ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

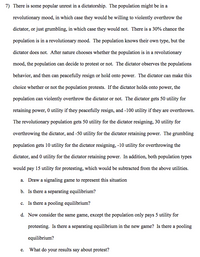

Transcribed Image Text:7) There is some popular unrest in a dictatorship. The population might be in a

revolutionary mood, in which case they would be willing to violently overthrow the

dictator, or just grumbling, in which case they would not. There is a 30% chance the

population is in a revolutionary mood. The population knows their own type, but the

dictator does not. After nature chooses whether the population is in a revolutionary

mood, the population can decide to protest or not. The dictator observes the populations

behavior, and then can peacefully resign or hold onto power. The dictator can make this

choice whether or not the population protests. If the dictator holds onto power, the

population can violently overthrow the dictator or not. The dictator gets 50 utility for

retaining power, O utility if they peacefully resign, and -100 utility if they are overthrown.

The revolutionary population gets 50 utility for the dictator resigning, 30 utility for

overthrowing the dictator, and -50 utility for the dictator retaining power. The grumbling

population gets 10 utility for the dictator resigning, -10 utility for overthrowing the

dictator, and 0 utility for the dictator retaining power. In addition, both population types

would pay 15 utility for protesting, which would be subtracted from the above utilities.

a. Draw a signaling game to represent this situation

b. Is there a separating equilibrium?

c. Is there a pooling equilibrium?

d. Now consider the same game, except the population only pays 5 utility for

protesting. Is there a separating equilibrium in the new game? Is there a pooling

equilibrium?

e.

What do your results say about protest?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The mayor of Green City is considering whether to institute a Covid vaccine mandate for public employees. The fire chief opposes vaccination, and has threatened to resign if a mandate is instituted. The mayor believes that instituting a mandate is critical to getting Covid under control, and thus not instituting the mandate would costs the city -50 utility. However, the fire chief is critical to maintaining public safety. If the fire chief resigns, it would cost the city 75 utility. The fire chief believes a mandate would be an invasion of his personal freedom, costing him 20 utility. The mandate only impacts the fire chief if he does not resign. However, resigning his job as fire chief would cost him 40 utility. Draw this game. Identify how many subgames it contains. Then, solve the game to find all subgame perfect Nash equilibria.arrow_forwardIf you choose two people at random, what is the probability that both have the same blood type?arrow_forwardNew answer neededarrow_forward

- Exercise 1.12. Consider the following game. There is a club with three members: Ann, Bob and Carla. They have to choose which of the three is going to be president next year. Currently Ann is the president. Each member is both a candidate and a voter. Voting is as follows: each member votes for one candidate (voting for oneself is allowed); if two or more people vote for the same candidate then that person is chosen as the next president; if there is complete disagreement, in the sense that there is exactly one vote for each candidate, then the person from whom Ann voted is selected as the next president. (a) Represent this voting procedure as a game frame, indicating inside each cell of each table which candidate is elected. (b) Assume that the players' preferences are as follows: AnnAm Carla Ann Bob, Carla Bob Ann, Bob Carla Ann Caria Carla. Using utility values 0, 1 and 2, convert the game frame into a game. (c) Apply the IDWDS to the game of part (b). Is there a weak iterated…arrow_forwardSoft selling occurs when a buyer is skeptical of the usefulness of a product and the seller offers to set a price that depends on realized value. For example, suppose a sales representative is trying to sell a company a new accounting system that will, with certainty, reduce costs by 10%. However, the customer has heard this claim before and believes there is only a 20% chance of actually realizing that cost reduction and a 80% chance of realizing no cost reduction. Assume the customer has an initial total cost of $200. According to the customer's beliefs, the expected value of the accounting system, or the expected reduction in cost, is $____ . Suppose the sales representative initially offers the accounting system to the customer for a price of $12.00. The information asymmetry stems from the fact that the ______(sales rep or buyer) has less information about the efficacy of the accounting system than does the ______(sales rep or buyer) . At this price, the…arrow_forwardPersons A and B are roommates. Person A smokes and Person B does not. The index s measures how smoky the room is. It varies from s=0, when there is no smoke in the room, to s=1, when the room is filled with smoke. Thus, 1-s measures how "clean" the air in the room is. Person A's utility function is ua(XA,s)=Xa.S, where xA is the amount of money Person A owns. Person B's utility function is ug(xg, 1s)=Xg .(1-s)³, where xg is the amount of money Person B owns. Each person starts with an endowment of 5 units of money. Person A has the legal right to a fill up the room with smoke and there exists a market for smoke "abatements". At the Walrasian equilibrium, how much money will person B be left with? а. Хв31.25 ОБ. Хв32.25 O c. XB=0.25 O d. Xg=0.25 е. None of the other answers.arrow_forward

- There are two types of drivers, safe types who have an annual probability of getting in an accident of 10% and risky types who get in a car crash with probability 20%. Each type represents half of the population. When a car crash occurs, it costs the insurance company $10,000. This problem is about asymmetric information, specifically in insurance markets. To answer this question, it helps to understand insurance. Insurance contracts work in the following way. The amount that the insurer pays in the event of an accident is Payout = (Accident cost - Deductible) *Coinsurance rate. The rest is paid by the individual. The expected value of a firm's expenses are E[Payout] = (probability of an accident)*Payout. The insurance premium is the price the consumer pays for insurance. It is paid regardless of whether there is an accident. Therefore, the insurer's expected profit = Premium - E[Payout]. a. Suppose the insurer offered only one type of contract: deductible=0 and coinsurance rate= 100%.…arrow_forwardThe ultimatum game is a game in economic experiments. The first player (the proposer) receives a sum of money and proposes a fair proposal (F - 5;5) or unfair proposal (U - 8;2). The second player (the responder) chooses to either accept (A) or reject (R) this proposal. If the second player accepts, the money is split according to the proposal. If the second player rejects, neither player receives any money. 1 A 5:5 2 F R 0:0 U A 8:2 2 1. Find the subgame perfect Nash Equilibrium using backward induction. R 0;0arrow_forwardMax Pentridge is thinking of starting a pinball palace near a large Melbourne university. His utility is given by u(W) = 1 - (5,000/W), where W is his wealth. Max's total wealth is $15,000. With probability p = 0.9 the palace will succeed and Max's wealth will grow from $15,000 to $x. With probability 1 - p the palace will be a failure and he’ll lose $10,000, so that his wealth will be just $5,000. What is the smallest value of x that would be sufficient to make Max want to invest in the pinball palace rather than have a wealth of $15,000 with certainty? (Please round your final answer to the whole dollar, if necessary)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education