Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

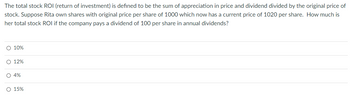

Transcribed Image Text:The total stock ROI (return of investment) is defined to be the sum of appreciation in price and dividend divided by the original price of

stock. Suppose Rita own shares with original price per share of 1000 which now has a current price of 1020 per share. How much is

her total stock ROI if the company pays a dividend of 100 per share in annual dividends?

O 10%

ο ο ο ο

O 12%

O 4%

O 15%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Suppose you purchase one share of the stock of Volatile Engineering Corporation at the beginning of year 1 for $36. At the end of year 1, you receive a $2 dividend and buy one more share for $30. At the end of year 2, you receive total dividends of $4 (i.e., $2 for each share) and sell the shares for $36.45 each. The dollar- weighted return on your investment is Answers: А. -1.75%. B. 8.00%. C. 4.08%. D. 8.53%. Е. 12.35%.arrow_forwardWhat is the required return on preferred stock, rPS, if the stock has an annual dividend of $9 and a price of $100?arrow_forwardSuppose you bought 150 shares of stock at an initial price of $47 per share. The stock paid a dividend of $.46 per share during the following year, and the share price at the end of the year was $50. a.Capital Gains Yield b.Divadend Yield c.Total rate of returnarrow_forward

- Your corporation has declared a cash dividend of $5.00 per share. Before the cash dividend the stock was selling for $60.00 per share. When the stock goes ex-dividend what will the price per share be? Please show your calculations in the space provided.What would the ex-dividend price per share be?arrow_forwardSuppose you know that a company's stock currently sells for $53.47 per share and the required return on the stock is 8.5 percent. You also know that the total return on the stock is evenly divided between capital gains yield and dividend yield. If it's the company's policy to always maintaina constant growth rate in its dividends, what is the current dividend per share? Answer to two decimals.arrow_forwardSpringtime Inc. has a perpetual preferred stock that pays a $9 per year dividend. The required rate of return on the preferred stock is 9%. What is the intrinsic value of a share of the preferred stock? a. $100 b. $90 c. $120 d. $85arrow_forward

- How much would you pay for a Summerhill common stock that pays a dividend of $1.8? You believe that Summerhill will grow at the rate of 11% for the long term, and you would require a return of 13% from such a stock.a. $ 99.90b. $90.00c. $ 15.37d. $88.27e. $ 14.45arrow_forwardWhat is the dividend yield if the annual dividend per share is $7.50 and the market price of a share of stock is $97?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education