FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

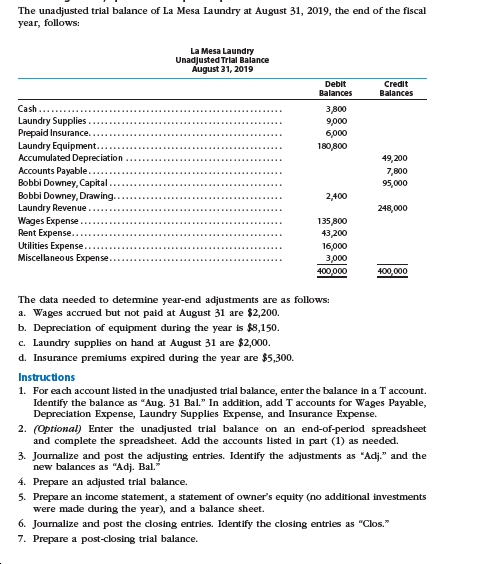

Transcribed Image Text:The unadjusted trial balance of La Mesa Laundry at August 31, 2019, the end of the fiscal

year, follows:

La Mesa Laundry

Unadjusted Trial Balance

August 31, 2019

Debit

Balances

Credit

Balances

Cash....

Laundry Supplies

Prepaid Insurance.

Laundry Equipment..

Accumulated Depreciation

Accounts Payable..

Bobbi Downey, Capital.

Bobbi Downey, Drawing.

Laundry Revenue

3в00

9,000

6,000

180,800

49,200

7,800

95,000

2,400

248,000

Wages Expense...

Rent Expense..

Utilities Expense...

Miscellaneous Expense...

135,800

43,200

16,000

з000

400,000

400,000

The data needed to detemine year-end adjustments are as follows:

a. Wages accrued but not paid at August 31 are $2,200.

b. Depreciation of equipment during the year is $8,150.

c. Laundry supplies on hand at August 31 are $2,000.

d. Insurance premiums expired during the year are $5,300.

Instructions

1. For each account listed in the unadjusted trial balance, enter the balance in a T account.

Identify the balance as "Aug. 31 Bal." In addition, add T accounts for Wages Payable,

Depreciation Expense, Laundry Supplies Expense, and Insurance Expense.

2. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet

and complete the spreadsheet. Add the accounts listed in part (1) as needed.

3. Journalize and post the adjusting entries. Identify the adjustments as "Adj." and the

new balances as "Adj. Bal."

4. Prepare an adjusted trial balance.

5. Prepare an income statement, a statement of owner's equity (no additional investments

were made during the year), and a balance sheet.

6. Journalize and post the closing entries. Identify the closing entries as "Clos."

7. Prepare a post-closing trial balance.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 9 steps with 9 images

Knowledge Booster

Similar questions

- 22 Salaries Payable 55 Insurance Expense 23 Unearmed Fees 59 Miscellaneous Expense The post-dosing trial balance as of April 30, 2019 Required: Journalize each of the May transactions using Kelly Consulling's clhar of accounts. (Do not Insert the account rumbers in the Post. Ref. colt compound transaction, if an amount box does not require an entry, leave it blank, May 3. Receved.cash fromn clients as an advance payrment for servies to be provided and recorded it as unearned fees, s1.500. Post. Ref. 4,500 May 5: Received cash from dlients on account, $2,450. Post. Ref. Debit 2,450 May 9: Paid cash for a newspaper advertisement, $225. Post. Ref. Debit DOOdODS日 May 13: Paid Office Station Co. for part of the debt incurred on April 5, $640. Post. Ref. Debit 640 May 15: Provided services on accournt for the period May 1-15, $9,180. Description Post. Ref. Debit 9,180 9,180 May 16: Paid part-time receptionist for two weeks' salary induding the amount owed on April 30, $750. Description Post.…arrow_forwardPrepare A Classified balance sheet, in report format, at June 30, 2020. READY HOSPITAL SUPPLIES ADJUSTED TRIAL BALANCE AS AT JUNE 30, 2020 ACCOUNT DEBIT CREDIT 1 Cash 127,000 2 A/c receivables 151,000 3 Allowance for bad debt 19,500 4 Prepaid insurance 48,000 5 Merchandise inventory 186,000 6 Store supplies 25,000 7 Prepaid rent 14,000 8 Furniture and fixtures 800,000 9 Accumulated depreciation-furniture & fixtures 320,000 10 Computer equipment 450,000 11 Accumulated depreciation-computer equipment 21,000 12 Interest payable 36,000 13 Accounts payable 133,500 14 Salaries payable 14,000 15 Unearned sales revenue 34,000 16 Portion of loan 90,000 17 Long term loan 270,000 18 Eva Ready Capital 898,500 19 Eva Ready Withdrawals 104,000 20 Sales revenue 1,091,000 21 Gain on computer equipment 14,000 22 Interest expense 36,000 23 Sales discount 7,000 24 Insurance expense 24,000 25…arrow_forwardNaa Adjorkor started business as a paper plate and cup manufacturer on 1 January 2018, making up accounts to 31 December 2018. Electricity bills received were as follows. 2018 2019 2020 GHC GHC GHC 31 January 6,491.52 6,753.24 30 April 5,279.47 5,400.93 6,192.82 31 July 4,663.80 4,700.94 5,007.62 31 October 4,117.28 4,620.00 5,156.40 What should the electricity charge be for the year ended 31 December 2018, 2019 and 2020; show the necessary journal entriesarrow_forward

- First using cash accounting, and then accrual accounting, discuss what the balances of each account will be on May 31, 2019 at Hippie Hospital for the financial period below, taking into consideration the transactions listed. Then, discuss why/how you arrived at your answer for each ending account balance. Beginning account balances for May 2019: Assets = $1,400,000 Liabilities = $500,000 Net Assets = $890,900 Revenue = $25,000 Expenses = $15,900 Transaction #1 (May 4, 2019) - the hospital signed a purchase order for a $2,500 supply purchase, which will be delivered/completed in mid-June. Transaction #2 (May 15, 2019) - the hospital provided $15,000 in patient care services and billed patients' insurance plans. Transaction #3 (May 25, 2019) - the hospital took out a loan for $4,000 to meet future, unexpected payroll obligations.arrow_forwardJim commenced business as a sole trader under the name of ‘JimTag’, and he has provided the following accounts and their closing balances for the year ended 31st December 2020: Jim Tag Unadjusted Trial Balance as at 31 December 2020 Accounts $ $ Capital: JimTag as at 1 January, 2020 98,900 Drawings 21,700 Sales 260,700 PAYG Withheld 23,200 Cost of Goods Sold 128,700 Cash at Bank 22,400 Accounts Receivable 14,150 GST Collected 25,500 Sales commissions expense 6,560 Staff salaries expense 64,500 Accounting fees 2,300 Advertising expense 7,970 Inventory as at 31 December, 2020 40,250 Computer Equipment at cost 36,000 Shop Fittings at cost 70,000 Accumulated Depreciation: Computer Equipment 5,400 Accumulated Depreciation: Shop Fittings 18,000 Accounts Payable 18,900 Long-term Bank…arrow_forwardCharles Whyte commenced business on May 1 2019, making up his accounts to September 30 annually. The statement of the Profit or Loss Account for the first 17 months ended September 30,2020 is as follows: Gross Profit Less: Repairs and maintenance. Local transport and travelling Salaries and wages Provision for bad debts Preliminary expenses Depreciation Bank interest and charges Legal and professional charges General expenses (Allowable) Clearing expense on motor vehicle Bad debt Amounts written off Loan to absconded employee (ii) (iii) (iv) (1) You are also given the following additional information. Bad debt £ (v) £'000 30/10/2018 1/1/2019 1/5/2019 1,500 2,450 6,500 1,350 960 1,630 1,520 1,380 1,870 685 2,800 Building Motor Vehicle Furniture and fittings Legal and professional charges were: Salaries and wages: The following qualifying capital expenditures were acquired on: Fines for contravention of the law Legal expenses for tax appeal Audit and accountancy charges £'000 19,300…arrow_forward

- Requirements 1. Journalize the transactions in the Johnson Pharmacies general journal. Round to the nearest dollar. Explanations required. 2. Prepare the liabilities section of the balance sheet for Johnson Pharmacies on March 1, 2019 after all the journal entries are recorded.arrow_forwardYou are provided with the following information form the accounts of BBS Ltd for the year ending 30 June 2019Cash Sales950 000Cost of Goods Sold35 000Amount received in advance for services to be performed in August 20199 500Rent expenses for year ended 30 June 20199 000Rent Prepaid for two months to 31 August 20191 200Doubtful debts expenses1 200Amount provided in 2019 for employees’ long-service leave entitlements5 000Goodwill impairment expenses7 000Required:Calculate the taxable profit and accounting profit for the year ending 30 June 2019. my confusion : not sure if LSL will be 50%of or not?arrow_forwardNaa Adjorkor started business as a paper plate and cup manufacturer on 1 January 2018, making up accounts to 31 December 2018. Electricity bills received were as follows. 2018 2019 2020 GHC GHC GHC 31 January 6,491.52 6,753.24 30 April 5,279.47 5,400.93 6,192.82 31 July 4,663.80 4,700.94 5,007.62 31 October 4,117.28 4,620.00 5,156.40 What should the electricity charge be for the year ended 31 December 2018, 2019 and 2020; show the necessary journal entriesarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education