FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

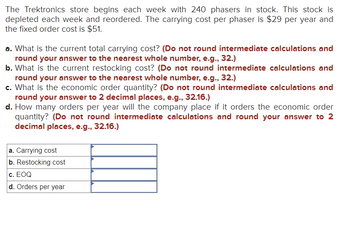

Transcribed Image Text:The Trektronics store begins each week with 240 phasers in stock. This stock is

depleted each week and reordered. The carrying cost per phaser is $29 per year and

the fixed order cost is $51.

a. What is the current total carrying cost? (Do not round intermediate calculations and

round your answer to the nearest whole number, e.g., 32.)

b. What is the current restocking cost? (Do not round intermediate calculations and

round your answer to the nearest whole number, e.g., 32.)

c. What is the economic order quantity? (Do not round intermediate calculations and

round your answer to 2 decimal places, e.g., 32.16.)

d. How many orders per year will the company place if it orders the economic order

quantity? (Do not round intermediate calculations and round your answer to 2

decimal places, e.g., 32.16.)

a. Carrying cost

b. Restocking cost

c. EOQ

d. Orders per year

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 16) can you please help with this question?arrow_forwardkeep costs down, CGC maintains a warehouse but no showroom or retail sales outlets. CGC has the following information for the second quarter of the year: 1. Expected monthly sales for April, May, June, and July are $180,000, $150,000, $270,000, and $50,000, respectively. 2. Cost of goods sold is 45 percent of expected sales. 3. CGC's desired ending inventory is 55 percent of the following month's cost of goods sold. 4. Monthly operating expenses are estimated to be: . Salaries: $33,000. ° Delivery expense: 8 percent of monthly sales. • Rent expense on the warehouse: $2,500. • Utilities: $500. • Insurance: $330. • Other expenses: $430. Required: 1. Compute the budgeted cost of purchases for each month in the second quarter. 2. Complete the budgeted income statement for each month in the second quarter. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the budgeted cost of purchases for each month in the second quarter. Total Cost of…arrow_forwardInventory Management a) The Electronics Store begins each week with 60 gadgets in stock. This stock is depleted and reordered weekly. The carrying cost per gadget is $21 per year and the fixed order cost is $45. What is the optimal number of orders that should be placed each year? b) A new customer has placed an order for a turbine engine that has a variable cost of $1.12 million per unit and a credit sales price of $1.64 million. Credit is extended for one period. Based on historical experience, payment for about 1 out of every 178 such orders is never collected. Therequired return is 2.1 percent per period. What is the NPV per unit if this is a one-time order?arrow_forward

- Please see imagine for questionarrow_forward8. A beauty supply store expects to sell 120 flat irons during the next year. It costs $1.60 to store one flat iron for one year. To reorder, there is a fixed cost of $6, plus $4.50 for each flat iron ordered. In what lot size and how many times per year should an order be placed to minimize inventory costs? how many flat irons per order how many orders per yeararrow_forwardA company is considering switching from a cash only policy to a net 30 credit policy. The price per unit is $500 and the variable cost per unit is $350. The company currently sells 1,400 units per month. Under the proposed policy the company expects to sell 1,500 units per month. The monthly compounded APR is 18%. Calculate the NPV of this switch. Assume that there are 30 days in one month. (Do not round intermediate calculations. Round the final answer to 2 decimal places. Omit any commas and the $ sign in your response. For example, an answer of $1,000.50 should be entered as 1000.50) .arrow_forward

- Red Hawk, Incorporated, is considering a change in its cash-only sales policy. The new terms of sale would be net one month. The required return is .96 percent per month. Current Policy New Policy Price per unit $ 1,100 $ 1,100 Cost per unit $ 910 $ 910 Unit sales per month 1,160 1,260 Calculate the NPV of the decision to switch. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Typing only. ..arrow_forwardEconomic order quantity (EOQ). Tinnendo, Inc. believes it will sell 4 million zen-zens, an electronic game, this coming year. Note that this figure is for annual sales. The inventory manager plans to order zen-zens 25 times over the next year. The carrying cost is $0.01 per zen-zen per year. The order cost is $510 per order. What are the annual carrying cost, the annual ordering cost, and the optimal order quantity for the zen-zens? Verify your answer by calculating the new total inventory cost. What is the annual carrying cost for the zen-zens? (Round to the nearest dollar.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education