Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

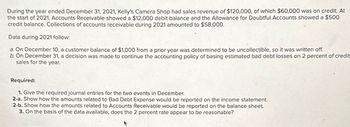

Transcribed Image Text:During the year ended December 31, 2021, Kelly's Camera Shop had sales revenue of $120,000, of which $60,000 was on credit. At

the start of 2021, Accounts Receivable showed a $12,000 debit balance and the Allowance for Doubtful Accounts showed a $500

credit balance. Collections of accounts receivable during 2021 amounted to $58,000.

Data during 2021 follow:

a. On December 10, a customer balance of $1,000 from a prior year was determined to be uncollectible, so it was written off.

b. On December 31, a decision was made to continue the accounting policy of basing estimated bad debt losses on 2 percent of credit

sales for the year.

Required:

1. Give the required journal entries for the two events in December.

2-a. Show how the amounts related to Bad Debt Expense would be reported on the income statement.

2-b. Show how the amounts related to Accounts Receivable would be reported on the balance sheet.

3. On the basis of the data available, does the 2 percent rate appear to be reasonable?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Starlight Enterprises has net credit sales for 2019 in the amount of $2,600,325, beginning accounts receivable balance of $844,260, and an ending accounts receivable balance of $604,930. Compute the accounts receivable turnover ratio and the number of days sales in receivables ratio for 2019 (round answers to two decimal places). What do the outcomes tell a potential investor about Starlight Enterprises if the industry average is 1.5 times and the number of days sales ratio is 175 days?arrow_forwardBerry Farms has an accounts receivable balance at the end of 2018 of $425,650. The net credit sales for the year are $924,123. The balance at the end of 2017 was $378,550. What is the number of days sales in receivables ratio for 2018 (round all answers to two decimal places)?arrow_forwardMillennial Manufacturing has net credit sales for 2018 in the amount of $1,433,630, beginning accounts receivable balance of $585,900, and an ending accounts receivable balance of $621,450. Compute the accounts receivable turnover ratio and the number of days sales in receivables ratio for 2018 (round answers to two decimal places). What do the outcomes tell a potential investor about Millennial Manufacturing if industry average is 2.6 times and number of days sales ratio is 180 days?arrow_forward

- Last year, Tobys Hats had net sales of 45,000,000 and cost of goods sold of 29,000,000. Tobys had the following balances: Refer to the information for Tobys on the previous page. Required: Note: Round answers to one decimal place. 1. Calculate the average accounts receivable. 2. Calculate the accounts receivable turnover ratio. 3. Calculate the accounts receivable turnover in days.arrow_forwardThe following select financial statement information from Candid Photography. Compute the accounts receivable turnover ratios and the number of days sales in receivables ratios for 2018 and 2019 (round answers to two decimal places). What do the outcomes tell a potential investor about Candid Photography if industry average for accounts receivable turnover ratio is 3 times and days sales in receivables ratio is 150 days?arrow_forwardDuring the year ended December 31, 2018, Kelly’s Camera Shop had sales revenue of $170,000, of which $85,000 was on credit. At the start of 2018, Accounts Receivable showed a $10,000 debit balance and the Allowance for Doubtful Accounts showed a $600 credit balance. Collections of accounts receivable during 2018 amounted to $68,000. Data during 2018 follow: On December 10, a customer balance of $1,500 from a prior year was determined to be uncollectible, so it was written off. On December 31, a decision was made to continue the accounting policy of basing estimated bad debt losses on 2 percent of credit sales for the year. Required: Give the required journal entries for the two events in December. Show how the amounts related to Accounts Receivable and Bad Debt Expense would be reported on the balance sheet and income statement for 2018. On the basis of the data available, does the 2 percent rate appear to be reasonable?arrow_forward

- During the year ended December 31, 2018, Kelly's Camera Shop had sales revenue of $140,000, of which $70,000 was on credit. At the start of 2018, Accounts Receivable showed a $11,000 debit balance and the Allowance for Doubtful Accounts showed a $540 credit balance. Collections of accounts receivable during 2018 amounted to $62,000. Data during 2018 follow: a. On December 10, a customer balance of $1,200 from a prior year was determined to be uncollectible, so it was written off. b. On December 31, a decision was made to continue the accounting policy of basing estimated bad debt losses on 2 percent of credit sales for the year. Required: 1. Give the required journal entries for the two events in December. 2. Show how the amounts related to Accounts Receivable and Bad Debt Expense would be reported on the balance sheet and income statement for 2018. 3. On the basis of the data available, does the 2 percent rate appear to be reasonable? Complete this question by entering your answers in…arrow_forwardWhat is the accounts receivable balance?arrow_forwardThe following are the receivables balances of Hendrix Company as of January 1, 2021 (the beginning of the fiscal year). $ 85,000 331,750 Notes receivable Accounts receivable Allowance for doubtful accounts Transactions during 2021 include the following: 1) Sales to customers of $2,017,800 were made during 2021. Customers have 60 days to pay for the product. 2) Accounts receivable of $1,942,000 were collected. 3) $7,000 was received in payment of an account which was written off the books as uncollectible during 2021. 4) Customer accounts of $30,200 were written off during 2021. 16,700 (Credit balance) 5) At year-end (December 31, 2021), an aging of the accounts receivable balance showed the following. Use the below information to record bad debt expense for 2021. Age Under 30 days 30-90 days 91-180 days 181-360 days Over 360 days Amount $169,250 100,000 55,900 38,200 14,000 Estimated % Uncollectible 0.8% 1.6 5.0 15.0 40.0 SHA Instructions a) Prepare the necessary journal entries for…arrow_forward

- At December 1, 2021, Vaughn Company's accounts receivable balance was $1860. During December, Vaughn had credit revenues on account of $7080 and collected accounts receivable of $6070. At December 31, 2021, the accounts receivable balance is $850 credit. Ⓒ $850 debit Ⓒ $2870 debit. O $2870 credit.arrow_forwardAt June 1, 2022, Whispering Winds Corp. had an Accounts Receivable balance of $19,100. During the month, the company had credit sales of $22,000 and collected Accounts Receivable of $27,700. What is the balance in Accounts Receivable at June 30, 2022? Ending Accounts Receivable $arrow_forwardNonearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,