FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

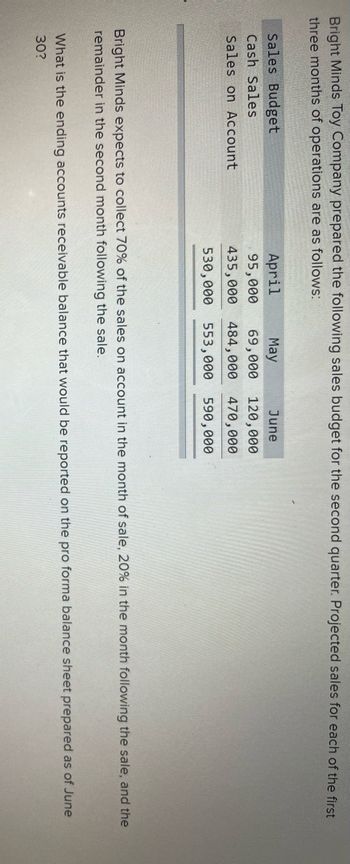

Transcribed Image Text:Bright Minds Toy Company prepared the following sales budget for the second quarter. Projected sales for each of the first

three months of operations are as follows:

Sales Budget

Cash Sales

Sales on Account

April

May

June

95,000 69,000 120,000

435,000 484,000 470,000

530,000 553,000 590,000

Bright Minds expects to collect 70% of the sales on account in the month of sale, 20% in the month following the sale, and the

remainder in the second month following the sale.

What is the ending accounts receivable balance that would be reported on the pro forma balance sheet prepared as of June

30?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Schedule of Cash Collections of Accounts Receivable Pet Supplies Inc., a pet wholesale supplier, was organized on January 1. Projected sales for each of the first three months of operations are as follows: January $160,000 February 240,000 March 340,000 All sales are on account. 58% of sales are expected to be collected in the month of the sale, 37% in the month following the sale, and the remainder in the second month following the sale. Prepare a schedule indicating cash collections from sales for January, February, and March. Pet Supplies Inc. Schedule of Cash Collections from Sales For the Three Months Ending March 31 January February March January sales on account: Collected in January $ Collected in February $ Collected in March $ February sales on account: Collected in February Collected in March March sales on account: Collected in March Total cash collected $ $ $arrow_forwardTrapp Co. was organized on August 1 of the current year. Projected sales for the next three months are as follows: August $100,000 September 185,000 October 225,000 The company expects to sell 40% of its merchandise for cash. Of the sales on account, one third are expected to be collected in the month of the sale and the remainder in the following month. Prepare a schedule indicating cash collections of accounts receivable for August, September, and October. For each month's sales on account, enter the collection months in chronological order. Trapp Co. Schedule of Collections of Accounts Receivable For Three Months Ending October 31, 20xX August September October August sales on account: Collected in August Collected in September September sales on account: Collected in September Collected in October October sales on account: Collected in October Totalsarrow_forwardJ. Lo's Clothiers has forecast credit sales for the fourth quarter of the year: Fourth Quarter September (actual) $ 73,000 October November December $ 63,000 58,000 83,000 Experience has shown that 35 percent of sales are collected in the month of sale, 60 percent are collected in the following month, and 5 percent are never collected. Prepare a schedule of cash receipts for J. Lo's Clothiers covering the fourth quarter (October through December). Credit sales Collections: In month of sales One month after sales Total cash receipts J. Lo's Clothiers September October November December $ 0 $ 0 $ 0arrow_forward

- please answer do not image formatarrow_forwardA company budgets the following merchandising purchases: April: $70.000; May $90,000, June: $60,000. All purchases are on account and the company pays 25% of purchases in the month of the purchase and the remaining amount in the following month. Cash disbursements for June for merchandise is $arrow_forwardEastern Auto Parts Inc. has 20 percent of its sales paid for in cash and 80 percent on credit. All credit accounts are collected in the following month. Assume the following sales: January February March April $ 82,000 72,000 117,000 62,000 Sales in December of the prior year were $92,000. Prepare a cash receipts schedule for January through April. Sales Cash receipts: Cash sales Prior month's credit sales Total cash receipts Eastern Auto Parts Inc. February January $ 80,000 $ March 81,000 $ April 106,000arrow_forward

- 4arrow_forwardsolve for jan feb march quaterarrow_forwardSchedule of Cash Collections of Accounts Receivable OfficeMart Inc. has "cash and carry" customers and credit customers. OfficeMart estimates that 25% of monthly sales are to cash customers, while the remaining sales are to credit customers. Of the credit customers, 20% pay their accounts in the month of sale, while the remaining 80% pay their accounts in the month following the month of sale. Projected sales for the next three months are as follows: October $127,000 November 159,000 December 232,000 The Accounts Receivable balance on September 30 was $85,000. Prepare a schedule of cash collections from sales for October, November, and December. Round all calculations to the nearest whole dollar. OfficeMart Inc.Schedule of Cash Collections from SalesFor the Three Months Ending December 31 October November December Receipts from cash sales: Cash sales $fill in the blank 1 $fill in the blank 2 $fill in the blank 3 September sales on account:…arrow_forward

- A company is preparing its cash buget for the month of May. Below is A/R information: Actual credit sale for March $130,000 Actual credit sale for April $160,000 Estimated credit sales for May $210,000 Estimated collections in the month of sale 25% Estimated collections in the first month after the month of sale 60% Estimated collections in the second month after the month of sale 10% Estimated provision of bad debts (made in month of sale) 5% ** Firm writes off all UNCOLLECTIBLE account receievables at the end of second month after the month of sale. Required: For the month of May, calculate the following: 1. Estimated cash receipts from account recievable collections. 2. The gross amount of A/R at the end of the month (after appropriate write off of uncollectiable amounts). 3. The net amount of A/R at the end of the month 4. Recalculate the requirement 1 & 2 under the assumption that estimated collections in the month of sale equal 60% and in the first…arrow_forwardSchedule of Cash Collections of Accounts Receivable Pet Supplies Inc., a pet wholesale supplier, was organized on January 1. Projected sales for each of the first three months of operations are as follows: January $300,000 February 500,000 March 750,000 All sales are on account. Seventy-five percent of sales are expected to be collected in the month of the sale, 20% in the month following the sale, and the remainder in the second month following the sale. Prepare a schedule indicating cash collections from sales for January, February, and March. Enter all amounts as positive numbers. Pet Supplies Inc. Schedule of Cash Collections from Sales For the Three Months Ending March 31 January February March January sales on account: Collected in January $fill in the blank 1 Collected in February $fill in the blank 2 Collected in March $fill in the blank 3 February sales on account: Collected in February fill in the blank 4…arrow_forwardStar Company was organized on August 1 of the current year. Projected sales for the next three months are as follows: August $250,000 September 200,000 October 275,000 The company expects to sell 50% of its merchandise for cash. Of the sales on credit, 30% are expected to be collected in the month of the sale and the remainder in the following month. What is Star Company expected cash collection for September?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education