Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

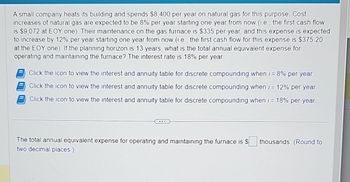

Transcribed Image Text:A small company heats its building and spends $8,400 per year on natural gas for this purpose. Cost

increases of natural gas are expected to be 8% per year starting one year from now (i.e., the first cash flow

is $9,072 at EOY one). Their maintenance on the gas furnace is $335 per year, and this expense is expected

to increase by 12% per year starting one year from now (i.e., the first cash flow for this expense is $375.20

at the EOY one). If the planning horizon is 13 years, what is the total annual equivalent expense for

operating and maintaining the furnace? The interest rate is 18% per year.

Click the icon to view the interest and annuity table for discrete compounding when i = 8% per year.

Click the icon to view the interest and annuity table for discrete compounding when i = 12% per year.

Click the icon to view the interest and annuity table for discrete compounding when i = 18% per year.

The total annual equivalent expense for operating and maintaining the furnace is $

two decimal places.)

thousands. (Round to

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Similar questions

- A company with $795,000 in operating assets is considering the purchase of a machine that costs $85,000 and which is expected to reduce operating costs by $17,000 each year. These reductions in cost occur evenly throughout the year. The payback period for this machine in years is closest to (Ignore income taxes.): (Round your answer to 1 decimal place.) Multiple Cholce 5 years 9.4 years 0.2 years 46.8 yearsarrow_forwardLou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of two new products for a five- year period. His annual pay raises are determined by his division's return on investment (ROI), which has exceeded 19% each of the last three years. He computed the following cost and revenue estimates for each product: Product A Product B Initial investment: Cost of equipment (zero salvage value) $ 190,000 $ 400,000 Annual revenues and costs: Sales revenues $ 270,000 $ 370,000 Variable expenses $ 128,000 $ 178,000 Depreciation expense $ 38,000 $ 80,000 Fixed out-of-pocket operating costs $ 72,000 $ 52,000 The company's discount rate is 17%. Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using tables. Required: 1. Calculate each product's payback period. 2. Calculate each product's net present value. 3. Calculate each product's internal rate of return. 4. Calculate each product's profitability index. 5.…arrow_forwardLou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of two new products for a five-year period. His annual pay raises are determined by his division’s return on investment (ROI), which has exceeded 17% each of the last three years. He has computed the cost and revenue estimates for each product as follows: Product A Product B Initial investment: Cost of equipment (zero salvage value) $ 176,600 $ 390,000 Annual revenues and costs: Sales revenues $ 260,000 $ 360,000 Variable expenses $ 124,000 $ 174,000 Depreciation expense $ 36,000 $ 78,000 Fixed out-of-pocket operating costs $ 71,000 $ 50,000 The company’s discount rate is 15%. Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor using tables. Required: 1. Calculate the payback period for each product. 2. Calculate the net present value for each product. 3. Calculate the internal rate of return for each…arrow_forward

- The plant holds an inventory of 250, has accounts receivable outstanding of 100, and accounts payable outstanding of 100. There will be immediate, one-time reductions of inventory and accounts payable by 20%. What is the working capital?arrow_forwardThe FernRod Motorcycle Company invested $150,000 at 4.5% compounded monthly to be used for the expansion of their manufacturing facilities. How much money will be available for the project in 5 1/2 years? (Round your answer to the nearest dollaarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education