FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

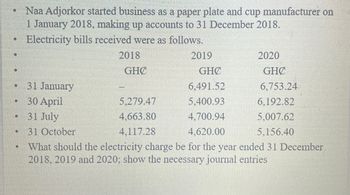

Transcribed Image Text:Naa Adjorkor started business as a paper plate and cup manufacturer on

1 January 2018, making up accounts to 31 December 2018.

Electricity bills received were as follows.

2018

2019

2020

GHC

GHC

GHC

31 January

6,491.52

6,753.24

30 April

5,279.47

5,400.93

6,192.82

31 July

4,663.80

4,700.94

5,007.62

31 October

4,117.28

4,620.00

5,156.40

What should the electricity charge be for the year ended 31 December

2018, 2019 and 2020; show the necessary journal entries

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Try Yourself - Question 2 Consider the following purchase history during October: Date Balance # of Days October 1 $110 8 October 9 $150 5 October 14 $260 8 October 22 $347 7 October 29 $612 3 The APR for this card is 16.45%. If the balance is not paid within the grace period, what is the total owed to the credit card company for this month? A. $261 B. $869 C. $616 D. $612 E. $704arrow_forwardProvide the answer is correct optionarrow_forward41 Tesla estimates the allowance for uncollectible accounts at 3% of the ending balance of accounts receivable. During 2024, Tesla's credit sales and collections were $121,000 and $131,000, respectively. What was the balance of accounts receivable on January 1, 2024, if $120 in accounts receivable were written off during 2024 and if the allowance account had a balance of $960 on December 31, 2024? Multiple Choice O $42,120 O $31,000 $420 None of these answer choices are correct.arrow_forward

- 1. Record journal entries for the following transactions of Hansen Bakery Company. Jan. 1, 2020 Dec. 31, 2020 Dec. 31, 2021 Dec. 31, 2022 Issued a $265,500 note to customer Jack Bullock as terms of a merchandise sale. The merchandise's cost to Hansen Bakery Company is $89,750. Note contract terms included a 36-month maturity date, and a 4.3% annual interest rate. Hansen Bakery Company records interest accumulated for 2020. Hansen Bakery Company records interest accumulated for 2021. Jack Bullock honors the note and pays in full with cash.arrow_forwardBUS 038 : Business Computatns4. You buy goods on an invoice dated October 28, with terms of 2/20, n/45. What is the last day of the discount period?arrow_forward9. Which of the following is recorded upon receipt of a payment on April 7, 2021, by a customer who pays a $900 invoice dated March 3, 2021, with terms 2/10, n/60? A. Debit Sales Discounts $18. B. Credit Purchase Discounts $18. C. Credit Accounts Receivable $882. D. Debit Cash $900.arrow_forward

- Prepare the entries for transaction below and indicate what journal it is 21 august issued a $600 credit memo to ultracity co. For an allowance on good sold on august 19, 2020arrow_forwardplz help thank uarrow_forward4. On January 1st, 2018, Blue Co. made a $10,000 sale for 1,000 water bottles on account with terms: of 2/15, n/30. If the company uses the net method, which of the following will be included in the Journal entry to record customer payment for all 1,000 water bottles on January 28th, 2018? a) credit Accounts Receivable $10,000 b) credit Sales Discounts Forfelted $200 c) debit Sales Discount $200 d) debit Cash $9,800arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education