FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Ans ? Financial accounting question

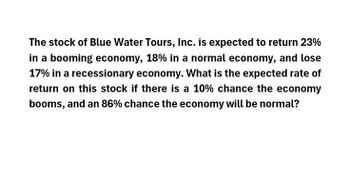

Transcribed Image Text:The stock of Blue Water Tours, Inc. is expected to return 23%

in a booming economy, 18% in a normal economy, and lose

17% in a recessionary economy. What is the expected rate of

return on this stock if there is a 10% chance the economy

booms, and an 86% chance the economy will be normal?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The common stock of Manchester & Moore is expected to earn 16.2 percent in a recession, 8 percent in a normal economy, and lose 3.5 percent in a booming economy. The probability of a boom is 18 percent while the probability of a recession is 7 percent. What is the expected rate of return on this stock?arrow_forwardIf the economy booms, Meyer&Co. stock will have a return of 20.9 percent. If the economy goes into a recession, the stock will have a loss of 13.2 percent. The probability of a boom is 62 percent while the probability of a recession is 38 percent. What is the standard deviation of the returns on the stock?arrow_forwardAssume the economy has an 6 percent chance of booming, am 8 percent chance of being recessionary, and being normal the remainder of the time. A stock is expected to return 22.5 percent in a boom, 11.5 percent in a normal economy, and −8 percent in a recession. What is the expected rate of return on this stock?arrow_forward

- Suppose that the probability that the economy will be in a recession one year from now is 0.25. If the economy is in a recession one year from now the price of XYZ common stock will be $150. If the economy is not in a recession one year from now the price of XYZ common stock will be $200. If the current price of XYZ stock is $175, what is the standard deviation of the returns of XYZ common stock over the next year? Enter your answer as a percent without the “%”. Round your final answer to two decimals.arrow_forwardAnalysts believe that Manufactured Earnings is a “darling” of Wall Street analysts. Its current market price is $27 per share, and its book value is $11 per share. Analysts forecast that the firm’s book value will grow by 12.5 percent per year indefinitely, and the cost of equity is 17percent. Given these facts, what is the market’s expectation of the firm’s long-term average ROE?arrow_forwardThe common stock of Manchester & Moore is expected to earn 14.8 percent in a recession, 8 percent in a normal economy, and lose 5.8 percent in a booming economy. The probability of a boom is 12 percent while the probability of a recession is 6 percent. What is the expected rate of return on this stock? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forward

- According to equity analysts at Goldman Sachs, over the next year, there is a 13% chance of an economic boom and a 75% likelihood of a normal economy. You just bought shares of Time Warner (ticker symbol: TWX) that are expected to earn 14% in a booming economy and 8% in a normal economy. What is Time Warner’s expected return if the company is expected to lose 4% in a recessionary economy? a. 7.69 b. 7.34 c. 6.43 d. 4.00 e. 8.30arrow_forwardWhat is the expected return on a stock if the firm will earn 24% during a period of economic boom, 14% during normal economic periods, and 2% during a period of recession if the probabilities of these economic environment are 20%, 65% and 15%, respectively?arrow_forwardPlease Solve In 15minsarrow_forward

- You recently purchased a stock that is expected to earn 19 percent in a booming economy, 8percent in a normal economy, and lose 28 percent in a recessionary economy. There is a 20percent probability of a boom and a 70 percent chance of a normal economy. What is yourexpected rate of return on this stock?arrow_forwardYou recently purchased a stock that is expected to earn 33 percent in a booming economy, 13 percent in a normal economy, and lose 40 percent in a recessionary economy. There is a 15 percent probability of a boom and a 60 percent chance of a normal economy. What is your expected rate of return on this stock?arrow_forwardYou recently purchased a stock that is expected to earn 19 percent in a booming economy, 8percent in a normal economy, and lose 28 percent in a recessionary economy. There is a 20percent probability of a boom and a 70 percent chance of a normal economy. What is standarddeviation on this stock?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education