ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

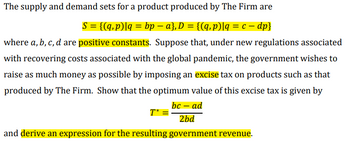

Transcribed Image Text:The supply and demand sets for a product produced by The Firm are

S = {(q, p)|q = bp − a}, D = {(q,p)|q = c − dp}

where a, b, c, d are positive constants. Suppose that, under new regulations associated

with recovering costs associated with the global pandemic, the government wishes to

raise as much money as possible by imposing an excise tax on products such as that

produced by The Firm. Show that the optimum value of this excise tax is given by

bc - ad

2bd

T* =

and derive an expression for the resulting government revenue.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

If the tax is imposed on the sellers, shouldn't the 'T' be used alongside the supply 'q' not the demand 'q'?

So would it not be q=b(p-T)-a?

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

If the tax is imposed on the sellers, shouldn't the 'T' be used alongside the supply 'q' not the demand 'q'?

So would it not be q=b(p-T)-a?

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The local space museum has hired you to assist them in setting admission prices. The museum’s managers recognize that there are two distinct demand curves for admission. One demand curve applies to people ages 12 to 64, whereas the other is for children and senior citizens. The two demand curves are: PA = 9.6 – 0.08QA PCS = 4 – 0.05QCS, where PA is the adult price, PCS is the child/senior citizen price, QA is the adult quantity, and QCS is the child/senior citizen quantity. Crowding is not a problem at the museum, so managers consider marginal cost to be zero. a. What price should they charge to each group to maximize profits? b. How many adults will visit the museum? How many children and senior citizens? c. What are the museum’s profits?arrow_forwardNonearrow_forwardI need the answer as soon as possiblearrow_forward

- Just part B. Please write it out on paper. Typing it back to back is difficult to understand what you mean.arrow_forwardThe market demand function for corn is Q¹ = 30 - 2P. The market supply function is Q = 5P-2.5, both measured in billions of bushels per year. Suppose the government imposes a $8.10 tax per bushel. What will be the effects on aggregate surplus, consumer surplus, and producer surplus? What will be the deadweight loss created by the tax? Instructions: Round your quantities to the nearest whole number. Round prices, surpluses and deadweight losses to 2 decimal places. a. What are the initial equilibrium effects? Complete the table below. Initial equilibrium price Initial equilibrium quantity Initial equilibrium consumer surplus Initial equilibrium producer surplus After-tax equilibrium price After-tax equilibrium quantity After-tax equilibrium consumer surplus After-tax equilibrium producer surplus $ Government revenue After-tax equilibrium aggregate surplus Deadweight loss $ Initial equilibrium aggregate surplus b. What are the effects after the government imposes a $8.10 tax per bushel.…arrow_forwardThe figure to the right shows the market for one-bedroom apartments in Calgary. If this market is initially unregulated, thousand units will rent for a price of $ per month. Suppose however, the city imposes the controlled price shown in the figure. In this case, in the short run, the market experiences an excess of thousand units. In the long run, if the controlled price remains in place, the market will show a of thousand units. This analysis indicates that as time passes, rent controls will cause housing shortages to Rental Price ($ per month) 905 610 Rental Housing Market Sshort run Slong run Controlled Price 24 50 60 Quantity of Rental Units (Thousands)arrow_forward

- In a town behind the local mountains, 3 individuals each buy flowers following theirindividual demands P = 8 − Q and 2 individuals each follow their individual demand P = 3 −Q. For prices between $0 to $3, the town’s aggregate demand for flowers is given by(a) P = 11 − 2Q(b) P = 30 − 5Q(c) P = 30 −Q5(d) P = 6 −Q5(e) None of the abovearrow_forwardThe market demand for bicycle helmets is given by D(P) = 90−4P and the market supply ischaracterized by S(P) =P−10. In both expressions, P is the price per unit. The government introduces a per unit subsidy of S per helmet, that is paid out to the producer for each sale of helmets. (a) What is the equilibrium price and quantity before the government intervenes in the market? (b) What is the equilibrium price and quantity after the government intervenes in the marketimposing a per subsidy S >0? Hint: You have to find the equilibrium for all relevant levels of S. (c) Calculate changes in consumer surplus, producer surplus and welfare, as a function of subsidy S, due to the introduction of the subsidy. What welfare conclusion(s) do you draw? Illustrate graphically.arrow_forwardIn the free-market equilibrium of a perfectly competitive market, the price of the good is 90 dollars and the elasticity of demand and the elasticity of supply values are respectively Ed* = -6.6 and Es* = 4.1 Suppose the government imposes a per-unit tax equal to 10.4 payable by consumers. Calculate the estimate of the price firms charge consumers in the tax equilibrium using the elasticity values provided above. Then enter that price value below.arrow_forward

- Suppose that the demand and supply functions for good x are given as follows: Q-120-2P, +1+P, and Q=-30+P, -2r+s-2/ where P, denotes the price of good x, P, denotes the price of a related product y. I denotes income, t denotes tax firms face, s denotes subsidy and f denotes factor prices. Suppose also that exogenous variables are given as follows: Income (I)-450, Price of the related product (P₂)-30, tax (1)-24, subsidy (s)-15 and factor prices (1)-36. What is the cross price elasticity of demand at the equilibrium? -0.27 and thus products x and y are complements. 0.27 and thus products x and y are substitutes. -0.23 and thus products x and y are complements. 0.23 and thus products x and y are substitutes.arrow_forward(1)Find q, ∂q/∂Y and ∂q/∂p, when the price that the firm sets is $30.00, and the average disposable income in the market is $3,000.00. (2)Find the price-elasticity of demand for the firm's good at the point in part (1).Use your answer to (2) to estimate the percentage change in demand if the firm raises the price for their good to $31.00 (and average income in the market stays fixed).arrow_forwardConsider the market for pork illustrated in the graph. Suppose initial demand (D') is Q = 290 – 20p and supply (S') is Q = 80 + 40p and that a $3.00 tax is charged to consumers, shifting the demand curve to D. Using the original and after-tax pork demand functions and the supply function, derive the initial equilibrium price and quantity and the after-tax equilibrium price and quantity. %24 (Enter all responses using real numbers rounded to two decimal places) The equilibrium price is initially $ per kg. P1 ey P2 D2 D1 Q2 Q, Q. Million kg of pork per year SEP 24 30 tv Help Me Solve This Text Paces HAT More Hein ear All MacBook Air 80 DII esc F10 F11 F3 F4 F5 F6 F7 F8 F9 F1 F2 @ # $ & * 1 3 4 5 6. 7 8. P P. S per kg >arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education