FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

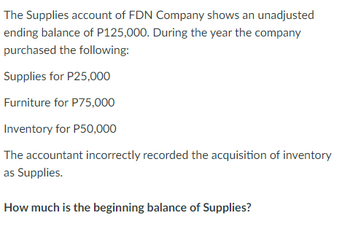

Transcribed Image Text:The Supplies account of FDN Company shows an unadjusted

ending balance of P125,000. During the year the company

purchased the following:

Supplies for P25,000

Furniture for P75,000

Inventory for P50,000

The accountant incorrectly recorded the acquisition of inventory

as Supplies.

How much is the beginning balance of Supplies?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Veron Inc. reported total assets of $1,600,000 and net income of $85,000 for the current year.Veron determined that inventory was understated by $23,000 at the beginning of the year and$10,000 at the end of the year. What is the corrected amount for total assets and net income forthe year?a. $1,610,000 and $95,000.b. $1,590,000 and $98,000.c. $1,610,000 and $72,000.d. $1,600,000 and $85,000arrow_forwardJillet Corporation began the year with inventory of 12,000 units of its only product. The units cost $8 each. The company uses a perpetual inventory system and the FIFO cost method. The following transactions occurred during the year: a. Purchased 60,000 additional units at a cost of $10 per unit. Terms of the purchases were 2/10. "/30. The company uses the gross method to record purchase discounts. The inventory was purchased f.o.b. shipping point and additional freight costs of $0.50 per unit were charged to Jillet. b. 1,200 units purchased during the year were returned to suppliers for credit. Jillet was also given credit for the freight charges of $0.50 per unit on the original purchase. The units were defective and were returned two days after they were received. The remaining inventory was paid within the discount period. (Hint: The discount applies only to inventory and not the freight.) c. Sales for the year totaled 55,000 units at $18 per unit. (Hint: The cost of the inventory…arrow_forwardNord Store’s perpetual accounting system indicated ending inventory of $20,000, cost of goodssold of $100,000, and net sales of $150,000. A year-end inventory count determined that goodscosting $15,000 were actually on hand. Calculate (a) the cost of shrinkage, (b) an adjusted costof goods sold (assuming shrinkage is charged to cost of goods sold), (c) gross profit percentagebefore shrinkage, and (d) gross profit percentage after shrinkage. Round gross profit percentagesto one decimal placearrow_forward

- James Company experienced the following events during its first accounting period: (1) Purchased $10,000 of inventory on account under terms 1/10 n/30. (2) Returned $2,000 of the inventory purchased in Event 1. (3) Paid the remaining balance in account payable for the inventory purchased in Event 1. Based on this information, which of the following shows how paying off the account payable (Event 3) will affect the Company's financial statements? Balance Sheet Income Statement Assets = Liabilities + A. (8,000) B. (7,900) C. (8,000) D. (7,920) Multiple Choice Option A Option D Option C Option B (8,000) (7,900) (8,000) (7,920) Stockholders' Equity n/a n/a n/a n/a Revenue n/a n/a n/a n/a Expense n/a 7,900 8,000 n/a Net Income n/a (7,900) (8,000) n/a Statement of Cash Flows (8,000) Operating Activity (7,900) Operating Activity (8,000) Operating Activity (7,920) Operating Activityarrow_forwardAssume the perpetual inventory system is used unless stated otherwise. Round all numbers to the nearest whole dollar unless stated otherwise. Computing cost of goods sold in a periodic inventory system M Wholesale Company began the year with a merchandise inventory of $5,000. During the year, M purchased $93,000 of goods and returned $6,600 due to damage. M also paid freight charges of $1,200 on inventory purchases. At year-end, M’s ending merchandise inventory balance stood at $17,200. Assume that M uses the periodic inventory system. Compute M’s cost of goods sold for the year.arrow_forwardRoxas Company reported the following net income: 2018 - P1,750,000 2019 - P2,000,000 An examination of the accounting records for the year ended December 31, 2019 revealed that several errors were made. The following errors were discovered: • The footings and extensions showed that the inventory on December 31, 2018 was overstated by P190,000. • Prepaid insurance of P120,000 applicable to 2020 was expensed in 2019. • Interest receivable of P20,000 was not recorded on December 31, 2019. . On January 1, 2019, an equipment costing P400,000 was sold for P220,000. At the date of sale, the equipment had accumulated depreciation of P240,000. • The cash received was recorded as miscellaneous income in 2019. . In addition, depreciation was recorded for the equipment for 2019 at the rate of 10%. Required: 1. Prepare worksheet showing corrected net income for 2018 and 2019. 2. Prepare adjusting entries on December 31, 2019 assuming (a) books are still open and (b) books are already closed.arrow_forward

- Seemore Lens Company (SLC) sells contact lenses FOB destination. For the year ended December 31, the company reported Inventory of $87,000 and Cost of Goods Sold of $454,000. a. Included in Inventory (and Accounts Payable) are $13,400 of lenses SLC is holding on consignment. b. Included in SLC's Inventory balance are $6,700 of office supplies held in SLC's warehouse. c. Excluded from SLC's Inventory balance are $9,700 of lenses in the warehouse, ready to send to customers on January 2. SLC reported these lenses as sold on December 31, at a price of $18,400. d. Included in SLC's Inventory balance are $3,850 of lenses that were damaged in December and will be scrapped in January, with zero realizable value. Required: For each item, (a)-(d), prepare the journal entry to correct the balances presently reported. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list > To record the elimination of consignment…arrow_forwardA company purchased inventory for $74,000 from a vendor on account, FOB shipping point, with terms of 3/10, n/30. The company paid the shipper $1,600 cash for freight in. The company paid the vendor nine days after the invoice date. If there was no beginning inventory, the cost of inventory would be (Assume a perpetual inventory system.) $70,180 $75,600 O $72,400 $73,380arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education