ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

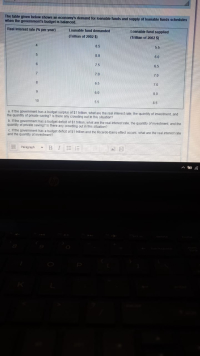

Transcribed Image Text:The table given below shows an economy's demand for loanable funds and supply of loanable funds schedules

when the government's budget is balanced.

Real Interest rate (% per year)

Loanable fund demanded

Loanable fund supplied

(Trillian of 2002 $)

(Trillian of 2002 $)

8.5

5.5

8.0

6.0

75

6.5

7.0

7.0

6.5

7.0

9.

6.0

8.0

10

5.5

8.5

a. If the government has a budget surplus of $1 trillion, what are the real interest rate, the quantity of investment, and

the quantity of private saving? Is there any crowding out in this situation?

b. If the government has a budget deficit of $1 trillion, what are the real interest rate, the quantity of investment, and the

quantity of private saving? is there any crowding out in this situation?

c. If the government has a budget deficit of $1 trillion and the Ricardo-Barro effect occurs, what are the real interest rate

and the quantity of investment?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Ten years ago, Ginny inherited $55,000 from her grandmother. She decided to invest all of this money in GE stock. Suppose she decides to sell the stock today so she can purchase her first home. The sale price of the stock is $75,000. Calculate the size of Ginny's taxable capital gain.arrow_forward- How do I find how much time it takes Jason to repay the loan under his proposal? - What is the amount Jessica prefers to receive at the end of each quarter under her new proposal, for 420 months? - Finally how do I calculate the amount of interest Jason will have paid over the life of the loan?arrow_forwardWhat are the key taxes levied which can be collected by state, territory, and local government in Australia? How is GST revenue shared with the states and territories?arrow_forward

- Given demand and supply for loanable fund Market at given time period in the table below Quantity of loanable fund demanded (billion $) Real Quantity of loanable fund supplied (billion $) interest rate 0.5 400 120 0.75 380 140 1 360 160 180 1.25 340 1.5 320 20 1.75 300 220 280 240 2.25 260 260 2.5 240 280 2.75 220 300 3 200 320 3.25 180 340 3.5 160 360 3.75 140 380 4 120 400 Instructions: 1. Using excel, find the equilibrium real interest rate and quantity of loanable fund, show the point on the graph. 2. If this country experiences an expansion business cycle phase that increases the demand for loanab fund by $40 billion. a) Find the new equilibrium real interest rate and quantity of loanable fund. b) Show the shift on the graph. 3. Starting from the original equilibrium If there is a decreases in aggregate income that decreases supply for loanable fund by $20 billion. a) Find the new equilibrium real interest rate and quantity of loanable fund. b) Show the shift on the graph. (arrow_forwardplease answer part 3arrow_forward#18. What would happen in the market for loanable funds if the government were to increase the tax on interest income? a The supply of loanable funds would shift right. b The demand for loanable funds would shift right. c The supply of loanable funds would shift left. d The demand for loanable funds would shift left.arrow_forward

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardlist 5 K The effective interest rate is calculated as the total interest earned during the year divided by the beginning balance of the investment as the first of the year. O True O False ..arrow_forward1. math of interest. please solve correctlyarrow_forward

- Bill's income is $1,000 and his net taxes are $350. His disposable income is Group of answer choices $650. $750. $1,350. -$350.arrow_forwardTrue or false: Investors and lenders are the same group of peoplearrow_forward23. James borrowed $600 from the bank at some rate per annum and that amount becomes double in 2 years. Calculate the rate at which James borrowed the money. Amount of Rs 12800 was invested by Mr Rohan dividing it into two differentarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education