FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Sh7

Please help me

Solution

Thankyou

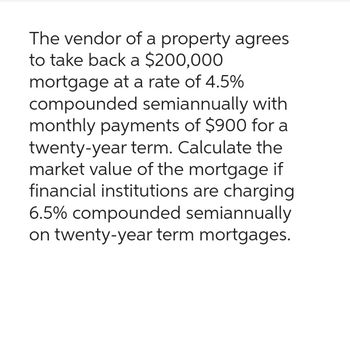

Transcribed Image Text:The vendor of a property agrees

to take back a $200,000

mortgage at a rate of 4.5%

compounded semiannually with

monthly payments of $900 for a

twenty-year term. Calculate the

market value of the mortgage if

financial institutions are charging

6.5% compounded semiannually

on twenty-year term mortgages.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- q15arrow_forward42 O Browser geNOWv2 | Online teachin X + n/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false DSU AcadCalendar C crunchy roll crunchy roll A Home - Hudl Spotify EReadir U D2L O DSU Support PDSU WebMail O DSU Account Monaco & Associates Use the following five transactions for Monaco & Associates, Inc. to answer the question(s). October 1 Bills are sent to clients for services provided in September in the amount of $800. Dravo Co. delivers office furniture ($1,060) and office supplies ($160) to Monaco 6 leaving an invoice for $1,220. 15 Payment is made to Dravo Co. for the furniture and office supplies delivered on October 9. 23 A bill for $430 for electricity for the month of September is received and will be paid on its due date in November. 31 Salaries of $850 are paid to employees. Based only on these transactions, what is the total amount of expenses that should appear on the income statement for the month of October? Oa. $1,280 Ob. $430…arrow_forwardJ 7 Choose from list of answer choices and show/explain work.arrow_forward

- I Session 6 L Dashboard x Question 9 X G What is the X Login | bar x M (Alen A ezto.mheducation.com/ext/map/index.html?_con%3con&external_browser%3D0&launchUrl=https%253A%2521 - Z. M MKT 100 (Section 2. H QuickLaunchSSO : Homework Saved Asset W has an expected return of 13.6 percent and a beta of 1.37. If the risk-free rate is 4.62 percent, complete the following table for portfolios of Asset W and a risk-free asset. (Leave no cells blank - be certain to enter "O" wherever required. Do not round intermediate calculations. Enter your portfolio expected return answers as a percent rounded to 2 decimal places, e.g.., 32.16. Enter your portfolio beta answers rounded to 3 decimal places, e.g., 32.161.) Portfolio Expected Percentage of Portfolio in Asset W Portfolio Beta Return 0 % % 25 % 50 75 % 100 % 125 % 150 % ......Tarrow_forwardUTF 8 Ch x Book 4 xisx Bb Signature E UTF-8Lece Connect p.mheducation.com/ext/map/indexhtml?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fperustatecollege.blackboard.com%252Fwebapps%252Fportal%2= Question 2 B Chapter 7E x 8 BUS 214 14 x Ques Chapters 7-9) 6 Saved Help Brian May, quitarist for Queen, does not know how to price his signature Antique Cherry Special that cost him £290 to make, He knows he wants 80% markup on cost. What price should Brian May ask for the guitar? Price aw -> %23 %24 4. 5 6. 2. 3. t y. e r karrow_forwardThis question has not been submitted previously. Thank youarrow_forward

- Question list O Question 1 O Question 2 O Question 3 O Question 4 More Info N 1 2 3 4 5 6 7 8 9 10 To Find F Given P FIP 1.1200 1.2544 1.4049 1.5735 1.7623 1.9738 2.2107 2.4760 2.7731 3.1058 K 0.8929 0,7972 0.7118 0.6355 0.5674 0.5066 0.4523 0.4039 Most likely estimates for a project are as follows. 0.3606 0.3220 To Find P Given F PIF Choose the correct choice below. Determine whether the statement "This project (based upon the most likely estimates) is profitable." is true or false. ✔Click the icon to view the relationship between the PW and the percent change in parameter. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 12% per year False O True To Find F Given A FIA 1.0000 2.1200 3.3744 4.7793 6.3528 8.1152 10.0890 12.2997 14.7757 17.5487 To Find P Given A PIA 0.8929 1.6901 2.4018 3.0373 3.6048 4.1114 4.5638 4.9676 5.3282 5.6502 To Find A Given F AIF 1.0000 04717 0.2963 0.2092 0.1574 0.1232 0.0991 0.0813 0.0877 0.0570 To Find A Given P…arrow_forwardmyedio.com Question 12 Listen Use the function f(x)=2x-5 • Find the inverse of f(x). . . Graph f(x) and f(x) and state the domain of each function. Prove that f(x) and f¹(x) are inverses, both graphically and algebraically. ATTACHMENTS W Algebra2 U9 UnitTest_Q17 docx 146.32 KBarrow_forwardPlz answer fast i give up vote without plagiarism pleasearrow_forward

- 5 X100 ry https://ng.cengage.com/static/nb/ui/evo/index.html?deploymentld-5829202317504197666520360810&eISBN=97... A S CENGAGE | MINDTAP I Chapter 4 Assignment Maria is a divorce attorney who practices law in San Francisco. She wants to join the American Divorce Lawyers Association (ADLA), a professional organization for divorce attorneys. The membership dues for the ADLA are $500 per year and must be paid at the beginning of each year. For instance, membership dues for the first year are paid today, and dues for the second year are payable one year from today. However, the ADLA also has an option for members to buy a lifetime membership today for $4,500 and never have to pay annual membership dues. Obviously, the lifetime membership isn't a good deal if you only remain a member for a couple of years, but if you remain a member for 40 years, it it's a great deal. Suppose that the appropriate annual interest rate is 8.5%. O 13 years O 15 years What is the minimum number of years that…arrow_forwardTopic: Uni X U2_AS i Topic: Uni X M Question X M Question x M Question √x ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https% 253A%252F%252Flms.mheducation.com%252Fmghmiddle Complete this question by entering your answers in the tabs below. Required 1 Required 2 F2 Moab Incorporated manufactures and distributes high-tech biking gadgets. It has decided to streamline some of its operations so that it will be able to be more productive and efficient. Because of this decision it has entered into several transactions during the year. a. Moab Incorporated sold a machine that it used to make computerized gadgets for $30,600 cash. It originally bought the machine for $21,400 three years ago and has taken $8,000 in depreciation. b. Moab Incorporated held stock in ABC Corporation, which had a value of $23,000 at the beginning of the year. That same stock had a value of $26,230 at the end of the year. c. Moab Incorporated sold some of its inventory for $9,200…arrow_forwardent II - Chapter 5 Saved Help Save & E 13 1.46853 0.68095 14 1.51259 0.66112 15 1.55797 0.64186 16 1.60471 0.62317 15.6178 10.63496 16.0863 10.95400 17.0863 11.29607 18.5989 11.93794 17.5989 11.63496 19.1569 12.29607 20.1569 12.56110 20.7616 12.93794 Monica wants to sell her share of an investment to Barney for $140,000 in 4 years. If money is wOrth 6% compounded semiannually, what would Monica accept today? Multiple Choice 110,517 $ 109.263 ( Prev 7 of 15 Next>arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education