FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

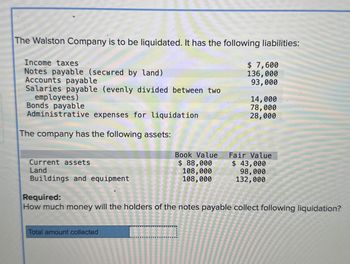

Transcribed Image Text:The Walston Company is to be liquidated. It has the following liabilities:

Income taxes

Notes payable (secured by land)

Accounts payable

Salaries payable (evenly divided between two

employees)

Bonds payable

Administrative expenses for liquidation

The company has the following assets:

$ 7,600

136,000

93,000

14,000

78,000

28,000

Book Value

Fair Value

Current assets

$ 88,000

Land

108,000

Buildings and equipment

108,000

$ 43,000

98,000

132,000

Required:

How much money will the holders of the notes payable collect following liquidation?

Total amount collected

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- TBB Corp. has the following information regarding three of its assets: Estimated Book Value Cash Flows Fair Value Equipment $ 100,000 $ 106,000 $ 90,000 Building $ 200,000 $ 250,000 $ 195,000 Patent $ 50,000 $ 58,000 $ 36,000 What amount of loss should be recorded by TBB due to asset impairment?arrow_forwardNorthern purchased the entire business of Southern including all its assets and liabilities for $658,000. Below is information related to the two companies: Northern Southern Fair value of assets $1,044,000 $798,000 Fair value of liabilities 585,000 315,000 Reported assets 813,000 634,000 Reported liabilities 483,000 258,000 Net Income for the year 59,000 58,000 How much goodwill did Northern pay for acquiring Southern?arrow_forwardPlease help solvearrow_forward

- jagdisharrow_forwardBig Corp. has been undergoing liquidation since December 1, 2020. As of July 31, 2021, the following data are available: P1,500,000 Liabilities not liquidated Liabilities to be liquidated P1,700,000 Assets acquired Assets realized P2,400,000 P2,250,000 Assets not realized P1,375,000 Liabilities assumed P2,625,000 Assets to be realized P2,750,000 Liabilities liquidated P1,750,000 Supplementary charges/debits P2,750,000 Supplementary credits P3,800,000 Answer the following questions: (answers can be repeated) Compute the ending cash balance of cash account (as of July 31, 2021) assuming that Choose... common stock and deficits are P2,750,000 and P750,000, respectively. What is the net gain/(loss) of Big Corp. from the liquidation? Choose...arrow_forward7 DUFFLE Corp. had the following data ascertained before liquidation: Total book value of the assets were P250,000. The book value of the inventories, P80,000 had an excess in the amount of P26,000 over its estimated fair value. The equipment’s estimated fair value had an excess in the amount of P2,500 over its book value of P120,000. Included in the book value of the assets was prepaid expenses of P18,000 which was considered worthless. Other assets not mentioned above have an estimated fair value which was P15,000 less than its book value. Total liabilities were P200,000. The accounts payable in the amount of P70,000 was secured by the inventories while the notes payable in the amount of P95,000 was secured by the equipment. Other liabilities not mentioned includes salaries and taxes in the amount of P12,500. what is the estimated recovery percentage for the notes payable? Group of answer choices 96.14% 95.90% 100% 96.43%arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education