ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

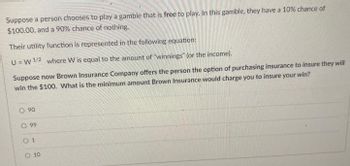

Transcribed Image Text:Suppose a person chooses to play a gamble that is free to play. In this gamble, they have a 10% chance of

$100.00, and a 90% chance of nothing.

Their utility function is represented in the following equation:

U=W 1/2 where W is equal to the amount of "winnings" (or the income).

Suppose now Brown Insurance Company offers the person the option of purchasing insurance to insure they will

win the $100. What is the minimum amount Brown Insurance would charge you to insure your win?

0.90

O. 99

01

O 10

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Scenario 2 Tess and Lex earn $40,000 per year and all earnings are spent on consumption (c). Tess and Lex both have the utility function (sqrt c) . Both could experience an adverse event that results in earnings of $0 per year. Tess has a 1% chance of experiencing an adverse event and Lex has a 12% chance of experiencing an adverse event. Tess and Lex are both aware of their risk of an adverse event. Refer to Scenario 2 If an insurance company knows the probability of Tess experiencing an adverse event, what is the actuarially fair premium charged to Tess per $1 of benefit? Round to two decimal placesarrow_forwardQUESTION 5 A consumer has utility u (I) = √I and income $1,600. The cost of going to the doctor is $1,150, and the cost of going to the gym is $150. If the consumer goes to the gym, the probability of getting sick is 20%; if she does not go to the gym, the probability of getting sick is 80%. When sick, the consumer must go to the doctor. An insurance company is offering a health insurance plan with an insurance premium of $230 and a co-pay of $110 (that is, the consumer must pay the $110 if she goes to the doctor). a) The consumer's expected utility from purchasing this insurance and going to the gym is b) The consumer's expected utility from purchasing this insurance and not going to the gym is c) In this market, the $110 copay ✓ QUESTION 6 A salesperson is trying to sell ca Given her effort e, with probabili The dealership pays her a bonu a) Given the bonus b, the salesp b) Suppose the dealership pays *Select Answer* 34.6061 35.7999 37.0135 43.0338 42.4303 46.2601 fixes the adverse…arrow_forwardYou are considering two options for your next family vacation. You can visit Disney World or Chicago. Your utility from Disney World is 100 if the weather is clear, and 0 if it rains. Chicago is worth a utility of 70 if the weather is clear and a utility of 40 if the weather is rainy. Also assume that the chance of rain at Disney World is going to be 50% and the chance of rain in Chicago is 40%. As a utility maximizer, should you plan to go to Disney World or Chicago? (Explain using relevant equations)arrow_forward

- Suppose that a person's utility function is the square root of wealth. Suppose the person earns $100,000 per year. He or she has an illness with a probability of 0.2, and the cost of the treatment is $30,000. Would the person pay $6,000 for insurance? Why or why not? What is the most this person would pay to be insured (hint: equate expected utility to utility with certainty)? Suppose their utility function changed to wealth squared (hint: are they now risk averse?). Would they pay $6,000 for insurance? Why or why not?arrow_forwardView image and calculate for second funciton.arrow_forwardKindly solve 3rd question onlyarrow_forward

- Anita bought a new scooter for $500. She is deciding whether she should insureher scooter against theft. She has recently read in the news that one out of 10 scooters arestolen in her town. She can buy scooter theft insurance at the price of 12 cents per $1 ofinsurance. How much insurance will Anita buy if her utility function is U(C) = 2C + 100?arrow_forwardHow do you solve this problem? (see attachment)arrow_forward# 4 Consider an individual with a utility function of the form u(w) = √w. The individual has an initial wealth of $4. He has two investments options available to him. He can eitffer keep his wealth in an interest-free account or he can take part in a particularly generous lottery that provides $12 with probability of 1/2 and $0 with probability 1/2. Assume that this person does not have to incur a cost if he decides to take part in the lottery. (a) Will this individual participate in the lottery? (b) Calculate this individual's certainty equivalent associated with the lottery. What is his risk premium?arrow_forward

- Billy's income Is equal to / = 100 and his utility function is U = [?. There is a 10% chance that he will be in an accident next year with his skateboard that will cause $70 worth of damage. Get the risk premium for Billy. b. An Insurance company offers a policy that will cover all the damages if an accident occurs Calculate the fair price for the insurance. %3D a.arrow_forward4) Luke is planning an around-the-world trip on which he plans to spend $10,000. The utility from the trip is a function of how much she spends on it (Y ), given by U(Y) = InY a). If there is a 25 percent probability that Luke will lose $1000 of his cash on the trip, what is the trip's expected utility. b). Suppose that Luke can buy insurance to fully against losing the $1,000 with a actuarially fair insurance. What is his expected utility if he purchase this insurance. Will he purchase the insurance? c). Now suppose utility function is U(Y) = Y/1000 What is his expected utility if he purchase the insurance in b). Will he purchase the insurance?arrow_forwardNeed the right answer among choices and also an explanation of the answer.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education