FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

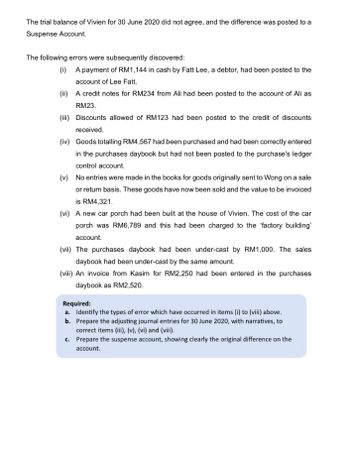

The trial balance of Vivien for 30 June 2020 did not agree, and the difference was posted to a

Suspense Account.

The following errors were subsequently discovered:

(i) A payment of RM1,144 in cash by Fatt Lee, a debtor, had been posted to the

account of Lee Fatt.

(ii) A credit notes for RM234 from Ali had been posted to the account of Ali as

RM23.

(iii) Discounts allowed of RM123 had been posted to the credit of discounts

received.

(iv) Goods totalling RM4,567 had been purchased and had been correctly entered

in the purchases daybook but had not been posted to the purchase's ledger

control account.

(v) No entries were made in the books for goods originally sent to Wong on a sale

or return basis. These goods have now been sold and the value to be invoiced

is RM4,321.

(vi) A new car porch had been built at the house of Vivien. The cost of the car

porch was RM6,789 and this had been charged to the 'factory building'

account.

(vii) The purchases daybook had been under-cast by RM1,000. The sales

daybook had been under-cast by the same amount.

(viii) An invoice from Kasim for RM2,250 had been entered in the purchases

daybook as RM2,520.

Required:

a. Identify the types of error which have occurred in items (i) to (viii) above.

b. Prepare the adjusting journal entries for 30 June 2020, with narratives, to

correct items (iii), (v), (vi) and (viii).

c. Prepare the suspense account, showing clearly the original difference on the

account.

Transcribed Image Text:The trial balance of Vivien for 30 June 2020 did not agree, and the difference was posted to a

Suspense Account.

The following errors were subsequently discovered:

(i) A payment of RM1,144 in cash by Fatt Lee, a debtor, had been posted to the

account of Lee Fatt.

(ii) A credit notes for RM234 from Ali had been posted to the account of Ali as

RM23.

(iii) Discounts allowed of RM123 had been posted to the credit of discounts

received.

(iv) Goods totalling RM4,567 had been purchased and had been correctly entered

in the purchases daybook but had not been posted to the purchase's ledger

control account.

(v) No entries were made in the books for goods originally sent to Wong on a sale

or return basis. These goods have now been sold and the value to be invoiced

is RM4,321.

(vi) A new car porch had been built at the house of Vivien. The cost of the car

porch was RM6,789 and this had been charged to the 'factory building'

account.

(vii) The purchases daybook had been under-cast by RM1,000. The sales

daybook had been under-cast by the same amount.

(viii) An invoice from Kasim for RM2,250 had been entered in the purchases

daybook as RM2,520.

Required:

a. Identify the types of error which have occurred in items (i) to (viii) above.

b. Prepare the adjusting journal entries for 30 June 2020, with narratives, to

correct items (iii), (v), (vi) and (viii).

c. Prepare the suspense account, showing clearly the original difference on the

account.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- What is the ending balance of the Allowance for doubtful receivables, given the following information: On January 1 2010, the Allowance for Doubtful Accounts of Alpha Inc. has a €10.500 credit balance and Accounts Receivable has a €150.000 debit balance. On December 31, some receivables are written down by €7.500 Answer: Xarrow_forwardThe following information applies to the questions displayed below.] On December 31, Jarden Company's Allowance for Doubtful Accounts has an unadjusted credit balance of $ 14,500. Jarden prepares a schedule of its December 31 accounts receivable by age. Accounts Receivable Age of Accounts Receivable Expected Percent Uncollectible $ 830,000 Not yet due 1.25 % 254,000 1 to 30 days past due 2.00 86,000 31 to 60 days past due 6.50 38,000 61 to 90 days past due 32.75 12,000 Over 90 days past due 68.00 2. Prepare the adjusting entry to record bad debts expense at December 31. Record the estimated ba debts. Required information 1 Record the estimated bad debts. Note: Enter debits before credits. Date December 31 General Journal Debit Credit Record entry Clear entry View general journalarrow_forwardBidiyah Co. estimates that RO 6,500 of its accounts receivable to be uncollectible. If Allowance for Doubtful Accounts has a RO 1,200 debit balance, the company should record a: Select one: O a. None of the answers are correct O b. debit to Bad Debt Expense for RO 5,300. O c credit to Allowance for Doubtful Accounts for RO 6,500. Od. debit to Allowance for Doubtful Accounts for RO 5,300. O e. credit to Bad Debt Expense for RO 7,700.arrow_forward

- The Garware Company uses allowance method to recognize uncollectible accounts expense. It provides you the following selected information Accounts receivable on December 31 2020 RO 280000 Required balance in Allowance for Doubtful Accounts account on December 31 2020 RO 4000 Existing balance in Allowance for Doubtful Accounts account on December 31 2019 RO 3500 The journal entry to recognize uncollectible accounts expense on December 31 2017 is a. Dr Uncollectible Accounts Expense 4000 and Cr Allowance for Doubtful Accounts 4000 b. Dr Uncollectible Accounts Expense 500 and Cr Allowance for Doubtful Accounts 500 c. Dr Accounts Receivable 3500 Cr Allowance for Uncollectible Accounts Expense 3500 d. Dr Accounts Receivable 3500 Cr Uncollectible Accounts Expense 3500arrow_forwardRequired information. [The following information applies to the questions displayed below] On December 31, Jarden Company's Allowance for Doubtful Accounts has an unadjusted credit balance of $15,000. Jarden prepares a schedule of its December 31 accounts receivable by age. Accounts Receivable $ 840,000 336,000 67,200 33,600 13,440 Age of Accounts Receivable Not yet due 1 to 30 days past due 31 to 60 days past due 61 to 90 days past due Over 90 days past due Expected Percent Uncollectible 1.15% 1.90 6.40 View transaction list View journal entry worksheet 32.25 67.00 2. Prepare the adjusting entry to record bad debts expense at December 31. Note: Round percentage answers to nearest whole percent. Do not round intermediate calculations.arrow_forwardPrior to recording the following. E. Perry Electronics, Incorporated, had a credit balance of $2.600 in its Allowance for Doubtful Accounts 1. On August 31, 2017, a customer balance for $540 from a prior year was determined to be uncollectable and was written off 2. On December 15, 2017, the customer balance for $540 written off on August 31, 2017, was collected in full Required: Using the following categories, indicate the accounts affected and the amounts (Enter any decreases to accounts with a minus sign.) Transaction 2a (Reversal of write-off) 2b (Collection from customer) Assets Liabilities Shareholders Equity Chearrow_forward

- Following is a list of credit customers along with their amounts owed and the days past due at December 31. Following that list are five classifications of accounts receivable and estimated bad debts percent for each class.A)Create an aging of accounts receivable schedule similar to Exhibit 9.8 and calculate the estimated balance for the Allowance for Doubtful Accounts.B)Assuming an unadjusted credit balance of $100, record the required adjustment to the Allowance for Doubtful Accountsarrow_forwardI have entered every answer for Dec 31, and it keeps telling me i am wrong. Can you help me solve?On December 31, 2021, when its Allowance for Doubtful Accounts had a debit balance of $1,315, Wildhorse Co. estimates that 11% of its accounts receivable balance of $107,400 will become uncollectible and records the necessary adjustment to Allowance for Doubtful Accounts. On May 11, 2022, Wildhorse Co. determined that B. Jared’s account was uncollectible and wrote off $1,207. On June 12, 2022, Jared paid the amount previously written off.Prepare the journal entries on December 31, 2021, May 11, 2022, and June 12, 2022. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit Choose a transaction date December 31, 2021May 11, 2022June 12, 2022 Enter an account title Enter a debit amount Enter a credit…arrow_forwardBlackhorse Productions, Incorporated, used the aging of accounts receivable method to estimate that its Allowance for Doubtful Accounts should be $19,350. The account had an unadjusted credit balance of $10,000 at that time. Required: Prepare journal entries for each of the following. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) a. The appropriate bad debt adjustment was recorded b. Later, an account receivable for $1000 was determined to be uncollectible and was written off. View transaction but Journal entry worksheet Record the end-of-period adjustment for bad debts under the aging of accounts receivable method. Note: Enter dets before creats. Transaction General Journal Debit Credit Cleary Resend untryarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education