Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

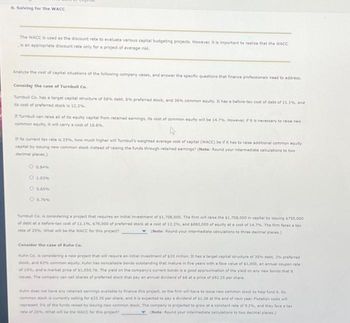

Transcribed Image Text:6. Solving for the WACC

The WACC is used as the discount rate to evaluate various capital budgeting projects. However, it is important to realize that the WACC

is an appropriate discount rate only for a project of average risk.

Analyze the cost of capital situations of the following company cases, and answer the specific questions that finance professionals need to address.

Consider the case of Turnbull Co.

Turnbull Co, has a target capital structure of 55% debt, 6% preferred stock, and 36% common equity. It has a before-tax cost of debt of 11.1%, and

its cost of preferred stock is 12.2%

of Turnbull can raise all of its equity capital from retained earnings, its cost of common equity will be 14.7%. However, if it is necessary to raise new

common equity, it will carry a cost of 16.0%

its current tax rate is 25%, how much higher will Turnbull's weighted average cost of capital (WACC) be if it has to raise additional common equity

capital by issuing new common stock instead of raising the funds through retained earnings? (Note: Round your intermediate calculations to two

decimal places)

0 0.04%

O 1.03 %

0 0.65%

Turnbull Co. is considering a project that requires an initial investment of $1,700,000. The firm will raise the $1,700,000 in capital by issuing $750,000

of debt at a before-tax cost of 11.1%, $70,000 of preferred stock at a cost of 12.2%, and $800,000 of equity at a cost of 14.7%. The firm faces a tax

rate of 25%. What will be the WACC for this project?

(Note: Round your intermediate calculations to three decimal places.)

Consider the case of Kuhun Co.

Kuhn Co. is considering a new project that will require an initial investment of $20 million. It has a target capital structure of 35% debt, 2% preferred

stock, and 63% common equity, Kuhn has noncallable bonds outstanding that mature in five years with a face value of $1,000, an annual coupon rate

of 10%, and a market price of $1,050.76. The yield on the company's current bonds is a good approximation of the yield on any new bonds that it

issues. The company can sell shares of preferred stock that pay an annual dividend of $5 at a price of $92.25 per share.

Kuhn does not have any retained earnings evailable to finance this project, so the firm will have to issue new common stack to help fund . Its

common stock is currently selling for $33.35 per share, and it is expected to pay a dividend of $1.35 at the end of next year Flotation costs will

represent 3% of the funds raised by issuing new common stack. The company is projected to grow at a constant rate of 9.2%, and they face a tax

rate of 25% What will be the WACC for this project?

(Note: Round your intermediate calculations to two decimal places)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The financial manager of a firm determines the following schedules of cost of debt and cost of equity for various combinations of debt financing: Debt/Assets After-Tax Cost of Debt Cost of Equity 0 % 4 % 7 % 10 4 7 20 4 7 30 4 9 40 5 10 50 5 12 60 8 13 70 8 15 Find the optimal capital structure (that is, optimal combination of debt and equity financing). Round your answers for the capital structure to the nearest whole number and for the cost of capital to one decimal place. The optimal capital structure: % debt and % equity with a cost of capital of % Why does the cost of capital initially decline as the firm substitutes debt for equity financing? The cost of capital initially declines because the firm cost of debt is than the cost of equity. Why will the cost of funds eventually rise as the firm becomes more financially leveraged? As the firm becomes more financially leveraged and riskier, the cost of debt…arrow_forwardWhich of the following statements is most correct? Group of answer choices The optimal capital structure maximizes the WACC. None of these. Increasing the amount of debt in a firm's capital structure is likely to increase the cost of both debt and equity financing. If the after-tax cost of equity financing exceeds the after-tax cost of debt financing, firms are always able to reduce their WACC by increasing the amount of debt in their capital structure.arrow_forward8. Conclusions about capital budgeting The decision process Before making capital budgeting decisions, finance professionals often generate, review, analyze, select, and implement long-term investment proposals that meet firm-specific criteria and are consistent with the firm's strategic goals. Companies often use several methods to evaluate the project's cash flows and each of them has its benefits and disadvantages. Based on your understanding of the capital budgeting evaluation methods, which of the following conclusions about capital budgeting are valid? Check all that apply. The NPV shows how much value the company is creating for its shareholders. For most firms, the reinvestment rate assumption in the MIRR is more realistic than the assumption in the IRR. Managers have been slow to adopt the IRR, because percentage returns are a harder concept for them to grasp. is the single best method to use when making capital budgeting decisions.arrow_forward

- The payback method helps firms establish and identify a maximum acceptable payback period that helps in their capital budgeting decisions. Consider the case of Green Caterpillar Garden Supplies Inc.: Green Caterpillar Garden Supplies Inc. is a small firm, and several of its managers are worried about how soon the firm will be able to recover its initial investment from Project Alpha’s expected future cash flows. To answer this question, Green Caterpillar’s CFO has asked that you compute the project’s payback period using the following expected net cash flows and assuming that the cash flows are received evenly throughout each year. Complete the following table and compute the project’s conventional payback period. For full credit, complete the entire table. (Note: Round the conventional payback period to two decimal places. If your answer is negative, be sure to use a minus sign in your answer.) Year 0 Year 1 Year 2 Year 3 Expected cash flow -$4,500,000…arrow_forwardThe WACC is a weighted average of the costs of debt, preferred stock, and common equity. How should the capital structure weights used to calculate the WACC be determined? Would the WACC depend in any way on the size of the capital budget? How might dividend policy affect WACC? Explainarrow_forward5. Taking into consideration all the information given, determine the Net Present Value of the project and advice the company on whether to invest in the new line of product. 6. Why should the cost of capital used in capital budgeting be calculated as a weighted average of the capital component rather than the cost of the specific financing used to fund a particular project?arrow_forward

- The financial manager of a firm determines the following schedules of cost of debt and cost of equity for various combinations of debt financing: Debt/Assets After-Tax Cost of Debt Cost of Equity 0 % 4 % 8 % 10 4 8 20 4 8 30 5 9 40 6 10 50 8 12 60 10 14 70 12 16 Find the optimal capital structure (that is, optimal combination of debt and equity financing). Round your answers for the capital structure to the nearest whole number and for the cost of capital to one decimal place. The optimal capital structure: % debt and % equity with a cost of capital of % Why does the cost of capital initially decline as the firm substitutes debt for equity financing? The cost of capital initially declines because the firm cost of debt is than the cost of equity. Why will the cost of funds eventually rise as the firm becomes more financially leveraged? As the firm becomes more financially leveraged and riskier, the cost of…arrow_forwardCHOICES A. Only Statement I is correctB. Only Statement II is falseC. Statements II and III are falseD. Only Statement III is falseE. All statements are correctarrow_forwardWhich of the following statements are correct? Preferred equities are separate form common equities Opportunity cost should not be included in the capital budgeting decision Retained earnings are important in calculating the WACC Weights for equity in the WACC calculation are always on book values Cash from net working capital for each year is defined as NWCn- NWCn-1arrow_forward

- Suppose a firm uses the WACC as the single hurdle rate in determining the value of capital budgeting projects rather than using risk adjusted hurdle rates. Choose the statement that actually completes the sentence describing the possible outcomes for the firm: the firm will tend to Accept profitable, low risk projects and reject unprofitable, high risk projects Accept profitable, low risk projects and accept unprofitable, high risk projects Reject profitable, low risk projects and reject unprofitable high risk projects Become less risky overtime Reject profitable, low risk projects and accept unprofitable, high risk projectsarrow_forwardBIE The Cost of Capital: Weighted Averige cost of capital The firm's target capital structure is the mix of debt, presured stack, and common equity the firm plans to mise funds for future projects. The target proportions of debt, preferred stock, and common equity, along with the cost of these I components, are used to calculate the firm's weighted average cost of capital (WACC). If the firm will not have to issue new common study then the cost of retained earnings is used in the firm's WACC calculation. However, if the firm will I have to issue new common stock, the cost of new common stock should be used in the firm's WALC calculation. Barton Industines expects that its target capital Structure for finds in the future for its raising capital budget will consist of 40% debt, 5% prefence stock, and 55% common equity. Note that the firm's marginal tax rate is 25%. Assume that the firm's cost of debt, rd is 10.0%, the firm's cost of preferred stock, rp is 9.2.%. and the firm's cost of…arrow_forwardThe payback period The payback method helps firms establish and identify a maximum acceptable payback period that helps in capital budgeting decisions. There are two versions of the payback method: the conventional payback method and the discounted payback method. Consider the following case: Green Caterpillar Garden Supplies Inc. is a small firm, and several of its managers are worried about how soon the firm will be able to recover its initial investment from Project Delta’s expected future cash flows. To answer this question, Green Caterpillar’s CFO has asked that you compute the project’s payback period using the following expected net cash flows and assuming that the cash flows are received evenly throughout each year. Complete the following table and compute the project’s conventional payback period. Round the payback period to the nearest two decimal places. Be sure to complete the entire table—even if the values exceed the point at which the cost of the project is…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education