ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

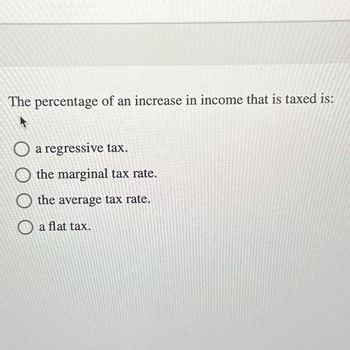

Transcribed Image Text:The percentage of an increase in income that is taxed is:

O a regressive tax.

O the marginal tax rate.

O the average tax rate.

O a flat tax.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- A tax whose impact varies inversely with the income of the person taxed, and poor people have a higher percentage of their income taxed than rich people, is known as aarrow_forwardIncome Amount of tax 10,000 1,000 50,000 10,000 100,000. 30,000 calculate the percentage of income paid in tax. Is this an example of a progressive, regressive or proportional tax? Explain.arrow_forwardPlz solve in 15 min it's urgent.arrow_forward

- Suppose that the demand for CDs is very price elastic and the supply is very price inelastic. A per unit tax imposed on CDs would be borne a. equally by buyers and sellers. b. more heavily by buyers. c. more heavily by sellers. d. by neither buyers or sellers.arrow_forwardDescribe Progressive taxation. And Regressive taxationarrow_forwardPercent of Income Paid in Total amount Income Tax of Tax Paid Family $10,000 10% $1,000 A Family $50,000 20% $10,000 В Family $100,000 30% $30,000 C Identify the tax structure based on the tax chart. Proportional Tax Progressive Tax Regressive Taxarrow_forward

- 8. Explain why each of the following taxes is progressive or regressive. a. $1 per pack federal excise tax on cigarettes b. The federal individual income tax d. The federal payroll tax.arrow_forwardThe incidence of a tax: - refers to who writes the check to the government. - is a measure of the revenue the government receives from it. - is a measure of the deadweight loss generated by the tax. - refers to who really bears the burden of the tax.arrow_forwardThe incidence of a tax falls more heavily on: A. Consumers than producers if demand is more inelastic than supply B. Producers than consumers of supply is more inelastic than demand C. Consumers than producers if supply is more elastic than demand D. All of the above are correctarrow_forward

- When a tax is collected from the buyers in a market,. a. the tax burden falls most heavily on the buyersb. the buyers bear the burden of the taxc. the sellers bear the burden of the taxd. the tax burden on the buyers and sellers is the same as an equivalent tax collected from the sellersarrow_forward7. Within the context of taxation policy, many economists have preferred the use of consumption tax to income tax. Explain.arrow_forwardGovernment collects the largest percentage of its revenue in which of the following ways? A) excise tax B) payroll tax C) corporate income tax D) personal income taxarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education