ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

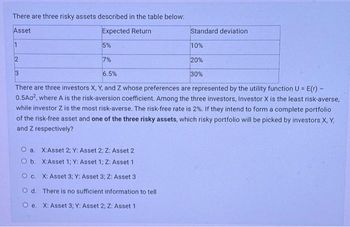

Transcribed Image Text:There are three risky assets described in the table below:

Asset

Expected Return

5%

7%

3

6.5%

There are three investors X, Y, and Z whose preferences are represented by the utility function U= E(r) -

0.5A02, where A is the risk-aversion coefficient. Among the three investors, Investor X is the least risk-averse,

while investor Z is the most risk-averse. The risk-free rate is 2%. If they intend to form a complete portfolio

of the risk-free asset and one of the three risky assets, which risky portfolio will be picked by investors X, Y,

and Z respectively?

2

O a. X:Asset 2; Y: Asset 2; Z: Asset 2

O b.

X:Asset 1; Y: Asset 1; Z: Asset 1

Standard deviation

O c.

X: Asset 3; Y: Asset 3; Z: Asset 3

Od. There is no sufficient information to tell

O e. X: Asset 3; Y: Asset 2; Z: Asset 1

10%

20%

30%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Consider the following portfolio choice problem. The investor has initial wealth w and utility u(x) = . There is a safe asset (such as a US government bond) that has net real return of zero. There is also a risky asset with a random net return that has only two possible returns, R₁ with probability 1- q and Ro with probability q. We assume R₁ 0. Let A be the amount invested in the risky asset, so that w - A is invested in the safe asset. 1) Find A as a function of warrow_forwardAssume that you have all your wealth (one million dollars) invested in the Vanguard 500 index fund, and that you expect to earn an annual return of 11%, with a standard deviation in returns of 24%. Since you have become more risk averse, you decide to shift $200,000 from the Vanguard 500 index fund to Treasury bills. The T-bill rate is 5%. Estimate the expected return and standard deviation of your new portfolio.arrow_forwardF3arrow_forward

- An investor has a power utility function with a coefficient of relative risk aversion of 3. Compare the utility that the investor would receive from a certain income of £2 with that generated by a lottery having equally likely outcomes of £1 and £3. Calculate the certain level of income which, for an investor with preferences as above, would generate identical expected utility to the lottery described. How much of the original certain income of £2 the investor would be willing to pay to avoid the lottery? Detail the calculations and carefully explain your answer.arrow_forwardUsing the Utility Function in Portfolio Management, where the utility function is the constant relative risk aversion utility of wealth function U(W) = W^(gamma)/gamma, set gamma to 0.5 and consider a 50-50 bet on winning 50,000 or getting nothing. What is the certainty equivalent wealth for this bet under these assumptions? Group of answer choices 30,000 10,000 25,000 12,500arrow_forwardA widely used utility function in the economics literature is the constant rate of risk aversion utility function. It is given by: u(c) = c*(1-n) (1-n) Assume that an agent lives for three periods (t-0,1,2) and discounts future utility at rate B (per period). The agent is born with asset level a, and his/her labour market income is yo and y, for periods O and 1 respectively, the agent retire in the last period (no labour income). The interest rate in this economy is r. Please answer the following questions based on the information displayed here. Choose the best option available. Select one: O a. The budget constrain in period t=2 is given by:C2+ ay az(1+r) O b. The budget constrain in period t=2 is given by: Cam a2(1+r) O C. The budget constrain in period t=2 is given by: u(c2)+ a a;(1+r) +ys O d. The budget constrain in period t=2 is given by: C2= az(1+r) +ya O e. The budget constrain in period t#2 is given by: C2+a a(1+r) +yaarrow_forward

- PLEASE PROVIDE CLEAR SOLUTION WITH CLEAR STEPS AND EXPLAINATION - DO NOT ANSWER IF YOU ARE NOT CONFIDENT.arrow_forwardNick is risk averse and faces a financial loss of $40 with probability 0.1. If nothing happens, his wealth is $260. If there is an actuarially fair insurance available to him, he buys the insurance so that his wealth would be the same in either state. True False Suppose that Jim has a von Neumann-Morgenstern utility function: U(c) = c². %3D Based on his utility function, we can tell that Jim is There is not enough information to determine his risk preference. risk averse. risk neutral. risk loving.arrow_forwardThe following payoff table provides profits based on various posible decision alternativesand various levels of demand at Kmart Print Shop. Alternatives Low High Alternative 1 10,000 30,000 Alternative 2 5,000 40,000 Alternative 3 -2,000 50,000 The probability of low demand is 0.4, whereas the probability of high demand is 0.6.What is the highest possible expected monetary value?arrow_forward

- Consider the following portfolio choice problem. The investor has initial wealth w and utility u(x) = . There is a safe asset (such as a US government bond) that has net real return of zero. There is also a risky asset with a random net return that has only two possible returns, R₁ with probability 1-q and Ro with probability q. We assume R₁ 0. Let A be the amount invested in the risky asset, so that w - A is invested in the safe asset. 1) What are risk preferences of this investor, are they risk-averse, risk neutral or risk-loving?arrow_forwardIf the risk-free rate is 3 percent and the risk premium is 5 percent, what is the required return?arrow_forwardA seller has an indivisible asset to sell. Her reservation value for the asset is s, which she knows privately. A potential buyer thinks that the assetís value to him is b, which he privately knows. Assume that s and b are independently and uniformly drawn from [0, 1]. If the seller sells the asset to the buyer for a price of p, the seller's payoff is p - s and the buyer's payoffis b - p. Suppose the buyer makes a take-it-or-leave-it offer p to the seller. What's the optimal offer if the buyer's value is b = 1/2?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education