FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

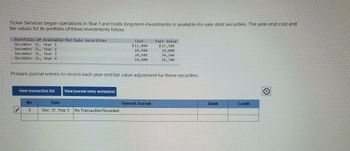

Transcribed Image Text:Ticker Services began operations in Year 1 and holds long-term investments in available-for-sale debt securities. The year-end cost and

fair values for its portfolio of these investments follow.

Portfolio of Available-for-Sale Securities

December 31, Year 1

December 31, Year 2

December 31, Year 3

December 31, Year 4

View transaction list View journal entry worksheet

Prepare journal entries to record each year-end fair value adjustment for these securities.

No

3

Cost

$11,000

18,900

20,600

14,800

Date

Dec. 31, Year 3 No Transaction Recorded

Fair Value

$17,500

28,000

30, 200

19,700

General Journal

Debit

Credit

Ⓒ

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Valuing Trading Securities at Fair ValueOn January 1, Valuation Allowance for Trading Investments had a zero balance. On December 31, the cost of the trading securities portfolio was $47,000, and the fair value was $48,300.Prepare the December 31 adjusting journal entry to record the unrealized gain or loss on trading investments.Dec. 31arrow_forwardEntries for Issuing Bonds and Amortizing Premium by Straight-Line Method Smiley Corporation wholesales repair products to equipment manufacturers. On April 1, 20Y1, Smiley issued $8,900,000 of 8-year, 12% bonds at a market (effective) interest rate of 9%, receiving cash of $10,399,742. Interest is payable semiannually on April 1 and October 1. a. Journalize the entry to record the issuance of bonds on April 1, 20Y1, If an amount box does not require an entry, leave it blank. b. Journalize the entry to record the first interest payment on October 1, 20Y1, and amortization of bond premium for six months, using the straight-line method. Round to the nearest dollar. If an amount box does not require an entry, leave it blank. c. Why was the company able to issue the bonds for $10,399,742 rather than for the face amount of $8,900,000? The market rate of interest is - the contract rate of interest.arrow_forwardPlease don't give image formatarrow_forward

- Entries for Issuing Bonds and Amortizing Premium by Straight-Line Method Smiley Corporation wholesales repair products to equipment manufacturers. On April 1, 20Y1, Smiley issued $7,800,000 of 4-year, 12% bonds at a market (effective) interest rate of 11%, receiving cash of $8,047,047. Interest is payable semiannually on April 1 and October 1. a. Journalize the entry to record the issuance of bonds on April 1, 20Y1. If an amount box does not require an entry, leave it blank. fill in the blank d175d3f50fce054_2 fill in the blank d175d3f50fce054_3 fill in the blank d175d3f50fce054_5 fill in the blank d175d3f50fce054_6 fill in the blank d175d3f50fce054_8 fill in the blank d175d3f50fce054_9 b. Journalize the entry to record the first interest payment on October 1, 20Y1, and amortization of bond premium for six months, using the straight-line method. Round to the nearest dollar. If an amount box does not require an entry, leave it blank. fill…arrow_forwardTrading Securities at Fair Value On January 1, 20Y9, Valuation Allowance for Trading Investments had a zero balance. On December 31, the cost of the trading securities portfolio was $62,600, and the fair value was $63,500. Journalize the December 31, 20Y9, adjusting entry to record the unrealized gain or loss on trading investments. If an amount box does not require an entry, leave it blank. Dec. 31arrow_forwardEntries for TS: Effective Interest Method Note: When answering the following questions, round answers to the nearest whole dollar. Amortization Schedule Journal Entries in Year 1, Journal Entries in Year 2 d. Record the receipt of interest on January 1 of Year 2. e. Record the sale of all of the bonds on January 2 of Year 2 for $166, 100. f. Record the adjustment to the Fair Value Adjustment account on December 31 of Year 2, assuming no additional TS investments.arrow_forward

- Entries for Issuing Bonds and Amortizing Premium by Straight-Line Method Instructions Chart of Accounts Journal Final Question Instructions Favreau Corporation wholesales repair products to equipment manufacturers. On April 1. Year 1, Favreau Corporation issued $12,700,000 of five-year, 11% bonds at a market (effective) interest rate of 9%, receiving cash of S13,704,946. Interest is payable semiannually on April 1 and October 1. Required: a. Journalize the entries to record the following. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. 1. Issuance of bonds on April 1. 2. First interest payment on October 1 and amortIzation of bond premium for six months, using the straight-line method. The bond premium amortization is combined with the semiannual…arrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forwardValuing Trading Securities at Fair Value On January 1, Valuation Allowance for Trading Investments had a zero balance. On December 31, the cost of the trading securities portfolio was $65,000, and the fair value was $66,700. Prepare the December 31 adjusting journal entry to record the unrealized gain or loss on trading investments.arrow_forward

- Entries for Issuing and Calling Bonds; Gain Emil Corp. produces and sells wind-energy-driven engines. To finance its operations, Emil Corp. issued $980,000 of 10-year, 11% callable bonds on May 1, 20Y1, at their face amount, with interest payable on May 1 and November 1. The fiscal year of the company is the calendar year. Journalize the entries to record the following selected transactions: 20Y1 May 1 Issued the bonds for cash at their face amount. Nov. 1 Paid the interest on the bonds. 20Y5 Nov. 1 Called the bond issue at 97, the rate provided in the bond indenture. (Omit entry for payment of interest.) Issued the bonds for cash at their face amount. If an amount box does not require an entry, leave it blank. 20Y1, May 1 Paid the interest on the bonds. If an amount box does not require an entry, leave it blank. 20Y1, Nov. 1 Called the bond issue at 97, the rate provided in the bond indenture. (Omit entry for payment of interest.) If an amount box does not require an entry, leave it…arrow_forwardBond Investment TransactionsJournalize the entries to record the following selected bond investment transactions for Starks Products:For a compound transaction, if an amount box does not require an entry, leave it blank.a. Purchased for cash $72,000 of Iceline, Inc. 9% bonds at 100 plus accrued interest of $1,080, paying interest semiannually. b. Received first semiannual interest payment. c. Sold $48,000 of the bonds at 103 plus accrued interest of $550.arrow_forwardEntries for Issuing Bonds and Amortizing Premium by Straight-Line Method Smiley Corporation wholesales repair products to equipment manufacturers. On April 1, 20Y1, Smiley issued $8,500,000 of 8-year, 6% bonds at a market (effective) interest rate of 4%, receiving cash of $9,654,106. Interest is payable semiannually on April 1 and October 1. a. Journalize the entry to record the issuance of bonds on April 1, 20Y1. If an amount box does not require an entry, leave it blank. Cash fill in the blank fill in the blank Premium on Bonds Payable fill in the blank fill in the blank Bonds Payable Journalize the entry to record the first interest payment on October 1, 20Y1, and amortization of bond premium for six months, using the straight-line method. Round to the nearest dollar. If an amount box does not require an entry, leave it blank. Interest Expense fill in the blank fill in the blank Premium on Bonds Payable fill in the blank fill in the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education