FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

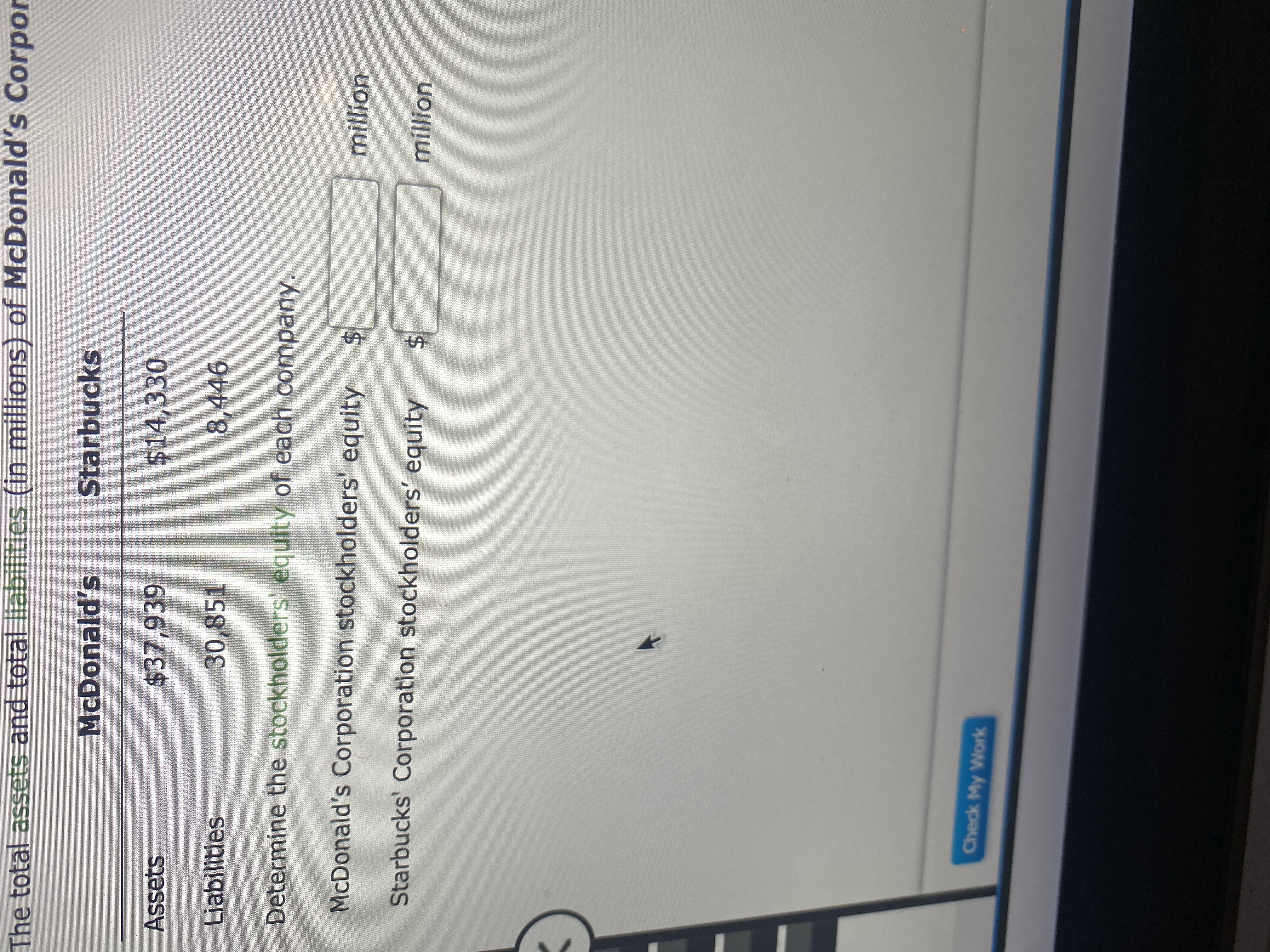

Transcribed Image Text:The total assets and total liabilities (in millions) of McDonald's Corpor

McDonald's

Starbucks

Assets

$37,939

$14,330

Liabilities

30,851

8,446

Determine the stockholders' equity of each company.

McDonald's Corporation stockholders' equity $

million

Starbucks' Corporation stockholders' equity

million

Check My Work

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Similar questions

- eBook Show Me How Calculator E Print Item Earnings Per share Financial statement data for the years ended December 31 for Dovetail Corporation follow: 2ΟΥ3 20Y2 Net income $485,750 $397,750 Preferred dividends $74,000 $74,000 Average numnber of common shares outstanding 45,000 shares 35,000 shares a. Determine the earnings per share for 20Y3 and 20Y2. Round your answers to two decimal places. 20Y3 X per share 20Y2 X per share b. Does the change in the earnings per share from 20Y2 to 20Y3 indicate a favorable or an unfavorable trend? Unfavorable v Feedback Y.Check My ok ep in mind the definition of earnings per share. Consider what the earnings per share number reveals. Check My Work 1 more Check My Work uses remaining. Previous Next O v 11:39 %24arrow_forwardMAD 12-5 Analyze and compare BB&T and Regions Financial BB&T Corporation (BBT) and Regions Financial Corporation (RF) are large regional banking companies. The net income and average common shares outstanding for both companies were reported in recent financial reports as follows (in millions): Obj. 7 Regions Financial BB&T $1,158 $64 Net income $2,458 Preferred dividends $167 Average number of common shares outstanding 815 1,255 a. Determine the earnings per share for each company. Round to the nearest cent. Which company appears more profitable from a total net income perspective? Which company appears more profitable from an earnings-per-share perspective? From a stockholder's perspective, is net income or earnings per share the better b. с. d. relative earnings measure between the two banks?arrow_forwardThe total assets and total liabilities (in millions) of McDonald’s Corporation (MCD) and Starbucks Corporation (SBUX) follow: McDonald’s Starbucks Assets $37,939 $14,330 Liabilities 30,851 8,446 Determine the stockholders’ equity of each companyarrow_forward

- Check My Work eBook Problem Walk-Through Edelman Engines has $20 billion in total assets – of which cash and equivalents total $120 million. Its balance sheet shows $4 billion in current liabilities – of O which the notes payable balance totals $0.89 billion. The firm also has $10 billion in long-term debt and $6 billion in common equity. It has 300 million shares of common stock outstanding, and its stock price is $20 per share. The firm's EBITDA totals $0.9 billion. Assume the firm's debt is priced at par, so the market value of its debt equals its book value. What are Edelman's market/book and its EV/EBITDA ratios? Do not round intermediate calculations. Round your answers to two decimal places. O M/B: EV/EBITDA:arrow_forwardsarrow_forwardVishnuarrow_forward

- Find the Return on Stockholders equity Find the Return on common stockholders equityarrow_forwardVijayarrow_forwardVertical Analysis of Balance Sheet Balance sheet data for Kwan Company on December 31, the end of two recent fiscal years, follow: Current Year Previous Year Current assets $355,300 $211,680 Property, plant, and equipment 543,400 509,600 Intangible assets 146,300 62,720 Current liabilities 188,100 94,080 Long-term liabilities 428,450 321,440 Common stock 104,500 109,760 Retained earnings 323,950 258,720 Prepare a comparative balance sheet for both years, stating each asset as a percent of total assets and each liability and stockholders' equity item as a percent of the total liabilities and stockholders' equity. If required, round percentages to one decimal place. Kwan Company Comparative Balance Sheet For the Years Ended December 31 Current Current year year Amount Percent Previous Previous year year Amount Percent Current assets $355,300 $211,680 % Property, plant, and equipment 543,400 509,600 % Intangible assets % 146,300 62,720 % % %arrow_forward

- QUESTION 6 Southeast Systems has the following balance sheet and the income statement. The company had 10 million shares of common stock outstanding and its market price of the common stock was $78 at the end of 2014. Make sure the unit is in million dollars. (unit: $ in millions) Southeast Systems Balance Sheets 2013 2014 2013 2014 Cash $50 $100 Accounts payable $450 $500 Accounts receivable 600 700 Notes payable 300 400 Inventory 500 550 Long-term debt 650 650 Net fixed assets 1,000 1,000 Common equity 300 300 Retained earnings 450 500 Total Assets $2,150 $2,350 Total Liabilities & Owner’s Equity $2,150 $2,350 Income Statement 2014 Sales $2,370 Cost of goods sold 2,070 Depreciation 200 EBIT 100 Interest expenses 20 Taxable income 80 Taxes 28 Net income $52 Dividends $2 (1) What is the…arrow_forwardquestion on exercise 16.4arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education