FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

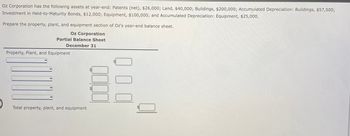

Transcribed Image Text:Oz Corporation has the following assets at year-end: Patents (net), $26,000; Land, $40,000; Buildings, $200,000; Accumulated Depreciation: Buildings, $57,500;

Investment in Held-to-Maturity Bonds, $12,000; Equipment, $100,000; and Accumulated Depreciation: Equipment, $25,000.

Prepare the property, plant, and equipment section of Oz's year-end balance sheet.

Oz Corporation

Partial Balance Sheet

December 31

Property, Plant, and Equipment

Total property, plant, and equipment

tA

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Data related to the acquisition of timber rights and intangible assets during the current year ended December 31 are as follows: A. Timber rights on a tract of land were purchased for $1,600,000 on February 22. The stand of timber is estimated at 5,000,000 board feet. During the current year, 1,100,000 board feet of timber were cut and sold. B. On December 31, the company determined that $3,750,000 of goodwill was impaired. C. Governmental and legal costs of $6,600,000 were incurred on April 3 in obtaining a patent with an estimated economic life of 12 years. Amortization is to be for three-fourths of a year. Required: 1. Determine the amount of the amortization, depletion, or impairment for the current year for each of the foregoing items. 2. Journalize the adjusting entries required to record the amortization, depletion, or impairment for each item. Refer to the Chart of Accounts for exact wording of account titles. CHART OF ACCOUNTS General Ledger…arrow_forwardPerdue Company purchased equipment on April 1 for $50,490. The equipment was expected to have a useful life of three years, or 3,780 operating hours, and a residual value of $1,350. The equipment was used for 700 hours during Year 1, 1,300 hours in Year 2, 1,100 hours in Year 3, and 680 hours in Year 4. Required: Determine the amount of depreciation expense for the years ended December 31, Year 1, Year 2, Year 3, and Year 4, by (a) the straight-line method, (b) units-of-activity method, and (c) the double-declining-balance method. Note: FOR DECLINING BALANCE ONLY, round the multiplier to four decimal places. Then round the answer for each year to the nearest whole dollar. a. Straight-line method Year Amount Year 1 12,285 V Year 2 Year 3 Year 4 b. Units-of-activity method Year Amount Year 1 9,100 Year 2 Year 3 $ Year 4 c. Double-declining-balance method Year Amountarrow_forwardWhispering Company owns equipment that cost $100,000 when purchased on January 1, 2019. It has been depreciated using the straight-line method based on an estimated salvage value of $10,000 and an estimated useful life of 5 years. Depreciation expense adjustments are recognized annually. Instructions: Prepare Whispering Company's journal entries to record the sale of the equipment in these four independent situations. Update depreciation on assets disposed of at time of sale. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) (a) (b) (c) (d) (e) (f) (a) Sold for $59,000 on January 1, 2022. Sold for $59,000 on April 1, 2022. SR. Account Titles and Explanation (b) Sold for $21,000 on January 1, 2022. Sold for $21,000 on September 1, 2022. Repeat (a), assuming Whispering uses double-declining…arrow_forward

- Assume that ACW Corporation has 2022 taxable income of $1,500,000 for purposes of computing the $179 expense. The company acquired the following assets during 2022 (assume no bonus depreciation): Asset Placed in Service Basis Machinery September 12 $470,000 Computer equipment February 10 $ 70,000 Delivery truck August 21 $ 93,000 Qualified real property April 2 $ 1,380,000 (MACRS, 15 year, 150% DB) Total $2,013,000 Question: What is the maximum amount of §179 expense ACW may deduct for 2022? Answer: Question: What is the maximum total depreciation that ACW may deduct in 2022 on the assets it placed in service in 2022?arrow_forwardThe following information relating to an investment in equipment has been extracted from the books of LRB Ltd: The total purchase price is $78,560. Net sales revenue (relating to the equipment): Year-1 $38,000; Year-2 $29,000; Year-3 $24,000; and Year-4 $20,000. The required rate of return is 12%. The expected salvage value is $14,266 at the end of year 4. The depreciation rate is 18% straight line. If the applicable tax rate is 32%, calculate the tax amount in the fourth year relating to the sale of the equipment only. Use excel spreadsheet to Answer.arrow_forwardIvanhoe Company, organized in 2022, has these transactions related to intangible assets in that year: Jan. Purchased a patent (5-year life) $305,500. Apr. 1. Goodwill purchased (indefinite life) $338,400. July Acquired a 9-year franchise; expiration date July 1, 2031, $676,800. Sept. 1 Research and development costs $173,900.arrow_forward

- On January 1, 2025, a corporation acquired equipment for $160,000. Residual value was estimated to be $40,000. The equipment has a useful life of four years. What is the journal entry for depreciation expense for the first year calculated by the straight-line method? DR Depreciation Expense - Equipment 40,000 CR Accumulated Depreciation 40,000 DR Accumulated Depreciation 30,000 CR Depreciation Expense - Equipment 30,000 DR Accumulated Depreciation 40,000 CR Depreciation Expense - Equipment 40,000 DR Depreciation Expense - Equipment 30,000 CR Accumulated Depreciation 30,000arrow_forwardNeed Help pleasearrow_forwardIn its first year, Firm KZ recognized $467,250 ordinary business income and a $15,850 loss on the sale of an investment asset. In its second year, Firm KZ recognized $530,000 ordinary business income, a $21,500 Section 1231 gain, and a $8,200 Section 1231 loss on two sales of operating assets. Required: a. Compute KZ's book and taxable income for its first year. b. Using a 21 percent tax rate, compute KZ's deferred tax asset or liability (identify which) on its balance sheet on the last day of the year. c. Compute KZ's book and taxable income for its second year. d. Compute KZ's deferred tax asset or liability (identify which) on its balance sheet on the last day of the second year. Complete this question by entering your answers in the tabs below. Req A and B Req C and D a. Compute KZ's book and taxable income for its first year. b. Using a 21 percent tax rate, compute KZ's deferred tax asset or liability (identify which) on its balance sheet on the last day of the year. Note: Round…arrow_forward

- On its December 31 prior year balance sheet, Calgary Industries reports equipment of $540,000 and accumulated depreciation of $91,000. During the current year, the company plans to purchase additional equipment costing $97,000 and expects depreciation expense of $47,000. Additionally, it plans to dispose of equipment that originally cost $59,000 and had accumulated depreciation of $7,300. The balances for equipment and accumulated depreciation, respectively, on its December 31 current year budgeted balance sheet are: Multiple Choice $578,000; $138,000. $481,000, $91,000, O $637,000; $130,700 $637,000; $138,000 $578,000, $130,700.arrow_forwardData related to the acquisition of timber rights and intangible assets during the current year ended December 31 are as follows: A. Timber rights on a tract of land were purchased for $3,461,120 on February 22. The stand of timber is estimated at 5,408,000 board feet. During the current year, 1,028,300 board feet of timber were cut and sold. B. On December 31, the company determined that $3,640,000 of goodwill was impaired. C. Governmental and legal costs of $6,108,000 were incurred on April 3 in obtaining a patent with an estimated economic life of 10 years. Amortization is to be for three-fourths of a year. Required: 1. Determine the amount of the amortization, depletion, or impairment for the current year for each of the foregoing items. 2. Journalize the adjusting entries required to record the amortization, depletion, or impairment for each item. Refer to the Chart of Accounts for exact wording of account titles.arrow_forwardFor financial reporting purposes, GAAP requires organization costs to be capitalized and treated as an intangible asset with an indefinite life. capitalized and amortized over the first five years of the company's existence. expensed in the period in which they are incurred. capitalized and amortized over 20 years.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education