FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

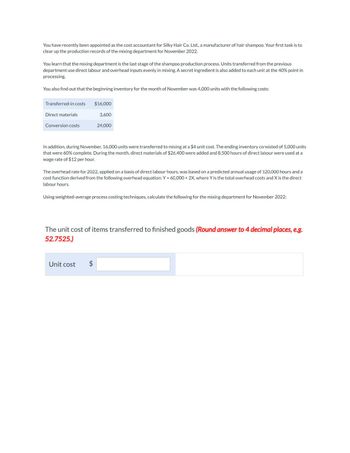

Transcribed Image Text:You have recently been appointed as the cost accountant for Silky Hair Co. Ltd., a manufacturer of hair shampoo. Your first task is to

clear up the production records of the mixing department for November 2022.

You learn that the mixing department is the last stage of the shampoo production process. Units transferred from the previous

department use direct labour and overhead inputs evenly in mixing. A secret ingredient is also added to each unit at the 40% point in

processing.

You also find out that the beginning inventory for the month of November was 4,000 units with the following costs:

Transferred-in costs

Direct materials

Conversion costs

$16,000

3,600

24,000

In addition, during November, 16,000 units were transferred to mixing at a $4 unit cost. The ending inventory consisted of 5,000 units

that were 60% complete. During the month, direct materials of $26,400 were added and 8,500 hours of direct labour were used at a

wage rate of $12 per hour.

The overhead rate for 2022, applied on a basis of direct labour hours, was based on a predicted annual usage of 120,000 hours and a

cost function derived from the following overhead equation: Y = 60,000+ 2X, where Y is the total overhead costs and X is the direct

labour hours.

Using weighted-average process costing techniques, calculate the following for the mixing department for November 2022:

Unit cost $

The unit cost of items transferred to finished goods (Round answer to 4 decimal places, e.g.

52.7525.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Ee 70.arrow_forwardSplish Company is a multiproduct firm. Presented below is information concerning one of its products, the Hawkeye. Date 1/1 2/4 2/20 4/2 11/4 (a) Transaction Beginning inventory Purchase Sale Purchase Sale Quantity Price/Cost Average-cost per unit $ 3,400 4,400 4,900 5,400 4,600 $19 28 47 36 51 Calculate average-cost per unit. (Round answer to 4 decimal places, e.g. 2.7613.)arrow_forwardHow did you find these?arrow_forward

- Subject: accountingarrow_forwardGlasgow Corporation has the following inventory transactions during the year. Unit Number of Units 53 133 Cost $ 45 47 Total Cost $ 2,385 6,251 10,150 5,763 Date Transaction Jan. 1 Beginning inventory Purchase Purchase Purchase Apr. 7 Jul.16 203 50 Oct. 6 113 51 502 $24,549 For the entire year, the company sells 433 units of inventory for $63 each.arrow_forwardGiven the following: Numberpurchased Costper unit Total January 1 inventory 32 $ 4 $ 128 April 1 52 6 312 June 1 42 7 294 November 1 47 8 376 173 $ 1,110 a. Calculate the cost of ending inventory using the FIFO (ending inventory shows 53 units). b. Calculate the cost of goods sold using the FIFO (ending inventory shows 53 units).arrow_forward

- Riverbed Vision Inc. opened for business on Jan 1, and uses a perpetual inventory system. During January, the company had the following purchases and sales for one of its products: Date Jan. 1 7 14 16 17 27 30 Purchases Units 1,414 800 925 517 Unit Cost $25 27 35 28 Sales Units Unit Price 614 1,200 1,507 $95 75 75arrow_forwardWhat is the wholesale price of an item, if the retail price is $104.37 and the amount of markup is $33.37? The wholesale price is $arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education