ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

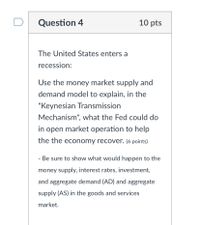

Transcribed Image Text:Question 4

10 pts

The United States enters a

recession:

Use the money market supply and

demand model to explain, in the

"Keynesian Transmission

Mechanism", what the Fed could do

in open market operation to help

the the economy recover. (6 points)

- Be sure to show what would happen to the

money supply, interest rates, investment,

and aggregate demand (AD) and aggregate

supply (AS) in the goods and services

market.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- A monetary policy that reduces the amount of money and loans in the economy is a contractionary monetary policy or a “tight” monetary policy. A monetary policy that expands the quantity of money and loans is known as an expansionary monetary policy or a “loose” monetary policy. Tight or contractionary monetary policy that leads to higher interest rates and a reduced quantity of loanable funds will reduce two components of aggregate demand. Conversely, a loose or expansionary monetary policy that leads to lower interest rates and a higher quantity of loanable funds will tend to increase business investment and consumer borrowing for big-ticket items. If loose monetary policy seeking to end a recession goes too far, it may push aggregate demand so far to the right that it triggers inflation. If tight monetary policy seeking to reduce inflation goes too far, it may push aggregate demand so far to the left that a recession begins. Note:- Do not provide handwritten solution. Maintain…arrow_forwardQ1. In this module we learned about severalreal-world complications that make monetary and fiscal policy more challenging than simple theory would suggest. Given the state of the Canadian economy and the causes of that state-think back to earlier discussions about the current economy-what should be the appropriate mix of fiscal and monetary policy, from a Keynesian perspective? From a neoclassical perspective? Which makes the most sense to you? Provide evidence (include and least one link/citation) to provide support to your conclusion.arrow_forwardThe United States enters a recession: Use the money market supply and demand model to explain, in the "Keynesian Transmission Mechanism", what the Fed could do in open market operation to help the the economy recover. - Be sure to show what would happen to the money supply, interest rates, investment, and aggregate demand (AD) and aggregate supply (AS) in the goods and services market.arrow_forward

- Monetary policy: Monetary policy refers to the use of interest rates and other monetary tools by the central bank to influence the economy. In the case of a severe negative supply shock, the central bank may lower interest rates to stimulate borrowing and investment, which can boost demand and offset the reduction in supply. However, this may lead to inflation if the increased demand leads to higher prices, which can further erode the purchasing power of consumers. Explain this graphically please.arrow_forward8) Using the aggregate demand-aggregate supply diagram, graphically illustrate and explain the impact of an expansionary monetary policy on the price level and real income in the long run.arrow_forwardSuppose the government decides to decrease government expenditures as a means of cutting the existing government budget deficit. Using a graph of aggregate demand and supply, show the effects of such a decision on the economy in the short run. Describe the effects on inflation and output. What will be the effect on the real interest rate, the inflation rate, and the output level if the Bank of Canada decides to stabilize the inflation rate?arrow_forward

- #6arrow_forward28)By using aggregate demand (AD) and aggregate supply (AS) curves, show and explain the effects of an anticipated increase in money supply on macroeconomic equilibrium according to Rational Expectations Hypothesisarrow_forwardRead the following premise carefully and answer the questions specifically and in detail. You must answer the request with the correct information, showing that you understand and can properly apply macroeconomic concepts. Try to address all elements of each question and always express the answers in your own words. Faced with an instability of economic growth caused by a recession or accelerated inflation, the Fed uses the open market operation to increase or decrease the available reserves of commercial banks which, in turn, will affect the amount of money available in the economy . In addition to the open market operation, the Fed has other tools available to promote growth, sustainability, and economic stability in a country. These tools have been used historically; A suitable example was the 2008 mortgage debt crisis. 1. Explain in detail monetary policy, its role and its effects on short and long-term economic fluctuations. Use the aggregate demand and supply model presented in…arrow_forward

- Question: A recent article (federalreserve.gov/econres/feds/files/2020049pap.pdf) published by the Federal Reserve (the central bank of the USA), suggests "the massive lockdown of the economy" has led to "a large negative demand shock. However, an accompanying increase in unemployment benefits has increased the income of some low-and middle-income households at least temporarily, which could helpfully support aggregate demand". The excerpt above suggests an increase in household income, which might lead to improved aggregate demand. a. Draw a diagram to explain the above situation to show the impact of increased income and how it affects aggregate demand.arrow_forward(a) Using a basic Keynesian income determination model, describe the effects of the following changes, assuming that money demand is infinitely elastic: (i) an increase in government expenditure (ii) an increase in the marginal propensity to save (iii) a decrease in export demand (iv) an increase in the marginal propensity to import (v) a cut in the official rate of interest by the Monetary Policy Committee of the Bank of England Illustrate your answers with diagrams.arrow_forward(a) Suppose that, in a liquidity trap, bank reserves are less liquid than government debt. If the central bank conducts an open market sale of government debt, what will be the effect on the price level? Use a diagram, explain your results. (b) Suppose that there is a decrease in the price of housing, which the central bank judges is a temporary asset price decrease. In the New Keynesian model, determine the central bank's optimal response to this asset price increase, using diagrams. (c) Suppose initially that inflation is at the central bank's target and the output gap is zero. Then, government spending goes up. Determine, with the aid of diagrams, how the degree of price stickiness affects the central bank's optimal response and explain your results.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education