FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

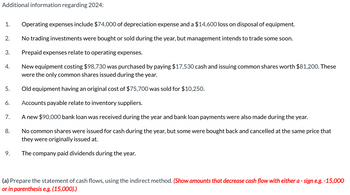

Transcribed Image Text:Additional information regarding 2024:

1. Operating expenses include $74,000 of depreciation expense and a $14,600 loss on disposal of equipment.

2.

No trading investments were bought or sold during the year, but management intends to trade some soon.

3.

Prepaid expenses relate to operating expenses.

4.

New equipment costing $98,730 was purchased by paying $17,530 cash and issuing common shares worth $81,200. These

were the only common shares issued during the year.

5.

Old equipment having an original cost of $75,700 was sold for $10,250.

6.

Accounts payable relate to inventory suppliers.

7.

A new $90,000 bank loan was received during the year and bank loan payments were also made during the year.

8.

No common shares were issued for cash during the year, but some were bought back and cancelled at the same price that

they were originally issued at.

9.

The company paid dividends during the year.

(a) Prepare the statement of cash flows, using the indirect method. (Show amounts that decrease cash flow with either a -sign e.g. -15,000

or in parenthesis e.g. (15,000).)

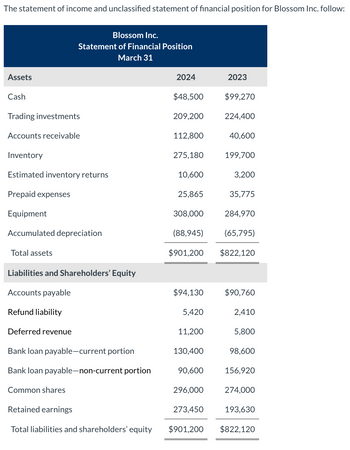

Transcribed Image Text:The statement of income and unclassified statement of financial position for Blossom Inc. follow:

Blossom Inc.

Statement of Financial Position

March 31

Assets

2024

2023

Cash

$48,500

$99,270

Trading investments

209,200

224,400

Accounts receivable

112,800

40,600

Inventory

275,180

199,700

Estimated inventory returns

10,600

3,200

Prepaid expenses

25,865

35,775

Equipment

308,000

284,970

Accumulated depreciation

(88,945)

(65,795)

Total assets

$901,200 $822,120

Liabilities and Shareholders' Equity

Accounts payable

$94,130

$90,760

Refund liability

5,420

2,410

Deferred revenue

11,200

5,800

Bank loan payable-current portion

130,400

98,600

Bank loan payable-non-current portion

90,600

156,920

Common shares

296,000

274,000

Retained earnings

273,450

193,630

Total liabilities and shareholders' equity

$901,200 $822,120

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The balance sheet and income statement shown below are for Koski Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over. Balance Sheet (Millions of $) 2021 Assets Cash and securities $ 4,200 Accounts receivable 17,500 Inventories 20,300 Total current assets $ 42,000 Net plant and equipment 28,000 Total assets $ 70,000 Liabilities and Equity Accounts payable $ 27,531 Accruals 12,369 Notes payable 5,000 Total current liabilities $ 44,900 Long-term bonds 9,000 Total liabilities $ 53,900 Common stock 3,864 Retained earnings 12,236 Total common equity $ 16,100 Total liabilities and equity $ 70,000 Income Statement (Millions of $) 2021 Net sales $ 112,000 Operating costs except depreciation 104,160 Depreciation…arrow_forwardThe balance sheet and income statement shown below are for Koski Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over. Balance Sheet (Millions of $) 2021 Assets Cash and securities $ 4,200 Accounts receivable 15,000 Inventories 16,800 Total current assets $ 36,000 Net plant and equipment 24,000 Total assets $ 60,000 Liabilities and Equity Accounts payable $ 18,048 Accruals 10,152 Notes payable 5,000 Total current liabilities $ 33,200 Long-term bonds 10,000 Total liabilities $ 43,200 Common stock 3,864 Retained earnings 12,936 Total common equity $ 16,800 Total liabilities and equity $ 60,000 Income Statement (Millions of $) 2021 Net sales $ 66,000 Operating costs except depreciation 61,380 Depreciation…arrow_forwardA company issues $1.1 million of new stock and pays $201,000 in cash dividends during the year. In addition, the company took advantage of falling interest rates to borrow $1.51 million in a new bond issue and paid off existing bonds with a face value of $2.05 million. The company bought 501 of another company's $1,010 bonds at a $101,000 premium. The net cash flow provided by financing activities is: A) An outflow of $201,000. B) An inflow of $359,000. C) An inflow of $540,000. D) An outflow of $101,000arrow_forward

- The following items are taken from the financial statements of Blue Spruce Company for the year ending December 31, 2022: Accounts payable $17,200 Accounts receivable $7,000 Accumulated depreciation-equipment $5,000 Bonds payable $17,000 Cash $22,000 Common stock $26,400 Cost of good sold $27,600 Depreciation expense $5,700 Dividends $$5,200 Equipment $40,000 Interest expense $2,000 Patents $5,180 Retained earnings January 1, 2022 $5,700 Salaries and wages expense $5,300 Sales revenue $51,500 Supplies $2,800 PREPARE AN INCOME STATEMENT.arrow_forwardOn July 1, 2020, Flounder Corporation purchased Young Company by paying $261,000 cash and issuing a $143,000 note payable to Steve Young. At July 1, 2020, the balance sheet of Young Company was as follows. Cash $50,000 Accounts payable $208,000 Accounts receivable 91,000 Stockholders’ equity 238,700 Inventory 108,000 $446,700 Land 41,100 Buildings (net) 74,800 Equipment (net) 70,500 Trademarks 11,300 $446,700 The recorded amounts all approximate current values except for land (fair value of $62,600), inventory (fair value of $125,800), and trademarks (fair value of $17,600). 1). Prepare the July 1 entry for Flounder Corporation to record the purchase. 2). Prepare the December 31 entry for Flounder Corporation to record amortization of intangibles. The trademark has an estimated useful life of 4 years with a residual value of $4,640. (arrow_forwardThe balance sheet and income statement shown below are for Koski Inc. Note that the firm has no amortization charges, it does not lease any assets, none of its debt must be retired during the next 5 years, and the notes payable will be rolled over. Balance Sheet (Millions of $) 2021 Assets Cash and securities $ 6,000 Accounts receivable 15,000 Inventories 15,000 Total current assets $ 36,000 Net plant and equipment 24,000 Total assets $ 60,000 Liabilities and Equity Accounts payable $ 18,090 Accruals 8,910 Notes payable 6,000 Total current liabilities $ 33,000 Long-term bonds 12,000 Total liabilities $ 45,000 Common stock 4,050 Retained earnings 10,950 Total common equity $ 15,000 Total liabilities and equity $ 60,000 Income Statement (Millions of $) 2021 Net sales $ 90,000 Operating costs except depreciation 83,700 Depreciation…arrow_forward

- Current Attempt in Progress Suppose the following items were taken from the 2027 financial statements of Texas Instruments, Inc. (All dollars are in millions.) Common stock $3,006 Accumulated depreciation-equipment $3,607 Prepaid rent 224 Accounts payable 1,519 Equipment 6,765 Patents 2,270 Stock investments (long-term) 697 Notes payable (long-term) 870 Debt investments (short-term) 1,803 Retained earnings 6,956 Income taxes payable 188 Accounts receivable 1,883 Cash 1,242 Inventory 1,262 Prepare a classified balance sheet in good form as of December 31, 2027. (List Current Assets in order of liquidity.) TEXAS INSTRUMENTS, INC. Balance Sheet (in millions) Assetsarrow_forwardMetlock Corporation has retained earnings of $681,500 at January 1, 2020. Net income during 2020 was $1,434,800, and cash dividends declared and paid during 2020 totaled $81,300. Prepare a retained earnings statement for the year ended December 31, 2020. Assume an error was discovered: land costing $88,800 (net of tax) was charged to maintenance and repairs expense in 2019.arrow_forwardComplete the missing balance sheet entries for Travers & Co.'s balance sheets for the years ending 2004 and 2005 based on the following statements: < BUDE I В H I • Travers issued $30 million of new common stock. • Travers had net income available to common shareholders of $77 million during 2005. At the end of 2005, Travers paid out $61 million in common dividends. • Travers neither issued nor retired long-term debt during 2005. • In 2005, Travers had cash flows from operating activities of $147 million, cash flow from investing activities of -$80 million, and cash flow from financing activities of -$16 million. BALANCE SHEET (Millions of dollars) Cash Accounts receivable Inventories Total current assets Net fixed assets Total assets Yr 2 A 170 190 B $ 280 H Yr 1 $ 10 140 210 $360 $ 250 $ 610 Accounts payable Notes payable Accrued liabilities Total current liabilities Long-term debt Total liabilities Preferred stock Common stock Retained earnings Total common equity Total liabilities…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education