FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

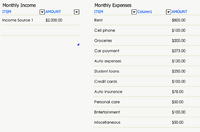

This is Ben’s budget. Use his budget to determine the answer to the following question:

Scenario: Suppose Ben wants to buy a house for $251,599.

- For a 30-year mortgage, Ben gets a 5% interest rate. Calculate his monthly payments for this 30-year mortgage, after the 20% down payment.

Transcribed Image Text:Monthly Income

Monthly Expenses

ITEM

AMOUNT

ITEM

Column1

AMOUNT

Income Source 1

$2,000.00

Rent

$800.00

Cell phone

$100.00

Groceries

$200.00

Car payment

$273.00

Auto expenses

$120.00

Student loans

$250.00

Credit cards

$100.00

Auto Insurance

$78.00

Personal care

$50.00

Entertainment

$100.00

Miscellaneous

$50.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Suppose you have budgeted $ 950 a month towards a mortgage. If you are offered a 30 year mortgage at an interest rate of 4.25%, how expensive a home mortgage can you afford?arrow_forwardShelly Franks is planning for her retirement, so she is setting up a payout annuity with her bank. She is now 35 years old, and she will retire when she is 65. She wants to receive annual payouts for twenty years, and she wants those payouts to receive an annual COLA of 4%. a. She wants her first payout to have the same purchasing power as does $15,000 today. How big should that payout be if she assumes inflation of 4% per year? b. How much money must she deposit when she is 65 if her money earns 8.3% interest per year? c. How large a monthly payment must she make if she saves for her payout annuity with an ordinary annuity? (The two annuities pay the same interest rate.) d. How large a monthly payment would she make if she waits until she is 40 before starting her ordinary annuity?arrow_forwardThe Jones want to save $95,000.00 in 5 years for a down payment on a house. If they make monthly deposits in an account paying 5% compounded monthly, what is the size of the payments that are required to meet their goal?arrow_forward

- Use the attached present and future value tables to answer the following questions: Tom pays $2,400 per year for rent on the first of January each year. He wants to deposit an amount in his 6% investment today that will allow him to draw $2,400 each year for the next 5 years. How much will he need to deposit today in order to draw $2,400 per year for 5 years? Round percentages and ratios to the nearest tenth of a percent, dollars to nearest whole dollar ________dollarsarrow_forwardJerry wants to take the next three years off work to travel around rhe world. he estimates his annual cask needs at $35,000. Jerry believes he can invest his savings at 6% until he depletes his funds. Present value annuity at 6% for 3 years is 2.6730 (present value interest factors for a one-dollar annuity discounted) Requirements: how much money does jerome need now to fund his travels?arrow_forwardHassan wants to buy a new car that will cost $15,000. He will make a down payment in the amount of $3,000. He would like to borrow the remainder from a bank at an interest rate of 8% compounded monthly. He agrees to make monthly payments for a period of two years in order to pay off the loan. Hassan has made 12 payments and wants to figure out the remaining balance immediately after the 12th that remaining balance? payment. What isarrow_forward

- Suppose you want to purchase a home for $525,000 with a 30-year mortgage at 4.84% interest. Suppose also that you can put down 30%. What are the monthly payments? (Round your answer to the nearest cent.) $ What is the total amount paid for principal and interest? (Round your answer to the nearest cent.) $ What is the amount saved if this home is financed for 15 years instead of for 30 years? (Round your answer to the nearest cent.)arrow_forwardIf Blitzen wants to buy a $120,000 house. Blitzen is going to pay $40,000 down and make monthly payments for 30 years. The rate is 3.1% monthly with 2 points. If the loan is paid off after 12 years, what is the true rate?arrow_forwardThis is Ben's budget. Use his budget to determine the answer to the following question: Scenario: Suppose Ben wants to buy a house for $251,599. For a 30-year mortgage, Ben gets a 5% interest rate. Calculate his monthly payments for this 30-year mortgage, after 20% down payment. Monthly Income Monthly Expenses ITEM V AMOUNT ITEM Column1 VAMOUNT Income Source 1 $2,000.00 Rent $800.00 Cell phone $100.00 Groceries $200.00 Car payment $273.00 Auto expenses $120.00 Student loans $250.00 Credit cards $100.00 Auto Insurance $78.00 Personal care $50.00 Entertainment $100.00 Miscellaneous $50.00arrow_forward

- Jamie is going to buy some furniture with a single payment loan that is discounted. The loan will be for $5,000 for two years at 10% interest. Calculate the APR on this loan. (Show all work.)arrow_forwardSuppose you have budgeted $ 950 a month towards a mortgage. If you are offered a 15-year mortgage at an interest rate of 6.25%, how expensive a home mortgage can you afford? Home price =arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education