ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

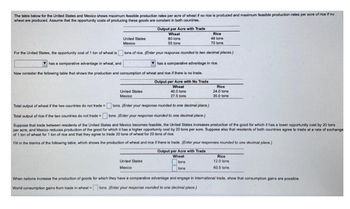

Transcribed Image Text:The table below for the United States and Mexico shows maximum feasible production rates per acre of wheat if no rice is produced and maximum feasible production rates per acre of rice if no

wheat are produced. Assume that the opportunity costs of producing these goods are constant in both countries.

Output per Acre with Trade

Wheat

80 tons

United States

Mexico

55 tons

For the United States, the opportunity cost of 1 ton of wheat is tons of rice. (Enter your response rounded to two decimal places.)

has a comparative advantage in wheat, and

has a comparative advantage in rice.

Now consider the following table that shows the production and consumption of wheat and rice if there is no trade.

Output per Acre with No Trade

Wheat

40.0 tons

27.5 tons

United States

Mexico

Total output of wheat if the two countries do not trade

tons. (Enter your response rounded to one decimal place.)

Total output of rice if the two countries do not trade

tons. (Enter your response rounded to one decimal place)

Suppose that trade between residents of the United States and Mexico becomes feasible, the United States increases production of the good for which it has a lower opportunity cost by 20 tons

per acre, and Mexico reduces production of the good for which it has a higher opportunity cost by 20 tons per acre. Suppose also that residents of both countries agree to trade at a rate of exchange

of 1 ton of wheat for 1 ton of rice and that they agree to trade 20 tons of wheat for 20 tons of rice.

Fill in the blanks of the following table, which shows the production of wheat and rice if there is trade. (Enter your responses rounded to one decimal place.)

Output per Acre with Trade

Wheat

tons

tons

United States

Mexico

Rice

48 tons

70 tons

Rice

24.0 tons

35.0 tons

Rice

12.0 tons

60.5 tons

When nations increase the production of goods for which they have a comparative advantage and engage in international trade, show that consumption gains are possible.

World consumption gains from trade in wheat-tons. (Enter your response rounded to one decimal place.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Suppose that each country completely specializes in the production of the good in which it has a comparative advantage, producing only that good. In this case, the country that produces pistachios will produce. million pounds per day and the country that produces chinos will produce million pairs per day.arrow_forwardNo written by hand solution Based on information below (2 countries x 2 products), if US has comparative advantage in producing Rice, what can you say about X? (note: figures represent production or output.) Please assume that X is a positive number. Rice Car US 7 6 Korea 9 X X < 4 X > 54/7 X < 63/7 X < 7arrow_forwardAssume that the comparative-cost ratios of two products-baby formula and tuna fish-are as follows in the nations of Canswicki and Tunata: Canswicki: 1 can baby formula = 3 cans tuna fish Tunata: 1 can baby formula = 5 cans tuna fish a. In what product should each nation specialize? Canswicki should produce [(Click to select), and Tunata should produce [(Click to select) ♥ b. Would the following terms of trade be acceptable to both nations? i. 1 can baby formula = 2 cans tuna fish: (Click to select) ii. 1 can baby formula = 3.5 cans tuna fish: (Click to select) iii. 1 can baby formula = 6 cans tuna fish: (Click to select)arrow_forward

- From an economic point of view, India and China are somewhat similar: Both are huge, low-wage countries, probably with similar patterns of comparative advantage, which until recently were relatively closed to international trade. China was the first to open up. Now that India is also opening up to world trade, how would you expect this to affect the welfare of China? Of the United States? (Hint: Think of adding a new economy identical to that of China to the world economy.) A. From China's perspective, the world relative supply curve will shift to the left. This shift will improve China's terms of trade. The U.S. purchases of Chinese exports will hurt the U.S. by decreasing the relative price of goods that the U.S. exports. B. From China's perspective, the world relative supply curve will shift to the right. This shift will worsen China's terms of trade. The U.S. purchase of Chinese exports will benefit the U.S. by increasing the relative price of goods that the U.S. exports. C. From…arrow_forwardTerms of trade Suppose that Greece and Austria both produce oil and wine. Greece’s opportunity cost of producing a bottle of wine is 4 barrels of oil, while Austria’s opportunity cost of producing a bottle of wine is 10 barrels of oil. By comparing the opportunity cost of producing wine in the two countries, you can tell that ______(Greece / Austria) has a comparative advantage in the production of wine, and ______(Greece / Austria) has a comparative advantage in the production of oil. Suppose that Greece and Austria consider trading wine and oil with each other. Greece can gain from specialization and trade as long as it receives more than _______(1/4barrel / 1/10barrel / 1barrel / 4barrels / 10barrels) of oil for each bottle of wine it exports to Austria. Similarly, Austria can gain from trade as long as it receives more than _______(1/4barrel / 1/10barrel / 1barrel / 4barrels / 10barrels) of wine for each barrel of oil it exports to Greece. Based on answers…arrow_forwardChoose four countries. One country in North America, another country in Central America, another country in the Caribbean and another country in South America and indicate, using the gravity model, which factors should increase or reduce trade between those countries. After that, choose a country in Europe and indicate, using the Gravity Model, how the intensity of trade changes with five countries. You must take into account the concept of the gravity model and the factors that affect trade such as language, culture, trade agreements, among others. Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- am. 111.arrow_forwardIn the past 20 years the United States has entered into several "free trade agreements." The commonality of these free trade agreement has been making it easier for foreign companies to sell their goods in the United States (imports) and for American companies to sell their goods overseas (exports) What are the key points of specific trade agreement the United States has entered into in the last 25 years? And what other countries are involved and what kinds of trade restrictions and/or tariffs were changed as a result of that agreement.arrow_forwardConsider a two‑nation world consisting of the United States and Mexico, which both produce strawberries. Assume there are no trade barriers or international transportation costs. The tables represent the markets for strawberries in the United States and Mexico. Mexican prices have been converted to U.S. dollars. What is the equilibrium world price per pound? What is the equilibrium quantity of exports and imports? Which country will export strawberries?arrow_forward

- The following hypothetical production possibilities tables are for China and the United States. Assume that before specialization and trade, the optimal product mix for China is alternative B and for the United States is alternative U. a. Are comparative-cost conditions such that the two areas should specialize? If so, what product should each produce? b. What is the total gain in apparel and chemical output that would result from such specialization? c. What are the limits of the terms of trade? Suppose that the actual terms of trade are 1 unit of apparel for 1 unit of chemicals and that 4 units of apparel are exchanged for 6 units of chemicals. What are the gains from specialization and trade for each nation?arrow_forwardA small country imports T-shirts. With free trade at a world price of $10, domestic production is 10 million T-shirts and domestic consumption is 42 million T-shirts. The country's government now decides to impose a quota to limit T-shirt imports to 20 million per year. With the import quota in place, the domestic price rises to $12 per T- shirt and domestic production rises to 15 million T-shirts per year. The quota on T- shirts causes domestic consumers to A) gain $7 million. B) lose $7 million. C) lose $70 million. D) lose $77 millionarrow_forwardHere is what Sweden and Canada can produce: Country Tons of Food Tons of Metal Sweden 40,000 XXXXX Canada XXXXX 1,000 Sweden has a comparative advantage in metal The price of metal will be between 10 and 20 food, if these countries trade. How much metal can Sweden produce? If you think the answer is 17,000, then write 17000, not 17,000.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education