EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Kindly help me with this question general Accounting

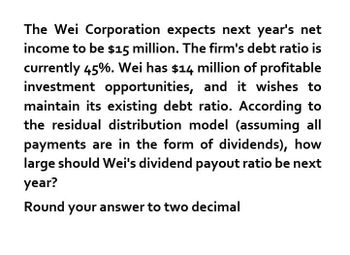

Transcribed Image Text:The Wei Corporation expects next year's net

income to be $15 million. The firm's debt ratio is

currently 45%. Wei has $14 million of profitable

investment opportunities, and it wishes to

maintain its existing debt ratio. According to

the residual distribution model (assuming all

payments are in the form of dividends), how

large should Wei's dividend payout ratio be next

year?

Round your answer to two decimal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- I need help with questions a-darrow_forwardThe future earnings, dividends, and common stock price of Callahan Technologies Inc. are expected to grow 5% per year. Callahan's common stock currently sells for $22.50 per share; its last dividend was $1.60; and it will pay a $1.68 dividend at the end of the current year. Using the DCF approach, what is its cost of common equity? Do not round intermediate calculations. Round your answer to two decimal places. % If the firm's beta is 1.6, the risk-free rate is 8%, and the average return on the market is 12%, what will be the firm's cost of common equity using the CAPM approach? Round your answer to two decimal places. % If the firm's bonds earn a return of 10%, based on the bond-yield-plus-risk-premium approach, what will be rs? Use the judgmental risk premium of 4% in your calculations. Round your answer to two decimal places. % If you have equal confidence in the inputs used for the three approaches, what is your estimate of Callahan's cost of common equity? Do not…arrow_forwardThe future earnings, dividends, and common stock price of Callahan Technologies Inc. are expected to grow 8% per year. Callahan's common stock currently sells for $21.75 per share; its last dividend was $1.50; and it will pay a $1.62 dividend at the end of the current year. a. Using the DCF approach, what is its cost of common equity? Do not round intermediate calculations. Round your answer to two decimal places. % b. If the firm's beta is 1.6, the risk-free rate is 8%, and the average return on the market is 12%, what will be the firm's cost of common equity using the CAPM approach? Round your answer to two decimal places. % c. If the firm's bonds earn a return of 10%, based on the bond-yield-plus-risk-premium approach, what will be rs? Use the judgmental risk premium of 4% in your calculations. Round your answer to two decimal places. % d. If you have equal confidence in the inputs used for the three approaches, what is your estimate of Callahan's cost of common equity? Do not…arrow_forward

- The future earnings, dividends, and common stock price of Callahan Technologies Inc. are expected to grow 4% per year. Callahan's common stock currently sells for $26.75 per share; its last dividend was $2.50; and it will pay a $2.60 dividend at the end of the current year. a. Using the DCF approach, what is its cost of common equity? Do not round intermediate calculations. Round your answer to two decimal places. % b. If the firm's beta is 2.0, the risk-free rate is 8%, and the average return on the market is 14%, what will be the firm's cost of common equity using the CAPM approach? Round your answer to two decimal places. % c. If the firm's bonds earn a return of 12%, based on the bond-yield-plus-risk-premium approach, what will be rs? Use the midpoint of the risk premium range discussed in Section 10-5 in your calculations. Round your answer to two decimal places. % d. If you have equal confidence in the inputs used for the three approaches, what is your estimate of Callahan's cost…arrow_forwardThe future earnings, dividends, and common stock price of Callahan Technologies Inc. are expected to grow 6% per year. Callahan's common stock currently sells for $27.25 per share; its last dividend was $2.00; and it will pay a $2.12 dividend at the end of the current year. Using the DCF approach, what is its cost of common equity? Do not round intermediate calculations. Round your answer to two decimal places. If the firm's beta is 0.6, the risk-free rate is 5%, and the average return on the market is 12%, what will be the firm's cost of common equity using the CAPM approach? Round your answer to two decimal places. If the firm's bonds earn a return of 10%, based on the bond-yield-plus-risk-premium approach, what will be rs? Use the midpoint of the risk premium range discussed in Section 10-5 in your calculations. Round your answer to two decimal places. If you have equal confidence in the inputs used for the three approaches, what is your estimate of Callahan's cost of common…arrow_forwardA firmrecently paid a dividend, D0, of $1.25. It expects to have nonconstant growth of 13% for 2 years followed by a constant rate of 8% thereafter. The firm's required return is 18%. What is the firm's horizon, or continuing, value? Do not round intermediate calculations. Round your answer to the nearest cent. What is the firm's intrinsic value today? Do not round intermediate calculations. Round your answer to the nearest cent.arrow_forward

- Sidman Products's common stock currently sells for $64 a share. The firm is expected to earn $7.04 per share this year and to pay a year-end dividend of $3.80, and it finances only with common equity. a. If investors require an 11% return, what is the expected growth rate? Do not round intermediate calculations. Round your answer to two decimal places. % b. If Sidman reinvests retained earnings in projects whose average return is equal to the stock's expected rate of return, what will be next year's EPS? (Hint: g = (1- Payout ratio)ROE). Do not round intermediate calculations. Round your answer to the nearest cent. per sharearrow_forwardThe future earnings, dividends, and common stock price of Callahan Technologies Inc. are expected to grow 3% per year. Callahan's common stock currently sells for $22.75 per share; its last dividend was $2.00; and it will pay a $2.06 dividend at the end of the current year. Using the DCF approach, what is its cost of common equity? Do not round intermediate calculations. Round your answer to two decimal places. % If the firm's beta is 1.6, the risk-free rate is 3%, and the average return on the market is 14%, what will be the firm's cost of common equity using the CAPM approach? Round your answer to two decimal places. %arrow_forwardSidman Products's common stock currently sells for $67 a share. The firm is expected to earn $7.37 per share this year and to pay a year-end dividend of $2.60, and it finances only with common equity. a. If investors require an 11% return, what is the expected growth rate? Do not round intermediate calculations. Round your answer to two decimal places. % b. If Sidman reinvests retained earnings in projects whose average return is equal to the stock's expected rate of return, what will be next year's EPS? (Hint: g - (1 - Payout ratio)ROE). Do not round intermediate calculations. Round your answer to the near ent. per sharearrow_forward

- Best Corporation is expected to pay $.60 next year and $1.10 the following year and $1.25 each year thereafter. If the required return is .14, what is the priice of the stock? $7.40 $2.95 $8.24 $2.22arrow_forwardThe next dividend payment by Hoffman, Inc., will be $2.60 per share. The dividends are anticipated to maintain a growth rate of 6.25 percent forever. Assume the stock currently sells for $48.80 per share. a. What is the dividend yield? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the expected capital gains yield? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) a. b. Dividend yield Capital gains yield ▶ % %arrow_forwardThe next dividend payment by Hoffman, Inc., will be $2.60 per share. The dividends are anticipated to maintain a growth rate of 6.25 percent forever. Assume the stock currently sells for $48.80 per share. a. What is the dividend yield? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the expected capital gains yield? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) a. Dividend yield b. Capital gains yield % %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT