Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

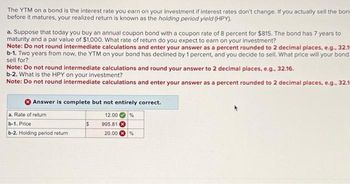

Transcribed Image Text:The YTM on a bond is the interest rate you earn on your investment if interest rates don't change. If you actually sell the bon

before it matures, your realized return is known as the holding period yield (HPY).

a. Suppose that today you buy an annual coupon bond with a coupon rate of 8 percent for $815. The bond has 7 years to

maturity and a par value of $1,000. What rate of return do you expect to earn on your investment?

Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.1m

b-1. Two years from now, the YTM on your bond has declined by 1 percent, and you decide to sell. What price will your bond

sell for?

Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.

b-2. What is the HPY on your investment?

Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.1

Answer is complete but not entirely correct.

12.00 %

995.81

20.00 %

a. Rate of return

b-1. Price

b-2. Holding period return

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Suppose you buy a bond with 3 years to maturity. The face value is 1000 and the coupon rate is 12 %. Assume after holding the bond for one year the market interest rate falls to 8 % a. What will be the new price of your bond? b. What will be the annual rate of return on your bond? c. Discuss the interest rate risk on bonds using your results in parts (a) and (b)?arrow_forwardConceptually good plsarrow_forwardYou own a bond with an annual coupon rate of 5% maturing in two years and priced at 85%. Suppose that there is a 23% chance that at maturity the bond will default and you will receive only 45% of the promised payment. Assume a face value of $1,000.A. What is the bond’s promised yield to maturity?B. What is its expected yield (i.e., the possible yields weighted by their probabilities)arrow_forward

- A 30-year maturity bond making annual coupon payments with a coupon rate of 11.00% has a ation of 13.50 years. The bond currently sells at a yield to maturity of 5.75%. Ducation a. Find the exact dollar price of the bond if its yield to maturity falls to 4.75%. What is the % change in price? b. Assume that you need to make a quick approximation using the duration rule. What is the % change in price as approximated by the duration rule when the yield to maturity falls to 4.75%? c. Does the duration-rule provide a good approximation of the % price change in this case? Why or why not?arrow_forwardYou have two bonds in your portfolio, Bond Y and Bond Z. Bond Y matures in 10 years and Bond Z matures in 5 years. They both have the same coupon rates. If interest rates increase or decrease which bond would you expect to have the largest change in their market price?arrow_forwardSuppose you purchase a 10-year bond with 6% annual coupons. You hold the bond for four years and sell it immediately after receiving the fourth coupon. If the bond's yield to maturity was 4.01% when you purchased and sold the bond, a. What cash flows will you pay and receive from your investment in the bond per $100 face value? b. What is the internal rate of return of your investment? Note: Assume annual compounding. The cash flow at time 1-3 is $ (Round to the nearest cent. Enter a cash outflow as a negative number.) (Round to the nearest cent. Enter a cash outflow as a negative number.) The cash outflow at time 0 is $ The total cash flow at time 4 (after the fourth coupon) is $ negative number.) b. What is the internal rate of return of your investment? (Round to the nearest cent. Enter a cash outflow as aarrow_forward

- Answer this question using the Par Value formula and showing all work. You have been given the following information for an existing bond that provides coupon payments. Par Value: $2000 Coupon rate: 6% Maturity: 4 years Required rate of return: 6%. What is the Present Value (PV) of the bond? If the required rate of return by investors were 11% instead of 6%, what would the Present Value of the bond be? Look at the same Par Value $2,000 Same Coupon rate: 6% Maturity: 10 years Required rate of return: 7% What is the Present Value of the Bond now? Explain how the longer maturities and higher required rate of return by investors affects the bond valuation.arrow_forwardAssume you can buy a bond that has a par value of $1000, matures in 10 years, yielding 6% and has a duration of 5. If you would like to use this bond to form a guaranteed investment contract “GIC” and offer a guaranteed rate of return to investors for certain years. a. what is the maximum yield you can offer? Why? Explain. b. For how many years would you make the guarantee? Explain.arrow_forwardSuppose today you buy a coupon bond that you plan to sell one year later. Which of the rate of return formula incorporates future changes into the bond's price?arrow_forward

- Suppose that a 1-year zero-coupon bond with face value $100 currently sells at $90.44, while a 2-year zero sells at $82.64. You are considering the purchase of a 2-year-maturity bond making annual coupon payments. The face value of the bond is $100, and the coupon rate is 12% per year. Required: a. What is the yield to maturity of the 2-year zero? b. What is the yield to maturity of the 2-year coupon bond? c. What is the forward rate for the second year? d. If the expectations hypothesis is accepted, what are (1) the expected price of the coupon bond at the end of the first year and (2) the expected holding-period return on the coupon bond over the first year? e. Will the expected rate of return be higher or lower if you accept the liquidity preference hypothesis? Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Required E Will the expected rate of return be higher or lower if you accept the liquidity preference hypothesis?…arrow_forwardYou plan to buy an 8% coupon 8-year maturity bond when market rate of return of similar bond is 10%. a) Calculate the proper price for this bond. b) TWO years later, the market rate has changed to 9% and the price of your bond has also changed accordingly. If you sell this bond at the market price, what is the ANNUAL rate of return from your investment in this bond? c) What will be your real rate of return over the two years if inflation rate is 3% in the first year and 5% in the second?arrow_forwardAssume that the Pure Expectations Theory of the term structure is correct. Also assume that the interest rate today on a 9-year security is 6.40%, while the interest rate today on a 15-year security is 8.00%. Finally assume that the interest rate on a 3-year security to be bought at Year 9 and held over Years 10, 11, and 12 is 6.80%. Given this information, determine the average annual return that investors today must expect that they will receive from investing in a 3-year security in 12 Years (that is, buying the security at Year 12 and holding it over Years 13, 14, and 15). O 13.00% O 12.50% 13.50% O 12.00% O 14.00%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education