (Negative amounts should be indicated by a minus sign.) c. What amount of gain or loss does…arrow_forwardGodoarrow_forward(J)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education