ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

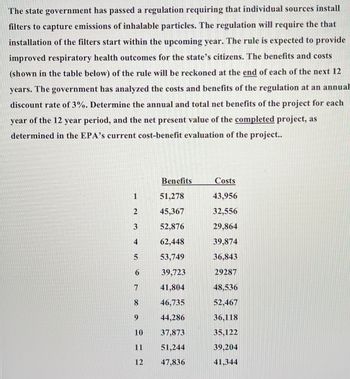

Transcribed Image Text:The state government has passed a regulation requiring that individual sources install

filters to capture emissions of inhalable particles. The regulation will require the that

installation of the filters start within the upcoming year. The rule is expected to provide

improved respiratory health outcomes for the state's citizens. The benefits and costs

(shown in the table below) of the rule will be reckoned at the end of each of the next 12

years. The government has analyzed the costs and benefits of the regulation at an annual

discount rate of 3%. Determine the annual and total net benefits of the project for each

year of the 12 year period, and the net present value of the completed project, as

determined in the EPA's current cost-benefit evaluation of the project..

1

2

3

4

5

6

7

8

9

10

11

12

Benefits

51,278

45,367

52,876

62,448

53,749

39,723

41,804

46,735

44,286

37,873

51,244

47,836

Costs

43,956

32,556

29,864

39,874

36,843

29287

48,536

52,467

36,118

35,122

39,204

41,344

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- S Pte Ltd (“SPL”) is a country incorporated and tax resident in Country S. It has developed a social audio platform whereby the users can connect with other users from different parts of the world via audio chat. SPL believes that social audio feature will be the next game changer in the internet space, especially when a lot of countries are still in lock-down mode and human-to-human connection becomes a huge concern during Pandemic.The social audio platform is getting more popular in Asia and SPL is keen to explore the possibility of setting up a Headquarter company in Singapore with operating subsidiaries in Malaysia, Thailand, Japan and Hong Kong. Required: Assuming SPL is interested in applying for tax incentives in Singapore, illustrate the two (2) relevant tax incentives SPL can consider based on the information stated above, and discuss any additional conditions SPL should be aware of.arrow_forwardthis assessment correct? what would be the interpretation to answer this question? If capacity for producing the A2B timer component is in fact limited, and therefore each sale of the household timer will eliminate the sale of an A2B component, how would you measure the household timer’s profitability?arrow_forwardPlease no written by hand solutions Suppose Fresno Technologies, a extended reality headsets manufacturer, wants to run an difference-in-difference estimation to quantify how well their new production process is working. There are two production lines: Line A and Line B. Line A receives the treatment (i.e., uses the new process). Production data is summarized below for before and after the application of the process. LineQuantity before TreatmentQuantity after Treatment(in units)(in units)Line A21002600Line B15001320 Calculate two difference estimates of difference-in-difference. First, an estimate in units. Second, an estimate in percentage. The first estimate is taking the difference of each line before and after the treatment, and then finding the difference between those differences. The second estimate is taking the percentage change in each line and then finding the difference between the percentage changes. The difference-in-difference estimate of the effect of the new…arrow_forward

- The government of a subtropical country is evaluating the costs and benefits of protecting a rainforest versus cutting it down for timber. The estimated value of the wood is $270$270 million. If the same forest is used as a national park, it may attract 0.030.03 million additional tourists per year. Statistically, each tourist spends $1,600$1,600 inside the country during their stay.How long will it take tourism to exceed the estimated value of the wood in the rainforest? Enter your answer in the box below and round to two decimal places if necessary.arrow_forwardCan you explain this equation and its importance in economics please and thank you. equation = MRTSL,K>PL/PKarrow_forward= 1. (i) A utility function has the form U(w) aw³ +bw² where a, b E R. Assuming w > 0 and a 0, is U(w) ever suitable for a non-satiated and risk-averse investor? If it is, state the range of values of w this holds for as a function of a and b. You must include your working. (ii) Give an example of a utility function with DARA. Show all your working. (iii) An investor has IRRA. Would this investor prefer a fair gamble or to do nothing? Provide a short explanation of your answer.arrow_forward

- [A] Suppose that a drug company has developed an ointment that can be used to treat sores and reduce scarring. Surveys indicated that the ointment, which costs $10,000 for a full course of treatment, can improve the quality of life from 0.6 to 0.7 for patients with this problem. Assume that this population has a life expectancy of 70 years. No need to worry about discounting. 1. What is the Incremental Cost-Utility Ratio (ICUR) for taking the ointment over doing nothing for a typical 20-year-old patient? [Hint: This patient has only 50 years of life remaining.] 2. If the cost-effectiveness threshold is $5,000 per QALYS, will the 20-year-old patient choose to get the ointment? What about a 60-year-old patient? [B] Is it appropriate to evaluate a healthcare intervention using various methods of economic evaluation as discussed in this course, or should we choose one primary method that best fits the analysis?arrow_forwardSuppose a small business owner is considering expanding their operations and requires additional capital to fund the expansion. The business currently has an annual revenue of $500,000 and incurs operating expenses of $350,000 per year. The owner estimates that the expansion project will generate an additional annual revenue of $200,000 and will require an annual operating expense of $120,000. The interest rate for a business loan is 6% per annum. Calculate the following: The net benefit (net revenue) from the expansion project. The maximum amount of loan the business owner should consider taking to finance the expansion, assuming they want to maximize their net benefit. Note: You can assume that all revenues and expenses occur at the end of the year, and the loan repayment will be done in equal annual installments over a specific period.arrow_forwardBoth an emission tax and a tradable discharge permit scheme "have not yet been applied to situations in the real world guarantee that the desired level of pollution will be reached even when there is uncertainty regarding the aggregate MAC function С. guarantee that pollution reduction will be achieved cost-effectively Od. All of the abovearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education