FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

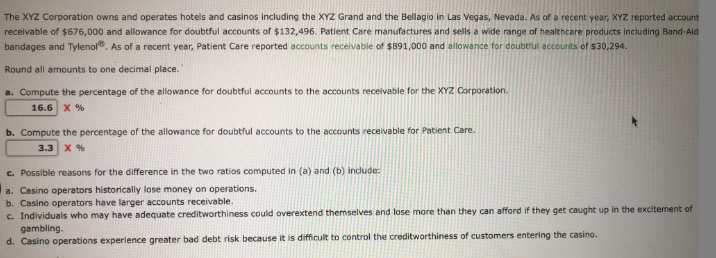

Transcribed Image Text:The XYZ Corporation owns and operates hotels and casinos including the XYZ Grand and the Bellagio in Las Vegas, Nevada. As of a recent year, XYZ reported account

receivable of $676,000 and allowance for doubtful accounts of $132,496. Patient Care manufactures and sells a wide range of healthcare products including Band-Ald

bandages and Tylenol. As of a recent year, Patient Care reported accounts receivable of $891,000 and allowance for doubtrul accounts of $30,294.

Round all amounts to one decimal place.

a. Compute the percentage of the allowance for doubtful accounts to the accounts receivable for the XYZ Corporation.

16.6 X %

b. Compute the percentage of the allowance for doubtful accounts to the accounts receivable for Patient Care.

3.3 x %

c. Possible reasons for the difference in the two ratios computed in (a) and (b) indude:

a. Casino operators historically lose money on operations.

b. Casino operators have larger accounts receivable.

c. Individuals who may have adequate creditworthiness could overextend themselves and lose more than they can afford if they get caught up in the excitement of

gambling.

d. Casino operations experience greater bad debt risk because it is difficult to control the creditworthiness of customers entering the casino.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Mr. Husker's Tuxedos Corp. ended the year 2021 with an average collection period of 35 days. The firm's credit sales for 2021 were $56.4 million. What is the year-end 2021 balance in accounts receivable for Mr. Husker's Tuxedos? (Enter your answer in dollars not in millions.) Accounts receivablearrow_forwardPlease be as detailed as possible in answering all requirements. Thank you in advance.arrow_forwardHoffman Paper Company, a profitable distributor of stationery and office supplies, has an agreement with its banks that allows Hoffman to borrow money on a short-term basis to finance its inventories and accounts receivable. The agreement states that Hoffman must maintain a current ratio of 1.5 or higher and a debt ratio of 50 percent or lower. Cash 2$ 55,000 Current liabilities $ 210,000 Accounts receivable 150,000 Long-term debt 300,000 Inventory 255,000 Stockholders' equity 630,000 Fixed assets (net) 680,000 Total liabilities and stockholders' equity $1,140,000 Total assets $1,140,000 Given the balance sheet provided above, determine how much additional money Hoffman could borrow at this time to invest in inventory and accounts receivable without violating the terms of its borrowing agreement. Round your answer to the nearest dollar. $arrow_forward

- Give me answer Urgentarrow_forwardFizzy Sodas and Hayes Companies are two of the largest and most successful beverage companies in the world in terms of the products that they sell and their receivables management practices. To evaluate their ability to collect on credit sales, consider the following rounded amounts reported in their annual reports (amounts in millions). Fiscal Year Ended: Net Sales Accounts Receivable Allowance for Doubtful Accounts Accounts Receivable, Net of Allowance Req 1 Complete this question by entering your answers in the tabs below. Req 2A Required: 1. Calculate the receivables turnover ratios and days to collect for Fizzy Sodas and Hayes Companies for 2018 and 2017. 2-a. Which of the companies was quicker to convert its receivables into cash in 2018? 2-b. Which of the companies was quicker to convert its receivables into cash in 2017? Req 2B Receivables Turnover Ratio Days to collect 2018 2018 $ 40,630 4,410 620 3,790 Fizzy Sodas Fizzy Sodas 2017 $ 45,120 4,710 610 4,100 Hayes Companies…arrow_forwardPlease help mearrow_forward

- On July 15, 2018, H.P. purchases a personal computer for his home. The computer cost $4,000. H.P. uses the computer 60 percent of the time in his business, 15 percent of the time for managing his investments and the remaining 25 percent of the time for various personal uses. Calculate H.P.'s maximum depreciation deduction for 2018 for the computer, assuming he does not make the election to expense or take bonus depreciation.arrow_forwardDuring the year ended December 31, 2021, Kelly's Camera Shop had sales revenue of $120,000, of which $60,000 was on credit. At the start of 2021, Accounts Receivable showed a $12,000 debit balance and the Allowance for Doubtful Accounts showed a $500 credit balance. Collections of accounts receivable during 2021 amounted to $58,000. Data during 2021 follow: a. On December 10, a customer balance of $1,000 from a prior year was determined to be uncollectible, so it was written off. b. On December 31, a decision was made to continue the accounting policy of basing estimated bad debt losses on 2 percent of credit sales for the year. Required: 1. Give the required journal entries for the two events in December. 2-a. Show how the amounts related to Bad Debt Expense would be reported on the income statement. 2-b. Show how the amounts related to Accounts Receivable would be reported on the balance sheet. 3. On the basis of the data available, does the 2 percent rate appear to be reasonable?arrow_forwardA small retailer allows customers to use two different credit cards in charging purchases. The CC Bank Card assesses a 4.6% service charge for credit card sales. The VIZA Card assesses a 3.8% charge on sales for using its card. This retailer also has its own store credit card. As of Feb 28 month-end, the retailer earned $65 in net interest revenue on its own card. Prepare journal entries to record the following selected credit card transactions. Feb. 2 Sold merchandise for $3,000 (that had cost $1800) and accepted the customer’s CC Bank Card. Feb. 6 Sold merchandise for $2200 (that had cost $1500) and accepted the customer’s VIZA Card. Feb 28 Recognized the $65 interest revenue earned on its store credit card for January.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education