Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

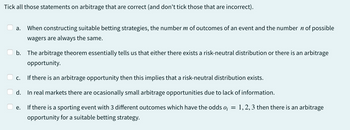

Transcribed Image Text:Tick all those statements on arbitrage that are correct (and don't tick those that are incorrect).

a. When constructing suitable betting strategies, the number m of outcomes of an event and the number ʼn of possible

wagers are always the same.

b. The arbitrage theorem essentially tells us that either there exists a risk-neutral distribution or there is an arbitrage

opportunity.

c.

If there is an arbitrage opportunity then this implies that a risk-neutral distribution exists.

d.

In real markets there are ocasionally small arbitrage opportunities due to lack of information.

e.

If there is a sporting event with 3 different outcomes which have the odds 0₁ = 1, 2, 3 then there is an arbitrage

opportunity for a suitable betting strategy.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Which of the following assumptions of the Black-Scholes model are often violated in empirical data? O All of the other answers are correct. O Continuously-compounded returns on the underlying asset follow a normal distribution. O The volatility of the underlying asset is constant. O There are no jumps in the price of the underlying asset. O Trading in the underlying asset is continuous.arrow_forwardDerivatives are used in risk management because they _____.a. diversify risksb. hedge risksc. avoid risksd. none of the abovearrow_forwardA Listen An example of the no-arbitrage principle holding would be when all risk-free investments offer investors: A) the same return B) negative returns C) positive returns D) zero returnarrow_forward

- 3. Suppose the market is wild; it is modeled by o → (a) What is the value of a Call? (b) What is the value of a Put? (c) Explain both answers in terms of finance.arrow_forwardExplain in your own words what dynamic hedging is, and how a trader could profit by dynamically hedging an option if they have a forecast of volatility that is different to implied volatility.arrow_forwardIf the forward rate is expected to be an unbiased estimate of the future spot rate, and interest rate parity holds, then: a. the international Fisher effect (IFE) is refuted. b. the international Fisher effect (IFE) is supported. c. covered interest arbitrage is feasible. d. the average absolute error from forecasting would equal zero.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education