FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:The Thompson Corporation, a manufacturer of steel products, began operations on October 1, 2022. The accounting department of

Thompson has started the fixed-asset and depreciation schedule presented below. You have been asked to assist in completing this

schedule. In addition to ascertaining that the data already on the schedule are correct, you have obtained the following information

from the company's records and personnel:

Note: Use tables, Excel, or a financial calculator. (FV of $1. PV of $1. EVA of $1. PVA of $1. EVAD of $1 and PVAD of $1)

a. Depreciation is computed from the first of the month of acquisition to the first of the month of disposition.

b. Land A and Building A were acquired from a predecessor corporation. Thompson paid $812,500 for the land and building

together. At the time of acquisition, the land had a fair value of $72,000 and the building had a fair value of $828,000.

c. Land B was acquired on October 2, 2022, in exchange for 3,000 newly issued shares of Thompson's common stock. At the date

of acquisition, the stock had a par value of $5 per share and a fair value of $25 per share. During October 2022, Thompson paid

$10,400 to demolish an existing building on this land so it could construct a new building.

d. Construction of Building B on the newly acquired land began on October 1, 2023. By September 30, 2024, Thompson had paid

$210,000 of the estimated total construction costs of $300,000. Estimated completion and occupancy are July 2025.

e. Certain equipment was donated to the corporation by the city. An independent appraisal of the equipment when donated placed

the fair value at $16,000 and the residual value at $2,000.

f. Equipment A's total cost of $110,000 includes installation charges of $550 and normal repairs and maintenance of $11,000.

Residual value is estimated at $9,000. Equipment A was sold on February 1, 2024.

g. On October 1, 2023, Equipment B was acquired with a down payment of $4,000 and the remaining payments to be made in 10

annual installments of $4,000 each beginning October 1, 2024. The prevailing interest rate was 8%.

Required:

Supply the correct amount for each answer box on the schedule.

Note: Round your intermediate calculations and final answers to the nearest whole dollar.

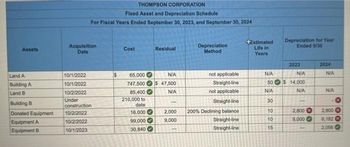

Transcribed Image Text:Assets

Land A

Building A

Land B

Building B

Donated Equipment

Equipment A

Equipment B

THOMPSON CORPORATION

Fixed Asset and Depreciation Schedule

For Fiscal Years Ended September 30, 2023, and September 30, 2024

Acquisition

Date

10/1/2022

10/1/2022

10/2/2022

Under

construction

10/2/2022

10/2/2022

10/1/2023

$

Cost

Residual

65,000

N/A

747,500 $ 47,500

85,400

N/A

210,000 to

date

16,000

99,000

30,840

2,000

9,000

Depreciation

Method

not applicable

Straight-line

not applicable

Straight-line

200% Declining balance

Straight-line

Straight-line

+Estimated

Life in

Years

N/A

50

N/A

30

10

10

15

Depreciation for Year

Ended 9/30

2023

N/A

$ 14,000

N/A

2,800

9,000

ⓇO

2024

N/A

N/A

2,800

8,182

2,056

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Accountants identify all expenditures as either a capital or a revenue expenditure. For each transaction listed, indicate the account to be debited. Assume all expenditures are material in amount. Transaction Select Account a. Changed engine oil b. Clear trees off purchased land c. Poured a concrete pad for a new machine d. Installed a refrigeration unit in the truck e. Replaced the truck tires f. Added an addition on to an existing building g. Re-painted the building h. Freight costs to ship newly acquired machine i. Purchased an office desk j. Architect fees incurred before building k. Costs to install a new machine l. Costs to train machine operators on new machine m. Costs to tear down a building on purchased land n. Replaced a burned out headlight on a truck o. Installed parking lot lighting p. Installed a wind deflector on truck to increase fuel…arrow_forwardThe following data are accumulated by Geddes Company in evaluating the purchase of $120,000 of equipment, having a four-year useful life: Net Income Net Cash Flow Year 1 $49,500 $79,500 Year 2 29,000 59,000 Year 3 16,500 46,500 Year 4 6,500 36,500 This information has been collected in the Microsaft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. K) Open spreadsheet a. Assuming that the desired rate of return is 15%, determine the net present value for the proposal. If required, round to the nearest dollac. Net present value b. Would management be likely to look with favor on the propesal? the net present value indicates that the return on the proposal is than the minimum desired rate of retum of 15%arrow_forwardThis is business algebra please show your work so I will understand the question.arrow_forward

- On January 1, 2024, the Mason Manufacturing Company began construction of a building to be used as its office headquarters. The building was completed on September 30, 2025. Expenditures on the project were as follows: January 1, 2024 March 1, 2024 June 30, 2024 October 1, 2024 January 31, 2025 April 30, 2025 August 31, 2025 On January 1, 2024, the company obtained a $3,900,000 construction loan with a 12% interest rate. The loan was outstanding all of 2024 and 2025. The company's other interest-bearing debt included two long-term notes of $6,000,000 and $9,000,000 with interest rates of 8% and 10%, respectively. Both notes were outstanding during all of 2024 and 2025. Interest is paid annually on all debt. The company's fiscal year-end is December 31. Required: 1. Calculate the amount of interest that Mason should capitalize in 2024 and 2025 using the specific interest method. 2. What is the total cost of the building? 3. Calculate the amount of interest expense that will appear in…arrow_forwardThe financial statements of Columbia Sportswear Company are presented in Appendix B. Click here to view Appendix B. The financial statements of Under Armour, Inc. are presented in Appendix C. Click here to view Appendix C. The complete annual report, including the notes to the financial statements, is available at the company's website. (b) What conclusions concerning the management of plant assets can be drawn from these data? 1. 2. 3. Return on assets Profit margin Asset turnover Columbia Sportswear Company 12.0% 9.8% 1.22 times Under Armour, Inc. -1.1% -0.9% 1.26 timesarrow_forward! Required information [The following information applies to the questions displayed below.] At the beginning of the year, Almond Factory bought three used machines. The machines immediately were overhauled, were installed, and started operating. Because the machines were different, each was recorded separately in the accounts. Details for Machine A are provided below. Cost of the asset Installation costs Renovation costs prior to use Repairs after production began $10,400 940 1,020 790 7. Prepare the journal entry to record year 2 double-declining balance depreciation expense for Machine C, which has a cost of $26,800, an estimated life of 10 years, and $1,400 residual value. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) A. Record the year 2 depreciation expense for Machine C.arrow_forward

- Required information [The following information applies to the questions displayed below.] Karane Enterprises, a calendar-year manufacturer based in College Station, Texas, began business in 2022. In the process of setting up the business, Karane has acquired various types of assets. Below is a list of assets acquired during 2022: Cost Date Placed in Asset Office furniture Machinery Used delivery truck* Service $ 400,000 1,810,000 90,000 02/03/2022 07/22/2022 08/17/2022 *Not considered a luxury automobile. During 2022, Karane was very successful (and had no §179 limitations) and decided to acquire more assets in 2023 to increase its production capacity. These are the assets acquired during 2023: Date Placed in Asset Luxury auto* Computers and information system Assembly equipment Storage building *Used 100% for business purposes. Cost Service $ 450,000 92,500 1,450,000 03/31/2023 05/26/2023 08/15/2023 800,000 11/13/2023 Karane generated taxable income in 2023 of $1,795,000 for purposes…arrow_forward3....new. //// Metlock Inc. was incorporated in 2019 to operate as a computer software service firm, with an accounting fiscal year ending August 31. Metlock’s primary product is a sophisticated online inventory-control system; its customers pay a fixed fee plus a usage charge for using the system.Metlock has leased a large, Alpha-3 computer system from the manufacturer. The lease calls for a monthly rental of $44,000 for the 144 months (12 years) of the lease term. The estimated useful life of the computer is 15 years.All rentals are payable on the first day of the month beginning with August 1, 2020, the date the computer was installed and the lease agreement was signed. The lease is non-cancelable for its 12-year term, and it is secured only by the manufacturer’s chattel lien on the Alpha-3 system.This lease is to be accounted for as a finance lease by Metlock, and it will be amortized by the straight-line method. Borrowed funds for this type of transaction would cost…arrow_forwardPrepare a classified statement of financial position in good form, without specific amounts. (List Current Assets in order of liquidity. ListProperty, Plant, and Equipment in order of Land, Buildings and Equipment.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education